Why 5N Plus (TSX:VNP) Is Up 9.6% After Analyst Upgrades and Expanded Industry Agreements

- In recent days, multiple analysts upgraded their outlooks for 5N Plus Inc., citing robust earnings performance and the company's enhanced position in advanced materials for high-growth industries including renewable energy, semiconductors, and aerospace.

- An important takeaway is that recurring contract wins and expanding supply agreements have increased the company's revenue visibility, as well as its appeal within the advanced materials sector.

- We'll explore how expanded agreements and recognition of earnings growth are shaping the investment narrative for 5N Plus Inc.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

5N Plus Investment Narrative Recap

To be a shareholder in 5N Plus right now, you need conviction in the company's ability to cement its place as a leading advanced materials supplier for renewable energy and high-tech industries, while managing customer concentration and policy risks. The recent wave of analyst upgrades, crediting strong earnings and expanding supply deals, appears to support 5N Plus’s most important short-term catalyst, increasing exposure to rapidly growing end markets via contract wins, while not fundamentally reducing the key risk of overdependence on a small set of large customers such as First Solar.

The most relevant announcement is the expanded multi-year supply agreement with First Solar, committing to significant volume increases (33 percent for 2025-2026, plus 25 percent for 2027-2028) and the addition of cadmium selenide production. This strengthens 5N Plus’s pipeline and underpins revenue visibility, directly bolstering its near-term growth thesis as highlighted in recent analyst target increases and positive earnings momentum. Contrasting this optimism, investors should also be aware of what continued reliance on only a few major clients could mean if...

Read the full narrative on 5N Plus (it's free!)

5N Plus' narrative projects $509.7 million revenue and $59.2 million earnings by 2028. This requires 15.1% yearly revenue growth and an $27 million earnings increase from $32.2 million currently.

Uncover how 5N Plus' forecasts yield a CA$19.68 fair value, a 8% upside to its current price.

Exploring Other Perspectives

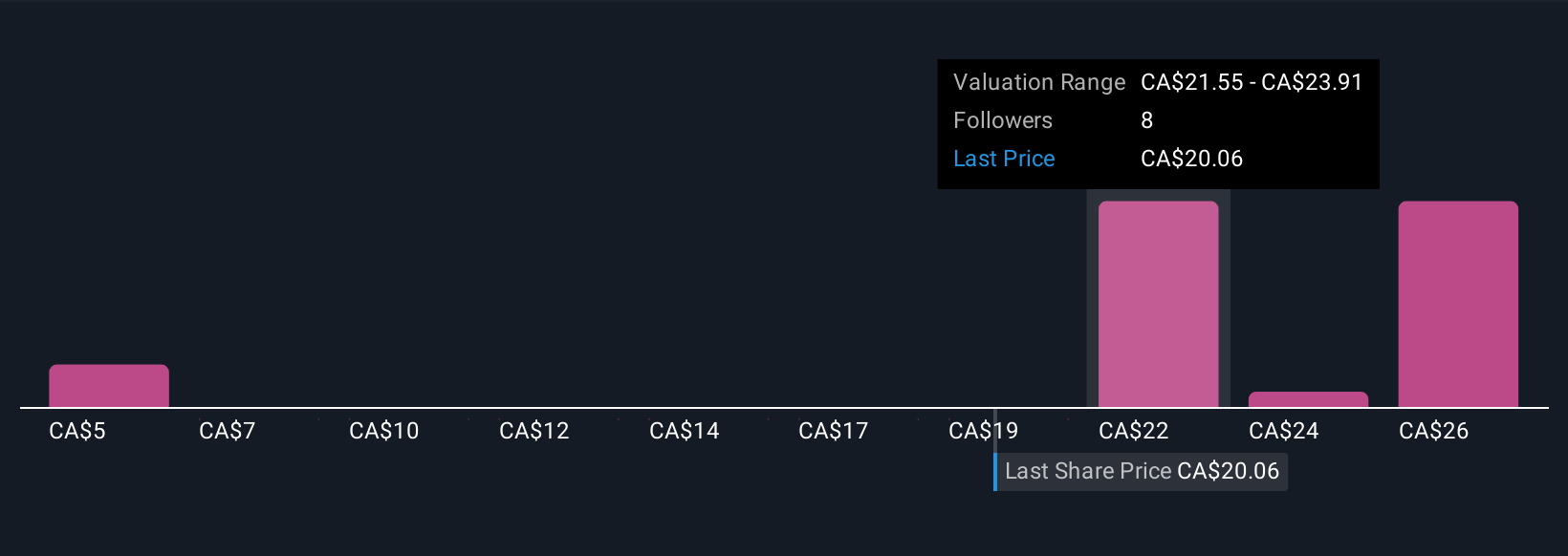

Simply Wall St Community members provided 4 fair value opinions for 5N Plus spanning CA$5 to CA$33.42 per share. As contract expansions drive revenue visibility, these different outlooks emphasize how perspectives can shift with new developments, see how your view aligns.

Explore 4 other fair value estimates on 5N Plus - why the stock might be worth as much as 83% more than the current price!

Build Your Own 5N Plus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 5N Plus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free 5N Plus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 5N Plus' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal