Do Concerns Over Transparency Reshape Fortinet's (FTNT) Long-Term Growth Narrative?

- In recent weeks, multiple law firms announced securities class action lawsuits against Fortinet, Inc., alleging that the company and certain executives misrepresented the scope and business impact of its FortiGate firewall product refresh cycle during the prior year.

- The complaints argue that the upgrade opportunity was overstated and key facts about the timing and limited nature of the refresh were not properly disclosed to investors, raising concerns about transparency and future revenue predictability.

- Given these legal and disclosure challenges, we'll explore how questions surrounding Fortinet’s transparency and upgrade cycle affect its investment narrative and growth outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Fortinet Investment Narrative Recap

To be a Fortinet shareholder, you need to believe that the company will sustain growth through expanding adoption of integrated cybersecurity solutions and successfully transition beyond its hardware-heavy roots. The recent class action lawsuits and related revelations about the FortiGate firewall refresh cycle have put the short-term hardware upgrade catalyst and management transparency under a spotlight, increasing near-term risk to revenue predictability and investor trust, at least until visibility improves.

Of particular relevance is the August 6, 2025 earnings announcement, where Fortinet disclosed it had pulled forward approximately 40% to 50% of its 2026 upgrade cycle in just a few months. This news, combined with the subsequent lawsuits, directly challenges assumptions about the timing and magnitude of the much-touted hardware refresh opportunity, potentially resetting expectations for growth and near-term financial performance.

By contrast, investors should be aware that questions about the true size and impact of the update cycle will remain critical as...

Read the full narrative on Fortinet (it's free!)

Fortinet's outlook anticipates $9.2 billion in revenue and $2.4 billion in earnings by 2028. This scenario assumes a 13.1% annual revenue growth rate and a $0.5 billion increase in earnings from the current $1.9 billion.

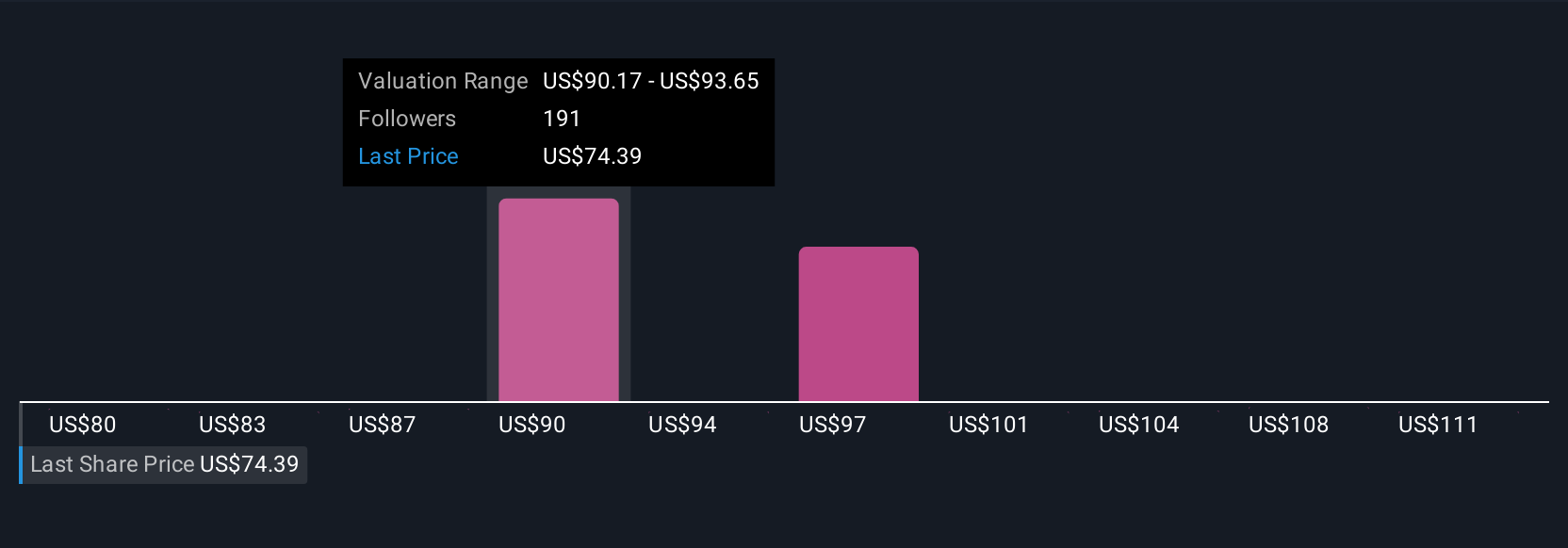

Uncover how Fortinet's forecasts yield a $90.32 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Thirty-three members of the Simply Wall St Community estimated Fortinet’s fair value anywhere from US$74.10 to US$110.52 per share. Given the wide range of perspectives, keep in mind that hardware upgrade risks and shifting transparency could weigh on your own outlook for the business.

Explore 33 other fair value estimates on Fortinet - why the stock might be worth 14% less than the current price!

Build Your Own Fortinet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortinet research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Fortinet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortinet's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal