Could Nouveau Monde Graphite's (TSX:NOU) Global Outreach Shape Its Long-Term Competitive Position?

- Nouveau Monde Graphite Inc. presented at the Munich Mining Conference 2025 on October 4th at the Munich Olympic Hall in Germany, sharing company updates with investors and industry attendees.

- This international conference presence provides the company with an opportunity to communicate its latest developments and objectives directly to a global audience.

- We'll examine how expanded visibility from the Munich conference presentation may impact Nouveau Monde Graphite's investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Nouveau Monde Graphite's Investment Narrative?

To see value as a shareholder in Nouveau Monde Graphite, you’d need to be convinced by the company’s ability to fund, build, and scale its Phase-2 mine and battery materials projects despite high ongoing losses, dilution, and reliance on future financing. Participation at the Munich Mining Conference adds visibility, potentially supporting customer and lender relationships at a time when securing supply agreements and backing for the billion-dollar project financing remains crucial. In the short term, however, the Munich news does not appear likely to materially change the most important catalysts or risks: NMG still faces increased losses, a short cash runway, and unproven revenue, with price moves so far driven by market sentiment and not fundamentals. While conference exposure helps keep NMG on investor radars, decisive progress on financing and commercial agreements remains the main catalyst, and failure there is still the key risk.

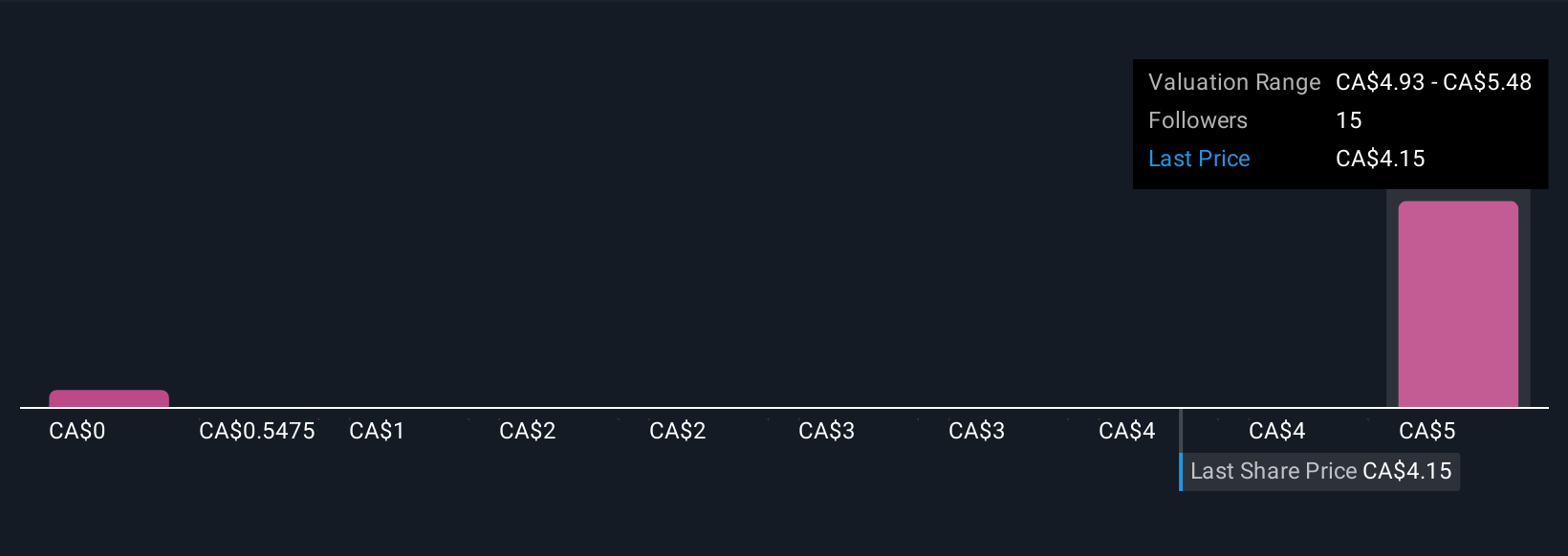

But not all risks are so visible in share price moves, especially around funding. Upon reviewing our latest valuation report, Nouveau Monde Graphite's share price might be too optimistic.Exploring Other Perspectives

Explore 2 other fair value estimates on Nouveau Monde Graphite - why the stock might be worth as much as CA$4.60!

Build Your Own Nouveau Monde Graphite Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nouveau Monde Graphite research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Nouveau Monde Graphite research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nouveau Monde Graphite's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal