Will Expanded Dealer Algorithms and Record Volumes Change Tradeweb Markets' (TW) Growth Narrative?

- Earlier this month, Tradeweb Markets Inc. announced an expansion of its dealer algorithmic execution capabilities for U.S. Treasuries, providing institutional clients with access to enhanced liquidity and advanced execution strategies via its dealer algo suite, now including J.P. Morgan and Morgan Stanley algorithms.

- This development highlights Tradeweb's ongoing commitment to innovation in electronic trading, underscored by recently reported record trading volumes and growing client adoption of automation tools.

- We'll explore how the introduction of expanded dealer algos and higher trading volumes may alter Tradeweb's overall investment outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Tradeweb Markets Investment Narrative Recap

For Tradeweb Markets, the core investment thesis hinges on the continued electronification of fixed income and derivatives trading, supported by robust platform adoption and innovations in automation and algorithmic execution. The recent dealer algorithm expansion for U.S. Treasuries strengthens Tradeweb’s offering, but it is unlikely to materially reduce the immediate risk of market share erosion in its core segment, especially given persisting reliance on voice trading during volatile periods.

The September 2025 operating update stands out, where Tradeweb posted record trading volumes of US$63.7 trillion and a 10% year-over-year increase in average daily volume. This momentum in electronic trading directly connects to one of the company’s most important catalysts, the migration from manual to automated trading, as institutional clients continue to adopt Tradeweb’s electronic tools and solutions.

However, despite continued product expansion and trading volume records, the ongoing shift of complex trades to voice channels remains an important detail investors should know…

Read the full narrative on Tradeweb Markets (it's free!)

Tradeweb Markets is projected to reach $2.6 billion in revenue and $917.7 million in earnings by 2028. This outlook is based on an assumed 10.6% annual revenue growth rate and a $359.9 million increase in earnings from the current $557.8 million.

Uncover how Tradeweb Markets' forecasts yield a $147.47 fair value, a 38% upside to its current price.

Exploring Other Perspectives

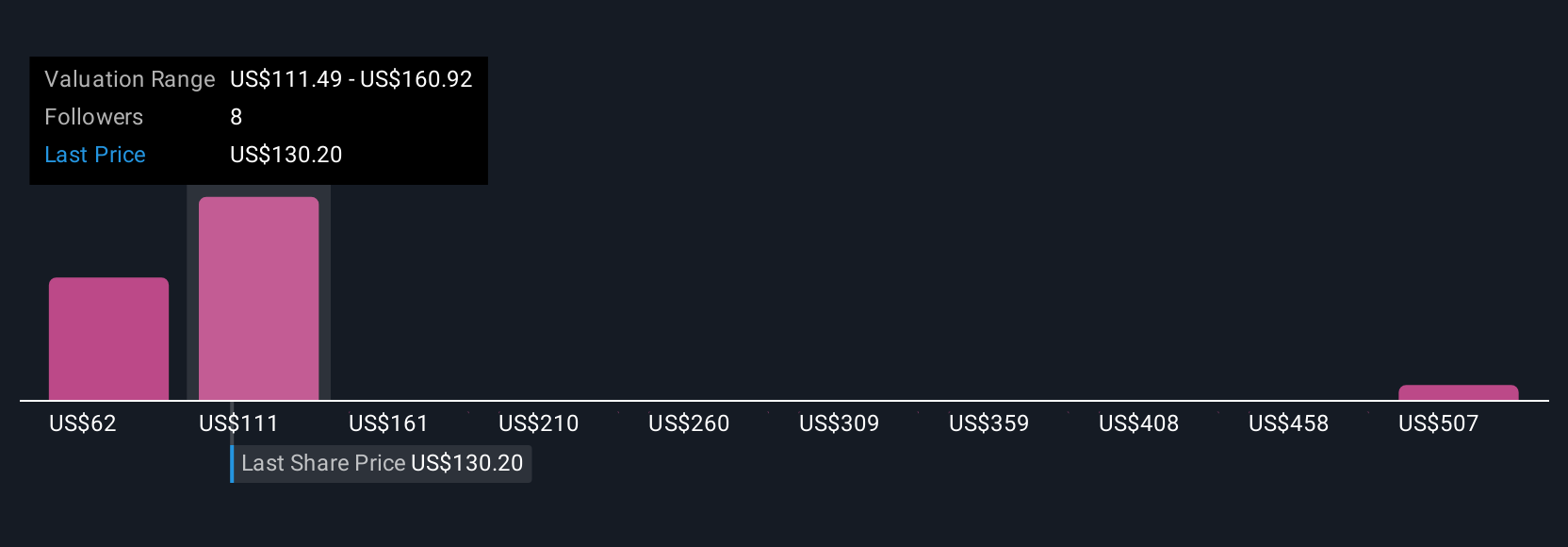

You’ll find four community fair value estimates for Tradeweb ranging from US$63.47 to US$556.37 per share, reflecting divergent outlooks. While many see upside as automation gains traction, the impact of persistent voice trading on growth remains a debated concern among market participants.

Explore 4 other fair value estimates on Tradeweb Markets - why the stock might be worth 41% less than the current price!

Build Your Own Tradeweb Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tradeweb Markets research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Tradeweb Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tradeweb Markets' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal