A Look at Vertex (VERX) Valuation Following Oracle Validated Integration Milestone

Vertex (VERX) has announced that its Accelerator for Oracle’s ERP has achieved Oracle Validated Integration, signaling closer alignment with Oracle’s integration best practices. This development could make adoption smoother and reduce integration risks for customers.

See our latest analysis for Vertex.

After a tough stretch, Vertex’s 1-day share price return of 1.33% hints at renewed optimism following the Oracle integration news. However, momentum remains muted compared to its earlier highs. Even with a challenging year-to-date share price return of -52.89%, long-term investors have still seen a 54.7% total shareholder return over the past three years. This underlines both volatility and the potential for recovery if operational wins keep coming.

If Vertex’s progress with major partners sparked your interest, it might be the right time to explore other promising software innovators. Check out our latest fast growing stocks with high insider ownership.

With shares still trading at a sizable discount to analyst targets and long-term returns that show recovery potential, investors might wonder whether Vertex’s stock is undervalued right now or if the market is already factoring in all the future growth.

Most Popular Narrative: 32.7% Undervalued

With Vertex last closing at $25.06 and the latest popular narrative setting fair value at $37.23, there is a meaningful gap that commands attention and debate. This setup underscores a forward-looking view based on ambitious growth projections and sector-specific tailwinds.

Significant near-term acceleration is expected as regulatory mandates for e-invoicing begin in major European economies like France and Germany in 2026 and 2027, forcing multinational enterprises to adopt advanced tax automation solutions. This dynamic should drive robust new customer wins and recurring revenue expansion for Vertex. Looming cloud ERP migration deadlines across the enterprise landscape over the next two or more years are likely to intensify as companies upgrade core financial systems, increasing demand for Vertex's cloud-native tax engines and integrations. This is expected to ultimately drive subscription and cloud revenue growth and improve recurring revenue mix.

Want to know the financial leap underpinning this big valuation? The real story involves daring forecasts for revenue growth, profit margins, and future earnings that go far beyond current numbers. Curious about the bold calculations fueling this gap? Take a closer look at the projections behind the narrative’s price target.

Result: Fair Value of $37.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic uncertainty or delays in cloud ERP migrations could stall Vertex’s trajectory and challenge even the most optimistic long-term forecasts.

Find out about the key risks to this Vertex narrative.

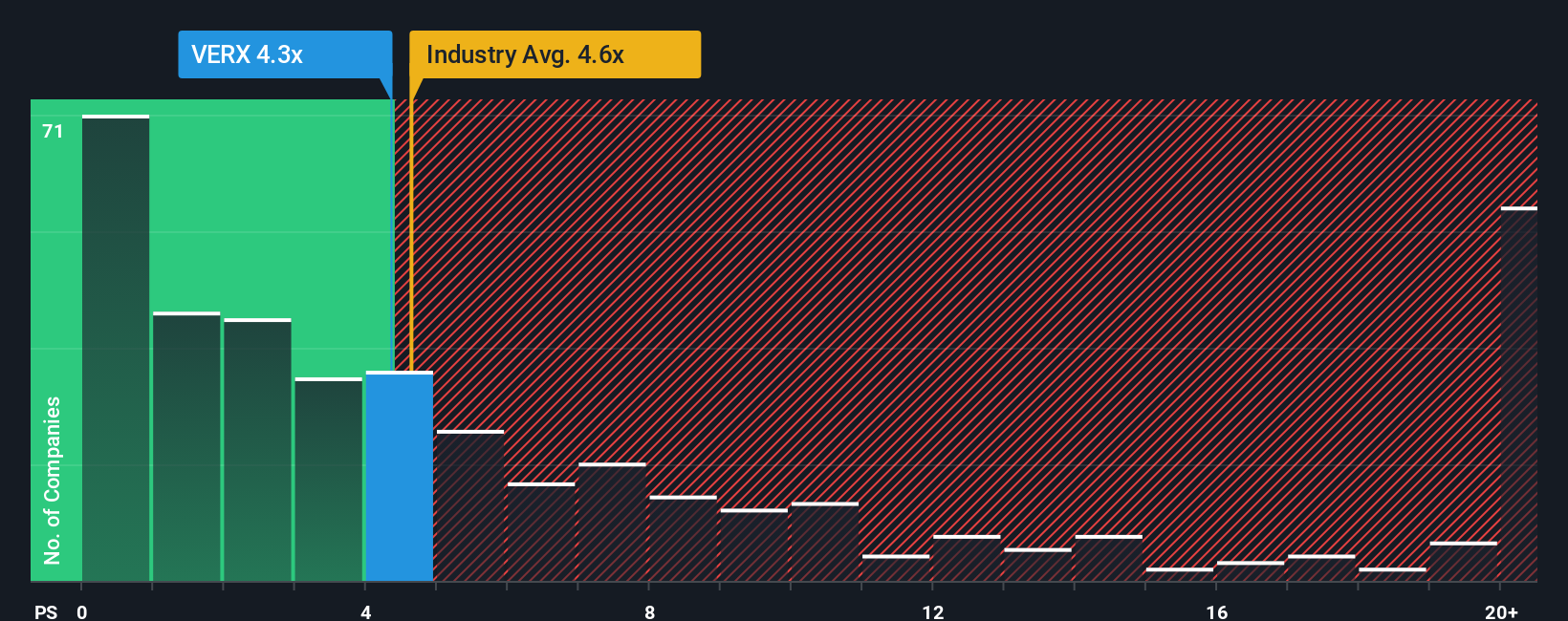

Another View: Looking at Price-to-Sales

While the popular narrative points to Vertex being undervalued, a closer look at its price-to-sales ratio tells a different story. Vertex trades at 5.6x sales, which is higher than both the US Software industry average of 5.1x and its peer average of 5.4x. With the fair ratio at 4.9x, the market may not be offering as much upside as expected. Is this a sign of resilience or room for a correction?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertex Narrative

If you'd like to look deeper or reach your own conclusions, you can build and personalize your own Vertex narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Vertex.

Looking for More Investment Ideas?

Take charge of your investment journey with unique stock ideas designed to help you get ahead of the crowd. You’ll regret missing out on these smart opportunities for your portfolio.

- Tap into the power of fast-growing technology with these 25 AI penny stocks, which is showing real momentum as the AI revolution transforms every industry.

- Secure reliable cash flow by targeting strong yields through these 18 dividend stocks with yields > 3%, which spotlights companies paying over 3% in dividends.

- Ride the next innovation wave as you seize growth potential in breakthrough computing via these 26 quantum computing stocks, which is leading advances in quantum technology solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal