Polaris (PII): Evaluating Valuation After Trade Tensions and Market Uncertainty Fuel Share Pressure

Polaris (NYSE:PII) has seen its stock come under pressure as investors react to President Trump’s remarks on China’s rare earth metal policies. This has fueled concerns over trade tensions and consumer spending outlooks amid a government shutdown.

See our latest analysis for Polaris.

After climbing earlier in the quarter, Polaris shares have been hit hard by recent market turbulence, falling over 10% in a single day and losing more than 26% in total shareholder return over the past year. While short-term volatility is clearly elevated amid policy uncertainties, the drop follows a stretch when momentum had been building. This signals changing risk perceptions and highlights the stock’s challenge to regain investor confidence.

If you’re weighing other discovery opportunities beyond Polaris, now’s a great moment to broaden your search and explore See the full list for free.

With the recent sell-off and ongoing uncertainty, the key question now is whether Polaris is trading at a bargain or if the market has already accounted for any rebound in growth prospects.

Most Popular Narrative: 8% Overvalued

With Polaris closing at $56.30 and the latest consensus narrative assigning a fair value of $52.00, the market price is currently outpacing what analysts believe is justified. Fresh analyst input is reshaping expectations as recent upgrades and new product rollouts come into focus.

"Bullish analysts have raised price targets substantially, reflecting growing confidence in Polaris's ability to navigate industry headwinds. Modest improvements in expected revenue growth are contributing to upward fair value revisions."

Want to find out why analysts think this premium is risky? The storyline hinges on breakthrough product launches and some surprisingly bold revenue and margin forecasts. Uncover the powerful forces and projections that are driving this new valuation. There are key assumptions that might catch you off guard.

Result: Fair Value of $52.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant uncertainty remains as Polaris faces large tariff costs and continued weakness in international markets. Either of these factors could challenge recovery hopes.

Find out about the key risks to this Polaris narrative.

Another View: What Do Sales Multiples Suggest?

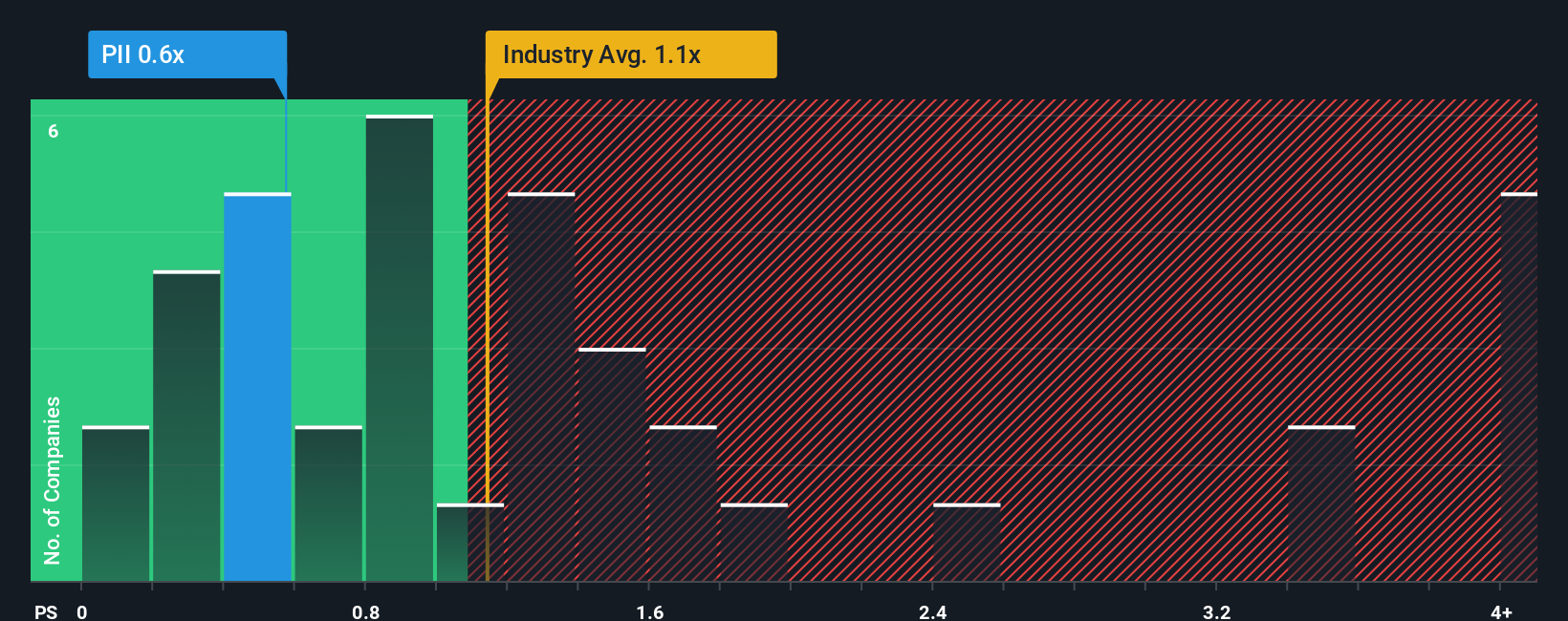

While analysts argue that Polaris is overvalued using future earnings estimates, another perspective surfaces from its price-to-sales ratio. Polaris trades at 0.5x sales, which stands out as lower than both the US Leisure industry average of 1x and a peer average of 1.3x. Even the fair ratio is higher at 0.7x. This signals the market is pricing in more risk or weaker growth than its peers. Does this present a hidden value play, or does it simply reflect deeper challenges?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Polaris Narrative

If you want to dig deeper or see things differently, the tools are there for you to craft your perspective on Polaris in just a few minutes. Do it your way.

A great starting point for your Polaris research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Let yourself in on opportunities others might overlook. Don't wait for the next market shift to act. Make your move with these advanced stock ideas handpicked for bold investors.

- Unearth potential hidden gems by checking out these 898 undervalued stocks based on cash flows that boast strong cash flow metrics and could be trading at a bargain right now.

- Tap into the future of medicine by browsing these 33 healthcare AI stocks featuring innovation-driven companies transforming healthcare with artificial intelligence.

- Power up your income with these 19 dividend stocks with yields > 3%, focusing on stocks offering reliable yields above 3 percent for steady returns, even in volatile times.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal