Why FuelCell Energy (FCEL) Is Up 36.2% After AI Data Center Demand Sparks Revenue Surge

- FuelCell Energy recently reported a near doubling in year-over-year revenue and highlighted its carbonate fuel cell platforms as a reliable power solution for the growing energy demands of artificial intelligence data centers.

- Investor enthusiasm is being fueled by the combination of the company's strong operational performance, sector-wide optimism across the hydrogen fuel cell industry, and anticipation that AI-driven electricity requirements could become a key growth driver.

- We’ll explore how growing demand from AI data centers may influence FuelCell Energy’s long-term earnings outlook and investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

FuelCell Energy Investment Narrative Recap

To be a shareholder in FuelCell Energy, you need conviction in the company’s ability to meet the surging energy demands of artificial intelligence data centers while overcoming ongoing profitability challenges. The recent sector-wide rally, sparked by optimism across hydrogen fuel cell peers rather than direct news from FuelCell Energy, lifts sentiment but does not meaningfully alter the immediate catalyst around revenue growth from new data center partnerships, nor does it resolve key risks tied to persistent financial losses and uncertain path to profitability.

Among recent announcements, the agreement with CGN-Yulchon Generation in South Korea stands out, aligning with the company’s goal to expand revenue by delivering and servicing carbonate fuel cell modules for decarbonization projects. This effort supports the broader catalyst of scaling proven technology for large customers, though it remains to be seen how quickly such deals can offset ongoing operational expenses.

However, despite strong top-line growth, investors should be aware that FuelCell Energy remains unprofitable with no near-term...

Read the full narrative on FuelCell Energy (it's free!)

FuelCell Energy's outlook anticipates $310.5 million in revenue and $31.6 million in earnings by 2028. This projection is based on a 33.9% annual revenue growth rate and a $175.3 million increase in earnings from the current level of -$143.7 million.

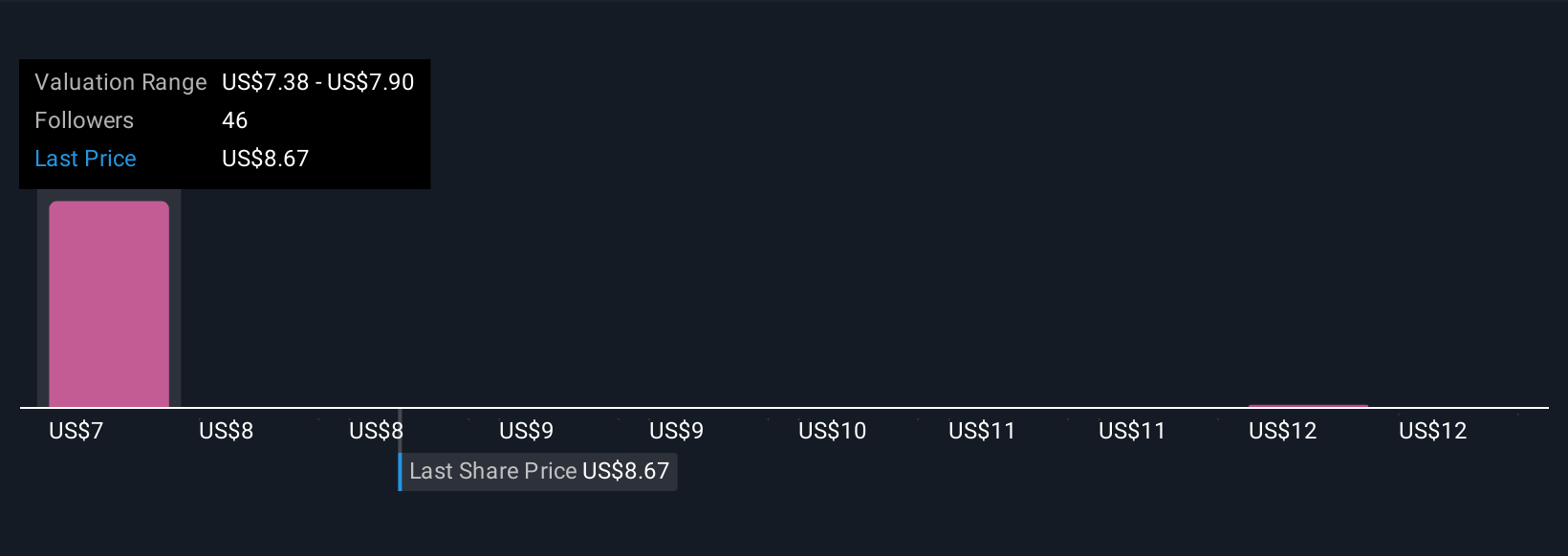

Uncover how FuelCell Energy's forecasts yield a $7.38 fair value, a 30% downside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range from US$7.38 to US$12.58 per share. Persistent net losses and a challenging path to profitability raise questions that affect how you might interpret these varied community perspectives.

Explore 4 other fair value estimates on FuelCell Energy - why the stock might be worth 30% less than the current price!

Build Your Own FuelCell Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FuelCell Energy research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free FuelCell Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FuelCell Energy's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal