Draganfly (CNSX:DPRO) Is Up 66.4% After Securing U.S. Army Flex FPV Drone Systems Contract

- Draganfly Inc. recently announced that the U.S. Army selected the company to supply its Flex FPV drone systems, supporting high-performance operations and establishing on-site manufacturing and training at overseas U.S. Forces facilities.

- This partnership signals a pivotal development in drone warfare capabilities, underscoring the military’s move towards agile, decentralized innovation directly at operational theatres.

- We'll explore how Draganfly’s enablement of on-site drone manufacturing for the U.S. Army shapes its broader investment narrative and future opportunities.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Draganfly's Investment Narrative?

To be a Draganfly shareholder, you need conviction in two key themes: rapid sector expansion and the company’s unique access to critical defense and government contracts. The recent U.S. Army partnership is especially significant, landing Draganfly squarely in the spotlight as military adoption of flexible, on-site drone manufacturing grows more urgent. Before this announcement, the main catalysts were continued contract wins, strong revenue forecasts and advancing technology. A core risk was high share price volatility and ongoing unprofitability, with the business relying on frequent capital raises and dilution. Now, the Army deal brings real operational credibility and could accelerate revenue visibility, helping Draganfly attract further partnerships or institutional backers. Yet, short-term risks remain, especially around execution and whether this contract meaningfully changes Draganfly’s path to consistent profitability. Given the huge recent share price move, expectations for near-term performance are running high.

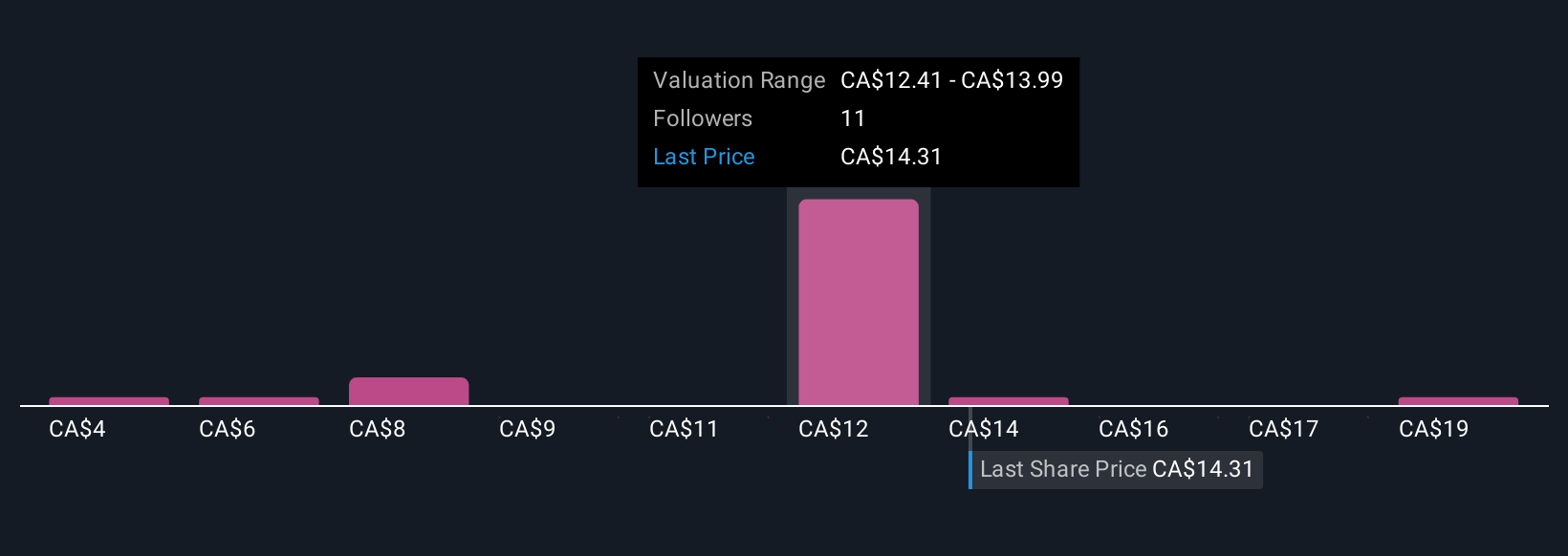

But investor expectations are running hot, execution risk is something everyone should keep in mind. Our expertly prepared valuation report on Draganfly implies its share price may be too high.Exploring Other Perspectives

Explore 6 other fair value estimates on Draganfly - why the stock might be worth as much as 44% more than the current price!

Build Your Own Draganfly Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Draganfly research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Draganfly research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Draganfly's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal