How Investors May Respond To Opera (OPRA) Launching Neon With AI-Powered Premium Browser Features

- Opera Limited has recently begun shipping Opera Neon, a new premium AI-powered browser that offers agentic automation, context-aware workspaces, and privacy-focused features aimed at power users.

- The launch of Neon marks a shift in Opera's browser strategy, setting it apart in the competitive field by embedding real-time, local AI capabilities directly into the browsing experience.

- We'll now explore how Opera Neon's agentic AI and premium subscription model influence the company's broader investment case.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Opera Investment Narrative Recap

To be a shareholder in Opera today, you need to believe the company can translate premium, AI-driven browser products like Opera Neon into higher-margin revenue, especially as differentiation and pricing power become more critical in a saturated browser market. While the recent Neon launch signals Opera’s intent to capture professional users, its immediate impact on accelerating near-term user growth is uncertain, and the most pressing risk remains Opera’s dependence on third-party AI providers, which could alter costs and margin structure if licensing terms or technology access shift.

Among Opera’s recent announcements, the ongoing partnership with Google Cloud to integrate advanced AI elements is highly relevant to Neon. This collaboration enables Opera to embed capabilities such as image generation and enhance real-time experiences, supporting Neon’s ambition as a productivity-focused, subscription-based browser and aligning closely with the company’s most important catalyst: leveraging AI to increase engagement and monetization.

However, investors should also be mindful that Opera’s agentic AI approach exposes the business to a very different kind of cost pressure and competitive risk that...

Read the full narrative on Opera (it's free!)

Opera's outlook anticipates $813.6 million in revenue and $135.8 million in earnings by 2028. This scenario relies on 13.6% annual revenue growth and a $55.2 million increase in earnings from the current $80.6 million.

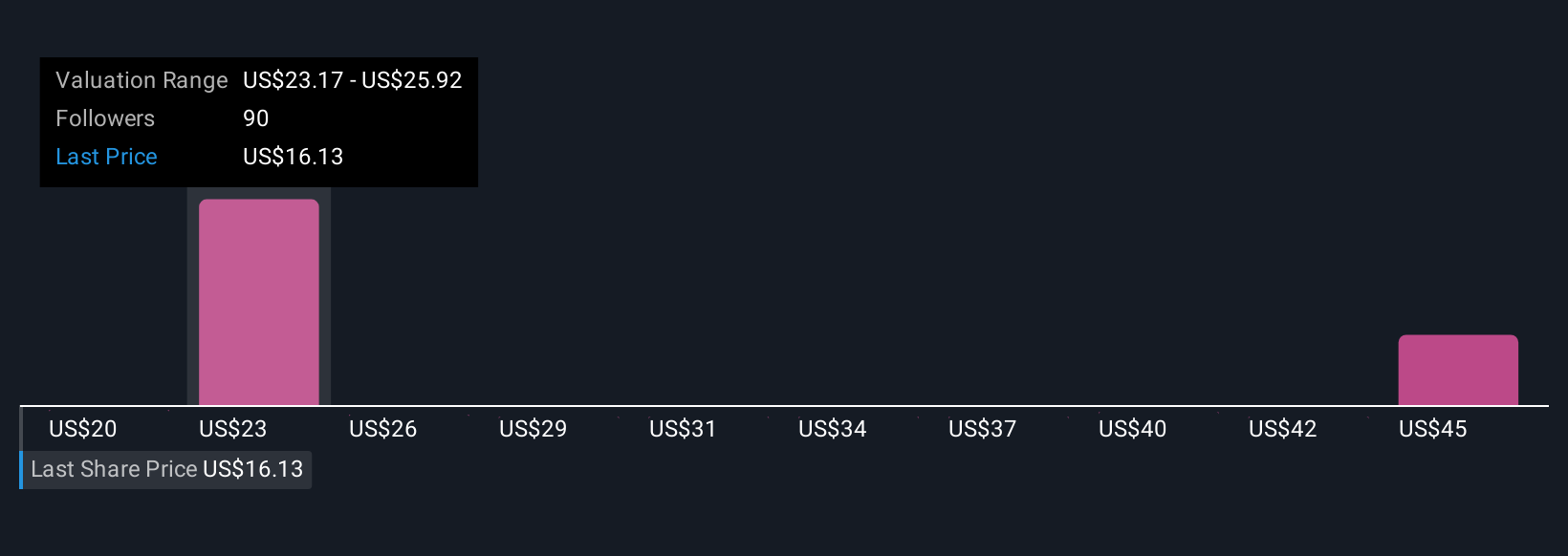

Uncover how Opera's forecasts yield a $25.50 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Seven different fair value estimates from the Simply Wall St Community range from US$20.41 to US$47.69, highlighting strong disparity in growth expectations. With Opera’s AI-driven Neon launch relying on external model providers, the plurality of views invites you to weigh both new product potential and persistent dependency risks.

Explore 7 other fair value estimates on Opera - why the stock might be worth just $20.41!

Build Your Own Opera Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Opera research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Opera research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Opera's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal