Takaichi Sanae's victory boosts easing expectations, and yen arbitrage trading may make a comeback

The Zhitong Finance App learned that with Sanae Takaichi, who advocates a loose monetary policy, was successfully elected as president of Japan's Liberal Democratic Party and is almost certain to be the next prime minister of Japan, the market expects the Bank of Japan to slow down the pace of interest rate hikes, and the once popular Japanese yen arbitrage trading seems about to make a comeback.

The yen fell across the board against major currencies on Monday as investors bet Sanae Takaichi's pro-stimulus stance would cause the Bank of Japan to slow its policy tightening schedule. The Bank of Japan's postponement of interest rate hikes is likely to induce traders to return to the so-called Japanese yen arbitrage trading strategy, which is to borrow low-yield yen and buy high-yield currencies such as the Brazilian real or Australian dollar to earn interest spreads. Jane Foley, head of foreign exchange strategy at Rabobank, said: “The market may conclude that 'Japanese yen arbitrage trading will restart' in the short term.”

On October 4, local time, the election results for the president of Japan's ruling Liberal Democratic Party were announced. Sanae Takaichi defeated many rivals including Shinjiro Koizumi and was successfully elected as the new president of the Liberal Democratic Party. Since the Liberal Democratic Party still maintains its position as the largest party in the Japanese Diet, Sanae Takaichi is expected to become Japan's first female prime minister in the prime minister nomination election in a few days.

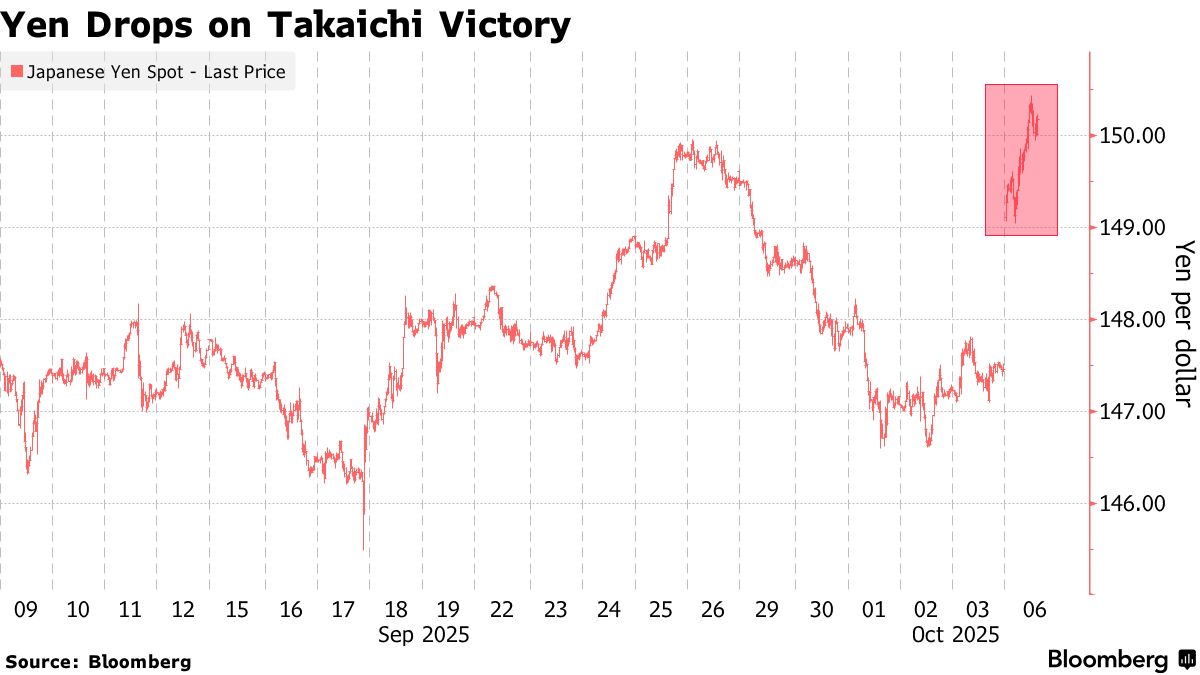

Takaichi Sanae's victory caused the yen to plummet by as much as 2% against the US dollar on Monday, while Japanese treasury bonds fell due to market concerns that Sanae Takaichi would introduce more government spending and boost inflation. Many market participants have also noticed that she has previously criticized the Bank of Japan's move to raise interest rates, and if she takes office, she may advocate slowing down the pace of policy austerity.

Takaichi Sanae's economic adviser Etsuro Honda said on Monday that if the Bank of Japan were to raise interest rates “too hastily” this month, it should wait until the Takaichi Sanae government is more stable before acting. “December would be a more appropriate time.”

These remarks prompted traders to drastically cut their bets on the Bank of Japan's tightening policy. Interest rate swaps show that the market currently only believes that the probability that the Bank of Japan will raise interest rates at the October 30 meeting is 19%, far lower than about 57% before the Liberal Democratic Party presidential election. If the Bank of Japan chooses to slow down the pace of raising the benchmark interest rate, it will give potential arbitrage traders more confidence that the yen will still be a cheap source of financing.

Masayuki Nakajima, a senior foreign exchange strategist at Mizuho Bank's London branch, also believes that the yen sell-off may accelerate further. He pointed out that the yen may fall to 180 against the euro (which hit a record low on Monday) and may face further pressure against other Asian currencies. He said, “If Sanae Takaichi continues to insist that 'a weak yen will not have a negative impact on the Japanese economy' and insists on the Bank of Japan's position that interest rates should not be raised, then arbitrage trading may resume, and the yen will weaken across the board.”

Deutsche Bank strategists say they have decided to close their previous bullish yen positions because “due to political surprises, there is currently a lack of positive catalysts.” Markets Live strategist Cameron Crise put it bluntly: “This year's market environment is reminiscent of the mid-2000s — the golden age of forex arbitrage trading.”

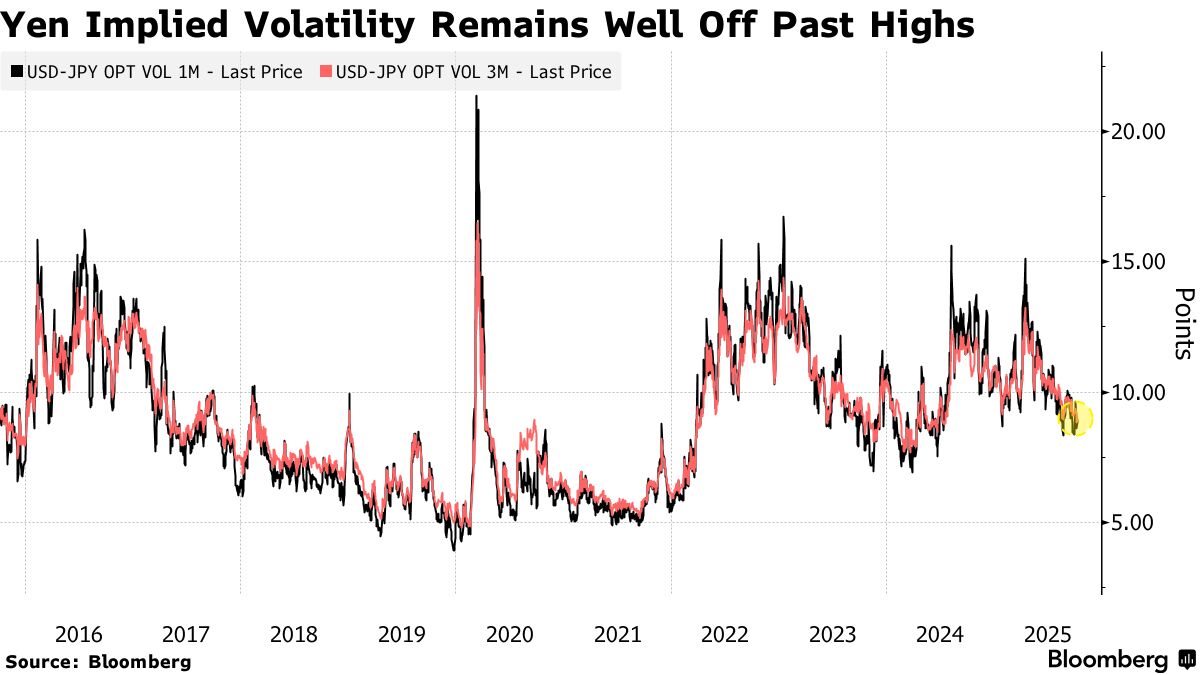

Arbitrage trading has been profitable in recent weeks, as the overall volatility of the foreign exchange market remains low. Arbitrage transactions funded in yen are particularly profitable. According to the data, traders who sell yen and buy Colombian pesos can profit more than 5%, while the Swiss franc, another popular financing currency, earns only slightly more than 3%. The implied one-month volatility of the dollar against the yen fell by more than 40% from its high during the year and hit its lowest level in more than 12 months in September.

Over the next few weeks, traders will keep a close eye on statements from Bank of Japan officials to look for any signs of slowing down the pace of austerity. However, Wells Fargo London macro strategist Erik Nelson believes that the Bank of Japan is unlikely to change direction. He said, “The Bank of Japan knows that elections are coming up, but it is still adamant that more interest rate hikes are about to occur. If the next official statement appears weak in terms of interest rate hike guidelines, it will encourage traders who short the yen, because arbitrage gains are still attractive. But I doubt the Bank of Japan will change the tone so quickly.”

Notably, investors have also been hit hard by Japanese yen arbitrage transactions before. The most recent one was in July 2024, when the Bank of Japan raised the benchmark interest rate and announced that it would cut bond purchases in half. The yen immediately appreciated sharply, causing global market turmoil and impacting high-yield currency and stock markets.

But at least for now, the yen's weakness may be enough to support the appeal of arbitrage trading. Shusuke Yamada, Japan's chief foreign exchange and interest rate strategist at Bank of America Securities, said, “Looking at it now, Japanese yen arbitrage trading is still attractive. We expect the USD/JPY exchange rate to rise to 155 by the end of the year. The market still needs to further absorb the impact of Takaichi's Sanae policy stance.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal