Does Ubiquiti’s (UI) Debt Strategy Reveal a Shift in Long-Term Financial Priorities?

- Ubiquiti Inc. recently reduced its net debt significantly from the previous year by leveraging substantial cash reserves, improving its financial strength and interest coverage.

- This underscores the company’s prudent balance sheet management and highlights its ability to effectively handle its debt obligations as earnings before interest and tax continue to grow.

- We'll examine how Ubiquiti's strengthened cash position and debt reduction influence its broader investment narrative and outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

What Is Ubiquiti's Investment Narrative?

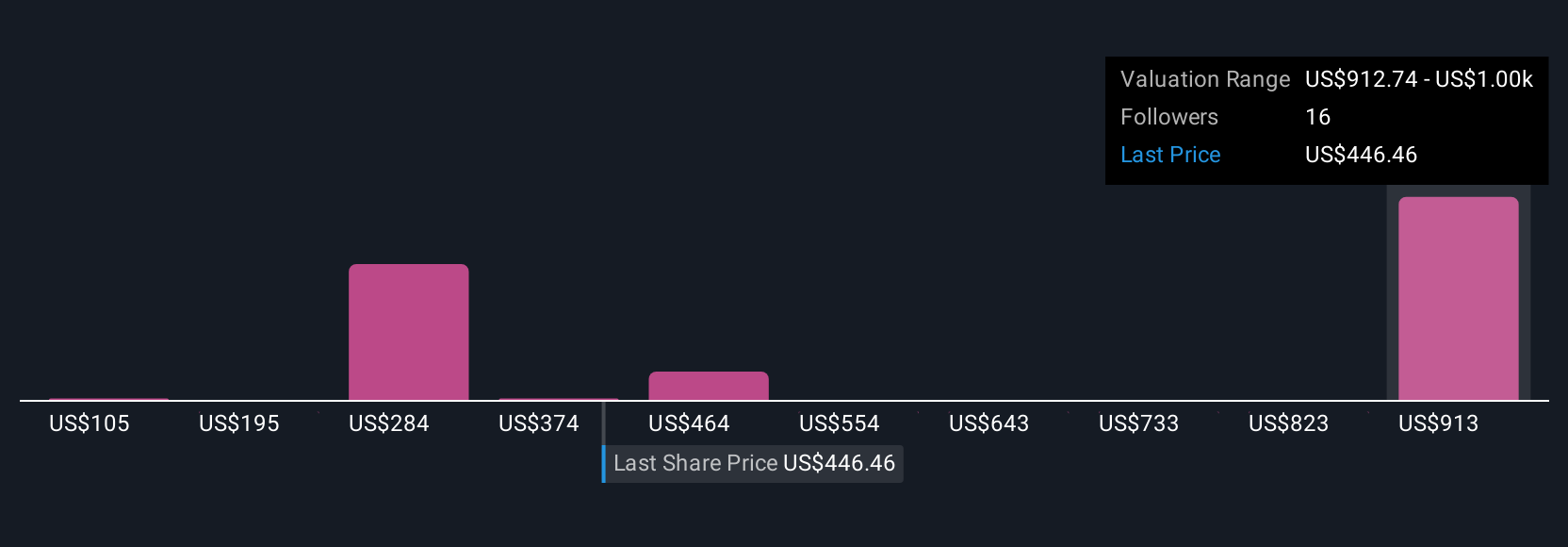

For shareholders of Ubiquiti, the big picture has often hinged on the company’s ability to blend robust earnings with prudent debt management. The latest reduction in net debt, backed by strong cash reserves, sends a reassuring signal about balance sheet health. While headline growth figures and recent index additions have fueled substantial share price momentum, this improved financial position could help sustain key short-term catalysts such as continued share buybacks and dividends. However, with the company trading well above consensus price targets and sporting a relatively high price-to-earnings ratio, the debate around valuation risk remains front and center. The latest debt reduction is a positive, but may not fundamentally alter the risk profile for new investors in the near term, given that high market expectations already appear priced in.

But some investors remain concerned about the board’s limited refresh and potential for governance risks. Ubiquiti's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 13 other fair value estimates on Ubiquiti - why the stock might be worth less than half the current price!

Build Your Own Ubiquiti Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ubiquiti research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Ubiquiti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ubiquiti's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal