Beyond Meat (BYND) Is Down 56.0% After Major Debt Restructuring and Shareholder Dilution Explained

- Earlier this week, Beyond Meat announced a major debt restructuring plan involving the exchange of 0% convertible notes due 2027 for 7% convertible notes due 2030 and the issuance of up to 326 million new common shares, significantly altering the company's capital structure.

- This restructuring substantially increases shareholder dilution and delays the company's debt maturity, highlighting ongoing efforts to manage financial pressures as the plant-based meat sector faces continued challenges.

- Next, we'll examine how the massive shareholder dilution from this debt exchange reshapes Beyond Meat's investment narrative and outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Beyond Meat Investment Narrative Recap

To own Beyond Meat stock, an investor must believe in a meaningful turnaround in plant-based protein demand, brand revitalization, and an eventual return to profitable growth. The recent debt restructuring, while easing short-term liquidity concerns by extending maturities, has made severe shareholder dilution a central, near-term risk, and clouds the importance of any catalysts until this dilution risk is better understood. As a result, the potential upside from cost reduction initiatives and structure changes is now weighed against a much larger equity base and lower share value per holder.

Among recent announcements, the August 2025 appointment of John Boken as interim Chief Transformation Officer stands out, given his restructuring background. This move is closely tied to the current focus on operational efficiency and debt management, both of which are necessary to address the critical liquidity and profitability hurdles that remain central to Beyond Meat's short-term outlook.

On the other hand, investors should be aware that even as debt obligations have been pushed out, the combination of dilution and persistently weak gross margins could...

Read the full narrative on Beyond Meat (it's free!)

Beyond Meat's outlook forecasts $300.3 million in revenue and $18.6 million in earnings by 2028. This is based on a 0.1% annual revenue decline and a $172.2 million increase in earnings from the current level of -$153.6 million.

Uncover how Beyond Meat's forecasts yield a $2.57 fair value, a 148% upside to its current price.

Exploring Other Perspectives

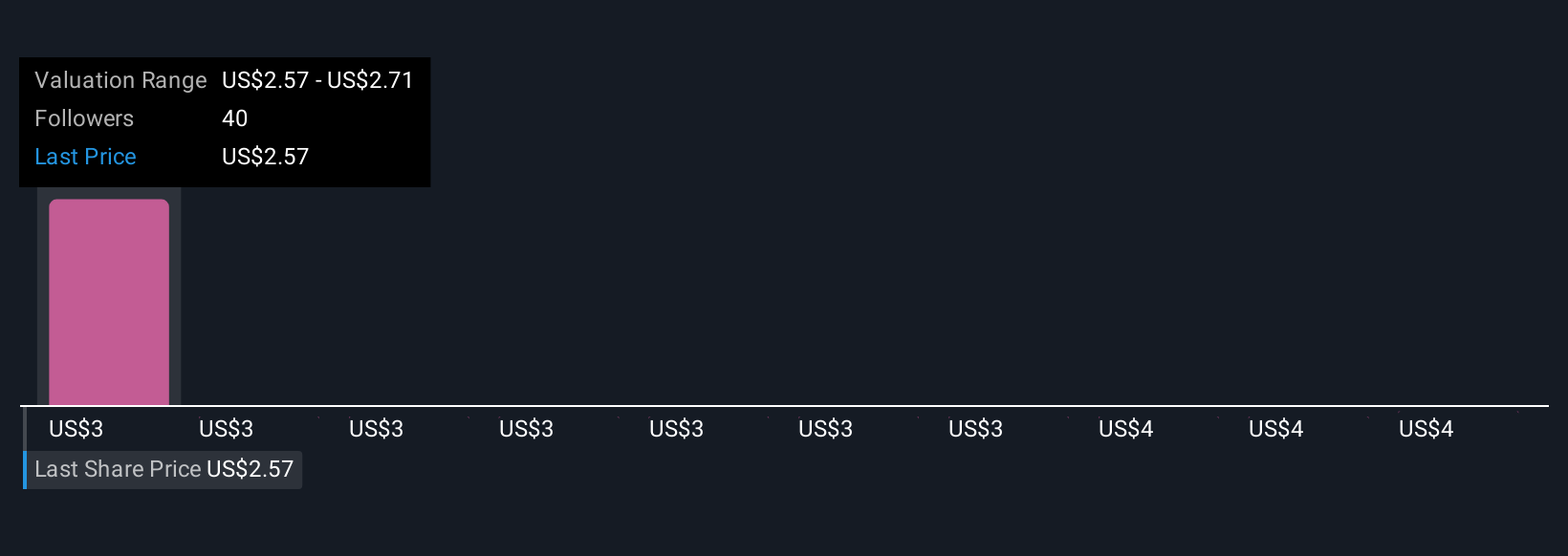

Three private investors in the Simply Wall St Community put Beyond Meat’s fair value in a tight range from US$2.57 to US$4. With opinions spanning this US$1.43 spread and dilution risk now front and center, consider how your expectations for future growth might differ from the consensus.

Explore 3 other fair value estimates on Beyond Meat - why the stock might be worth over 3x more than the current price!

Build Your Own Beyond Meat Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beyond Meat research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Beyond Meat research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beyond Meat's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal