The Bull Case For NexGen Energy (TSX:NXE) Could Change Following C$800 Million Dual-Market Equity Raise

- NexGen Energy Ltd. has announced a major dual-market equity financing initiative totaling approximately C$800 million, comprising a C$400 million bought deal offering in North America and an A$400 million offering in Australia, with proceeds earmarked for the Rook I Project and general corporate purposes.

- This sizeable cross-border capital raise highlights NexGen's ambition to support the development of its flagship uranium project and strengthen its financial position on two continents.

- We'll explore how this capital-raising effort focused on Rook I funding could reshape NexGen Energy’s investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is NexGen Energy's Investment Narrative?

For a shareholder, NexGen Energy represents a story built on long-term uranium demand and the successful development of the Rook I Project. The newly announced C$800 million dual-market equity raise is a crucial step, potentially removing one of the most pressing short-term risks: funding uncertainty for pre-production activities and project advancement. This influx of capital could accelerate engineering work and support newly signed uranium offtake agreements, both significant near-term catalysts. Still, it's essential to consider that this financing may dilute current shareholders, particularly in a company that is unprofitable, with net losses reported in both recent quarters and the latest fiscal year. The offering comes amid a period of major insider selling and ongoing questions about profitability and valuation relative to peers. While the fresh capital could ease worries over project execution, shareholder dilution and lack of near-term profits remain key risks.

On the other hand, dilution from equity raising is a risk every investor should consider.

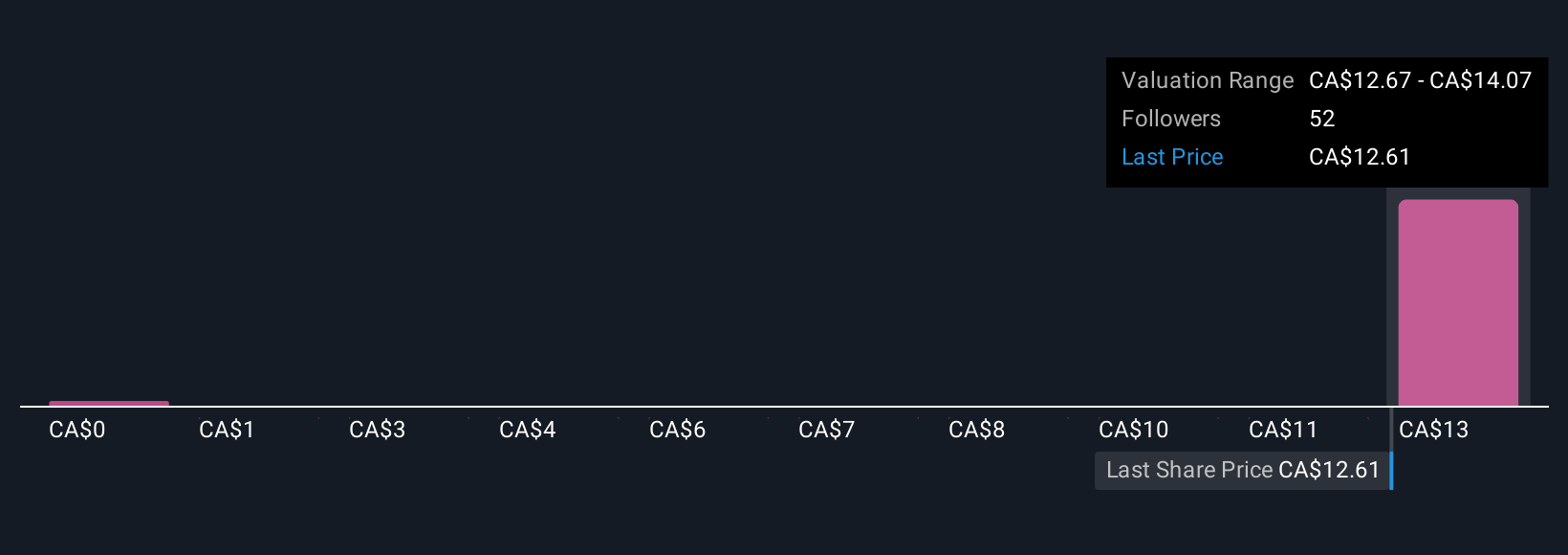

Our expertly prepared valuation report on NexGen Energy implies its share price may be too high.Exploring Other Perspectives

Explore 5 other fair value estimates on NexGen Energy - why the stock might be worth less than half the current price!

Build Your Own NexGen Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NexGen Energy research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free NexGen Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NexGen Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal