A Look at BWX Technologies’s Valuation After Securing a $1.6 Billion, Decade-Long DOE Contract

BWX Technologies (NYSE:BWXT) just landed a $1.6 billion, decade-long contract from the Department of Energy. This commitment focuses on building and running a U.S. facility for high-purity depleted uranium, reinforcing BWXT’s role in advanced nuclear materials.

See our latest analysis for BWX Technologies.

The $1.6 billion Department of Energy contract is just the latest in a series of wins for BWX Technologies, which has recently landed other large-scale government deals and seen its proposed projects backed by state agencies. Riding this momentum, BWXT's share price has soared, with a year-to-date share price return of 77% and a 66.8% total shareholder return over the past year. The stock’s surge clearly reflects growing confidence in its future opportunities.

If BWXT’s run of major government projects has you wondering what else could be in play, it might be time to explore See the full list for free.

With BWXT’s shares already boasting substantial returns and trading close to analyst price targets, the key question for investors is whether there is still upside left or if the market has already priced in this wave of contract-driven growth.

Most Popular Narrative: 10.3% Undervalued

BWX Technologies’ most popular narrative places its fair value at $220, with the last close at $197.37, suggesting the current price trails the growth story’s potential. This perspective centers on BWXT’s control of government nuclear contracts and expansion through acquisitions, setting the stage for a remarkable long-term trajectory.

Having a ‘monopoly’ on government contracts regarding nuclear reactor engines on submarines and aircraft carriers helps position BWXT for all government related news in the industry. Being the only contractor that develops, manufactures and maintains the engines for those vehicles almost guarantees consistent multi-billion dollars in contracts from the DoD.

This narrative hides a bold forecast built around the company’s grip on major contracts, deal momentum, and a strategy for revenue growth that diverges from the rest of the sector. Wondering which profit drivers fuel this bullish outlook and how future earnings could shatter expectations? Unpack the numbers and logic behind that premium price target inside the full analysis.

Result: Fair Value of $220 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, any shift in government funding or heightened regulatory pressure could stall BWXT’s growth trajectory and quickly impact its optimistic outlook.

Find out about the key risks to this BWX Technologies narrative.

Another View: Multiples Signal Caution

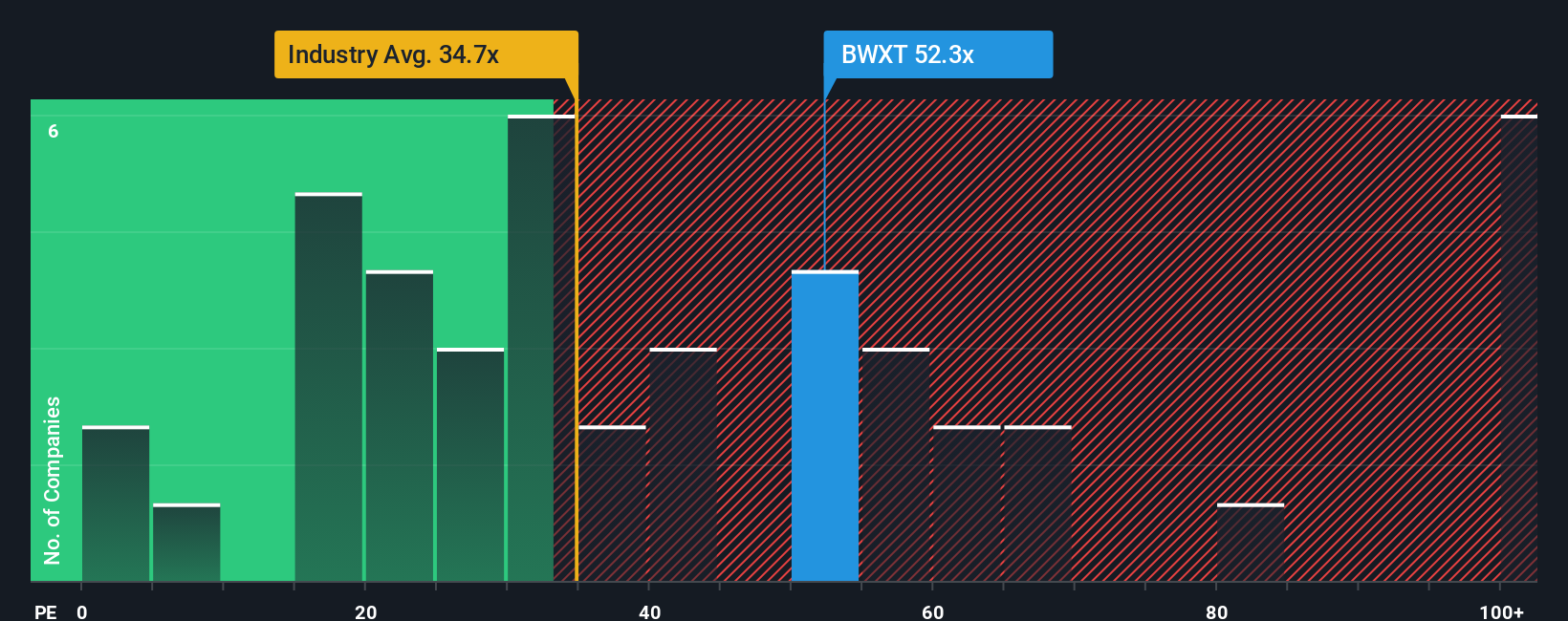

While some see BWXT as undervalued based on its growth story, a quick look at its price-to-earnings ratio tells a more conservative story. BWXT trades at 61.3 times earnings, which is far higher than both its industry (39.8x) and peer average (37.4x), and even above its fair ratio of 30.1x. This significant gap suggests investors may be paying a hefty premium, raising the risk if future growth slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BWX Technologies Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you can craft a custom narrative for BWX Technologies in just a few minutes. Do it your way

A great starting point for your BWX Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count by tapping into investment opportunities most investors overlook. The right research now could be the difference between catching the next big winner or missing out.

- Capture growth with these 891 undervalued stocks based on cash flows, which reveals stocks the market may be pricing too low compared to their real potential for returns.

- Earn income while you invest using these 18 dividend stocks with yields > 3% to pinpoint companies offering attractive yields above 3% and reliable payouts.

- Break into future-shaping sectors when you use these 25 AI penny stocks to access companies advancing game-changing artificial intelligence solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal