Assessing Wix (WIX) Valuation Following Analyst Upgrades and Increased Share Buyback Authorization

Wix.com (WIX) has seen its shares climb in the past week, outpacing the broader market as investors look ahead to the upcoming earnings report. Positive sentiment is building, likely fueled by recent estimate upgrades and a larger share buyback plan.

See our latest analysis for Wix.com.

After a brief surge last week, Wix.com's share price momentum has cooled, with a 1-day decline of 3.29% capping off a rough patch that includes a year-to-date share price return of -38.05%. While the current price drop reflects shifting risk perceptions in the software sector, it is worth noting that the one-year total shareholder return stands at -19.95%. This highlights that long-term holders have faced steeper losses even as optimism around undervaluation and new revenue streams persists.

If you're weighing fresh opportunities in tech, now could be the right moment to discover See the full list for free.

With shares trading about 46% below analyst price targets and a nearly 48% discount to intrinsic value, investors are left to wonder if Wix.com is truly undervalued or if the market is already reflecting all future growth.

Most Popular Narrative: 34.9% Undervalued

Wix.com's most widely followed narrative points to a fair value of $206.09, which is meaningfully above the last close of $134.15. This valuation gap reflects optimism around the company’s ability to sustain growth, expand into new markets, and achieve higher earnings.

Accelerating adoption of AI-powered tools and onboarding funnels is driving a significant increase in new user cohorts and higher conversion to paid subscriptions, which supports expectations for revenue growth in both the near and long term.

Ready for a deep dive? The full narrative unpacks bold financial projections and ambitious growth plans. These are numbers that could redefine what investors expect from Wix.com. Find out what is fueling this premium and the key metrics analysts are using to justify it. Don’t miss the surprising drivers behind this valuation.

Result: Fair Value of $206.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in organic web traffic and rising competition from new AI-enabled platforms could limit the company’s long-term growth potential.

Find out about the key risks to this Wix.com narrative.

Another View: Looking at Market Comparisons

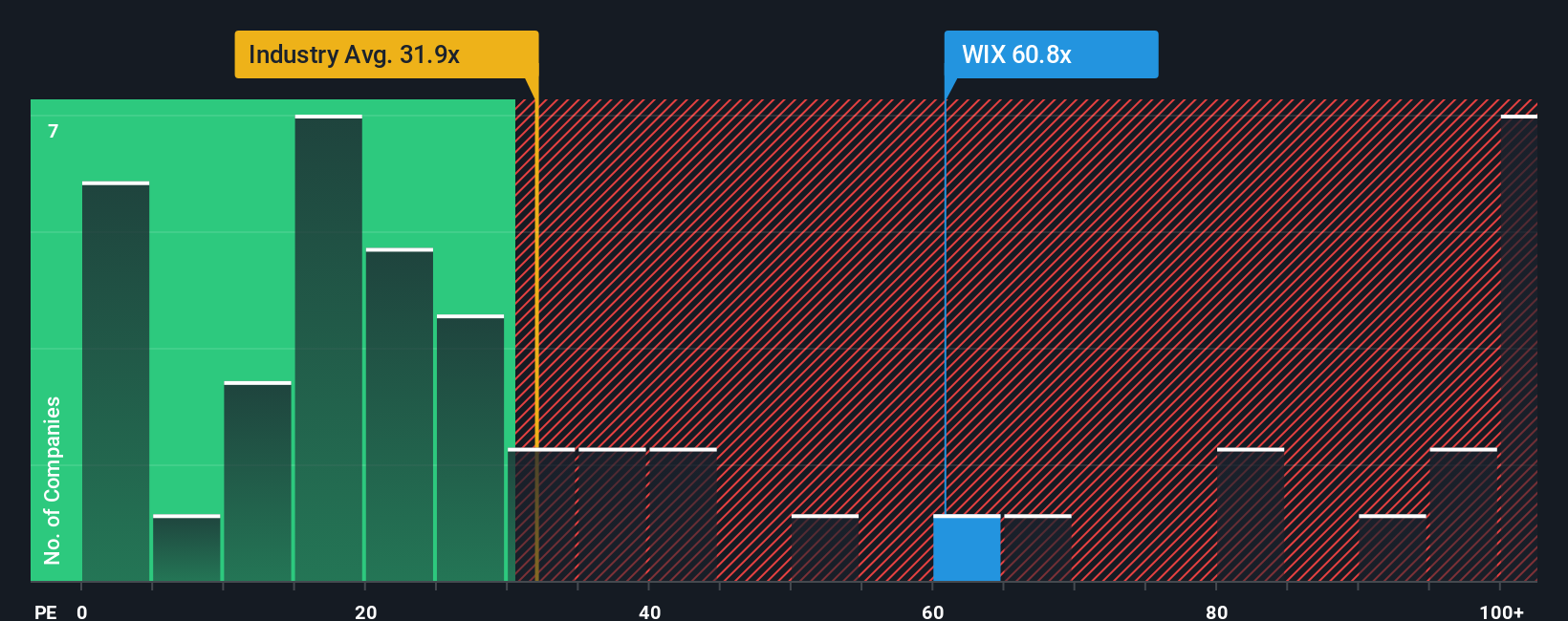

While the analyst consensus highlights Wix.com as undervalued based on future earnings growth, the current price-to-earnings ratio tells a different story. At 44.9 times earnings, the company trades well above the US IT industry average of 30.7x, and is slightly higher than its estimated fair ratio of 42x.

This gap signals a risk that the market may already be pricing in much of Wix.com’s growth. As a result, investors should consider whether this premium is sustainable or if the stock could revert closer to peer and fair ratio levels.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wix.com Narrative

If the numbers and perspectives here do not reflect your own outlook, you can review the data yourself and shape your own investing narrative in just a few minutes. Do it your way.

A great starting point for your Wix.com research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next market win could be just a click away. Don’t let opportunity pass you by. Fuel your portfolio with these handpicked investment themes from Simply Wall St:

- Boost your income potential and tap into companies with reliable returns by checking out these 19 dividend stocks with yields > 3% offering yields above 3%.

- Ride the innovation wave with these 26 quantum computing stocks, making breakthroughs in quantum technology and transforming tomorrow’s industries today.

- Catch early-stage momentum and growth stories before they hit the mainstream with these 3586 penny stocks with strong financials, backed by strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal