Will Unity’s (U) Security Response Shape Developer Trust or Raise New Questions About Market Leadership?

- Earlier this month, Unity Software disclosed a major security vulnerability affecting all games built on its engine since version 2017.1, providing developers with both immediate patch solutions and updates for various platforms.

- Though there is no evidence this flaw was exploited, the incident's potential to impact user data and developer confidence makes it a significant operational risk for Unity's extensive ecosystem.

- We'll explore how Unity's rapid response to this critical vulnerability could influence its narrative of technology leadership and market trust.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Unity Software Investment Narrative Recap

To hold Unity Software stock, an investor often weighs faith in the company's ability to monetize its technology across gaming and emerging industries, driven by broader adoption of real-time 3D content and new AI-powered tools. While the recent security vulnerability has posed an operational risk and triggered a short-term stock decline, Unity’s swift mitigation, paired with no evidence of active exploitation, means the impact on its near-term innovation roadmap and key growth catalysts appears contained for now.

Among the latest announcements, Unity’s expanded partnership with Globant stands out, it targets real-time 3D solutions for sectors like automotive and healthcare, reinforcing the company’s ambitions to diversify revenue and accelerate adoption in non-gaming markets. This underpins the core catalyst of Unity's ongoing product innovation and pursuit of recurring revenues beyond its foundational gaming business.

However, beneath the surface, investors should not lose sight of ...

Read the full narrative on Unity Software (it's free!)

Unity Software's narrative projects $2.3 billion revenue and $313.8 million earnings by 2028. This requires 9.3% yearly revenue growth and a $747.7 million increase in earnings from the current -$433.9 million.

Uncover how Unity Software's forecasts yield a $35.17 fair value, a 6% downside to its current price.

Exploring Other Perspectives

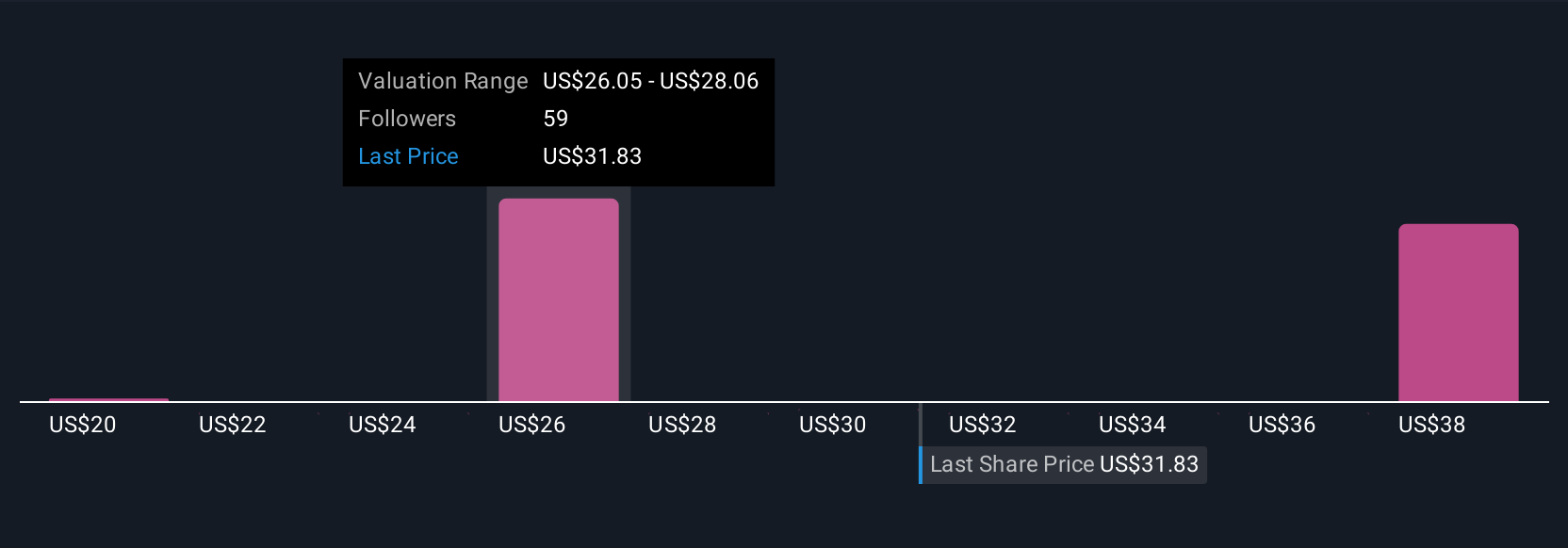

Nine members of the Simply Wall St Community placed fair value estimates for Unity between US$20.31 and US$44. In contrast, heightened R&D expenses associated with aggressive AI and product expansion could test Unity’s path to sustained profitability, a factor worth weighing as you compare these alternative outlooks.

Explore 9 other fair value estimates on Unity Software - why the stock might be worth 46% less than the current price!

Build Your Own Unity Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Unity Software research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Unity Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Unity Software's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal