How BYD’s Tripled European Sales Could Shift Its Valuation in 2025

If you have BYD on your watchlist or already own shares, you probably know how much there is to consider these days. The stock has definitely been making headlines, and the price action tells its own story. Over the past year, BYD returned 8.6%. What’s really eye-catching is the nearly 27% climb so far this year. Stretch that timeline out a bit and the story gets even more compelling, with a stunning 177% return over the past five years.

Of course, it hasn't all been smooth sailing. A not-too-distant selloff wiped out billions in market value, sending the stock down over 30% from its highs just a few months ago. Much of this drama came as BYD faced pressure to defend its market share. For example, there were deep discounts in challenging markets like Japan, and some anxiety over new tariffs from Mexico. On the other hand, there have been bursts of good news, such as European sales tripling in August and the company outselling Tesla there in July. Investors are clearly recalibrating how they see BYD’s risk and growth potential.

So, is the stock now an undervalued opportunity, or is caution still the watchword? The latest valuation score for BYD comes in at 4 out of 6, meaning it passes two-thirds of the undervaluation checks. Next, let's break down what those valuation measures really tell us, and why an even fuller picture of the company’s value might be hiding just out of sight.

Why BYD is lagging behind its peers

Approach 1: BYD Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to their value today. This helps investors gauge what the business might really be worth based on expected future performance rather than just current earnings or sales.

For BYD, the DCF model starts with its most recent Free Cash Flow, which stands at a negative CN¥124.3 Million. Looking ahead, analysts predict a significant turnaround, estimating Free Cash Flow to reach CN¥79.4 Billion by 2027. Longer-term projections, extrapolated by Simply Wall St, push this figure as high as CN¥149.4 Billion by 2035. These impressive growth estimates suggest the company has ample runway for expansion.

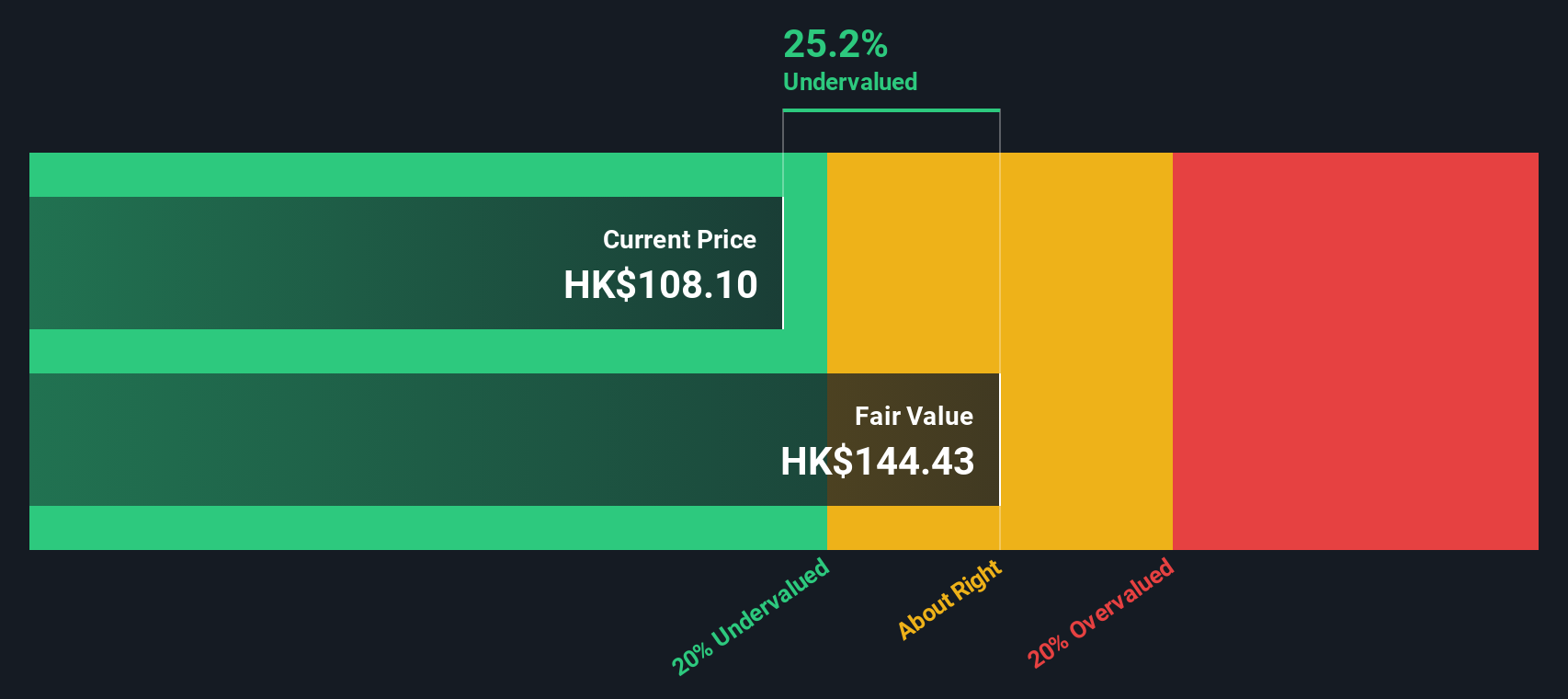

After running these cash flow projections through the DCF model, BYD’s estimated intrinsic value comes out to HK$144.42 per share. This represents a 24.2% discount compared to where shares are currently trading. This may indicate that the market is undervaluing BYD’s long-term earning power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BYD is undervalued by 24.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: BYD Price vs Earnings

The Price-to-Earnings (PE) ratio is a well-established valuation tool for assessing profitable companies like BYD. It helps investors measure how much they are paying for each dollar of current earnings, making it especially relevant for comparing mature, revenue-generating businesses within the same sector.

It is important to remember that a “normal” or “fair” PE ratio will vary depending on a company’s expected growth, profitability, and risk profile. Higher growth expectations can justify a higher PE, while increased risk or slowing earnings growth usually results in a lower fair value.

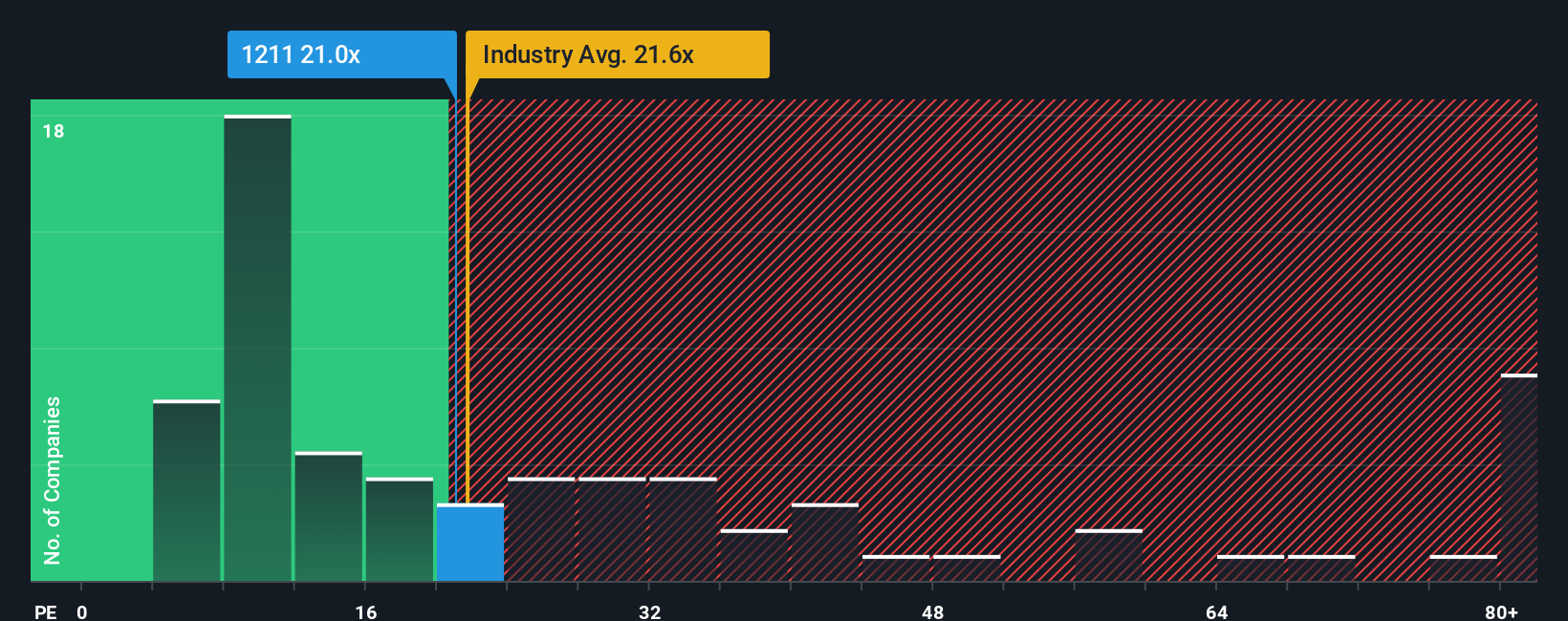

Currently, BYD trades at a PE ratio of 21.7x. Compared to other auto sector peers, whose average is around 9.8x, BYD looks expensive at face value. Even the broader industry average is lower, at 18.0x. However, Simply Wall St’s proprietary “Fair Ratio,” which accounts for factors like earnings growth, industry, profit margin, market cap, and risk, is 17.8x for BYD.

The advantage of the Fair Ratio is that it moves beyond simple peer or industry comparisons by factoring in detailed company-specific attributes. This ensures the valuation considers BYD’s unique strengths and risks as well as its sector trends.

Since BYD’s current PE ratio of 21.7x is somewhat above the Fair Ratio of 17.8x, the stock appears to be trading at a premium based on current earnings power and growth prospects.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BYD Narrative

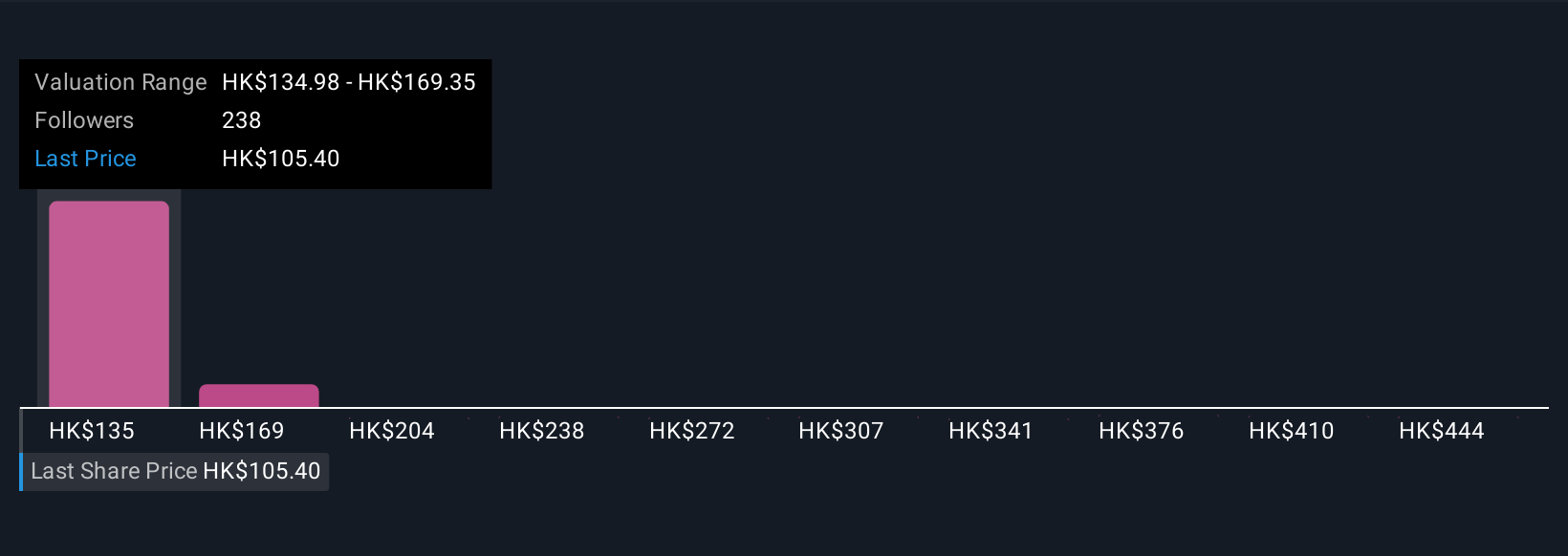

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, powerful way investors can tell the story behind a company’s numbers by combining their views on fair value, future revenue, earnings, and margins to create a clear thesis for why the stock might rise or fall.

Narratives connect the dots between a company’s strategic outlook, a personalized financial forecast, and the resulting fair value, making investment decisions more meaningful than just looking at ratios. On the Simply Wall St Community page, millions of investors use Narratives as an accessible tool to set their expectations, compare Fair Value against the current share price, and quickly spot opportunities to buy or signals to sell.

Unlike static metrics, Narratives update automatically as new data, such as earnings reports or major news, becomes available. This ensures your perspective stays current. For example, one BYD investor might believe the company’s rapid European expansion justifies a much higher fair value, while another may hold a more cautious outlook due to recent market volatility. Both viewpoints are instantly reflected with Narratives.

Do you think there's more to the story for BYD? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal