Kinsale Capital Group (KNSL): Revisiting Valuation After Fresh Analyst Optimism and Management Confidence

Following a series of upbeat meetings with Truist Securities, Kinsale Capital Group (KNSL) leadership underscored their confidence in the company’s path. They particularly pointed to stronger property insurance markets and growth momentum in states like Texas and Florida.

See our latest analysis for Kinsale Capital Group.

After a year marked by robust top-line growth and upbeat signals from industry analysts, Kinsale Capital Group’s recent stock moves have reflected both cautious optimism and the underlying strength of its specialty insurance business. While day-to-day share price changes have been minor, the company’s three-year total shareholder return of over 65% highlights its ability to deliver long-term value. Momentum has cooled slightly in the near term, but the company continues to show resilience.

If you’re looking for what else is drawing attention in the market right now, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With analyst optimism setting the stage and recent growth still in focus, the key question for investors remains: Is Kinsale Capital Group trading below its true value, or is the market already factoring in all of its future potential?

Most Popular Narrative: 11% Undervalued

Kinsale Capital Group's narrative-driven fair value stands at $499.11, which is 11.4% above the latest close of $442.56. This narrative presents a higher fair value in light of projected growth drivers, setting the stage for a deeper look at the numbers that matter most.

Robust growth in small business property, high-value homeowners, and new E&S segments such as agribusiness and select homeowners markets reflects expanding opportunities from shifting risk and economic complexity in the U.S. These dynamics support future revenue growth as new business submissions and innovative product launches increase Kinsale's addressable market.

Want to understand the engine fueling this narrative’s upside? The real story hinges on bold forecasts for revenue, margin shifts, and future earnings multiples. A single quantitative leap could make all the difference. Find out which crucial assumptions set this price target apart.

Result: Fair Value of $499.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation or intensifying competition in key segments could put pressure on Kinsale’s margins and challenge its robust growth narrative going forward.

Find out about the key risks to this Kinsale Capital Group narrative.

Another View: The Multiples Perspective

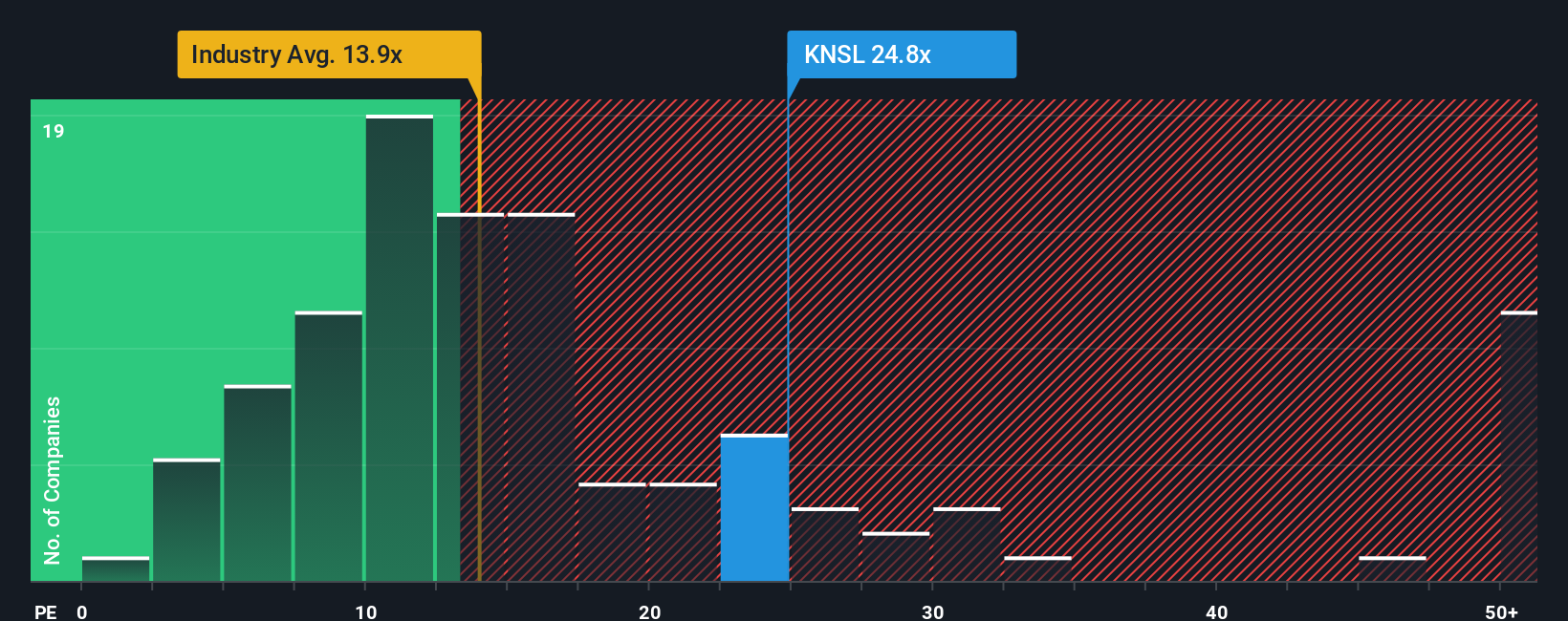

While growth assumptions look strong, looking at the share price through the lens of earnings multiples tells a different story. Kinsale trades at 23.1 times its earnings, well above the US Insurance industry average of 13.7 times and the estimated fair ratio of 13.3. This premium signals that the market expects a lot from the company, but it also means less room for error. If growth doesn’t meet expectations, the share price could come under pressure. Which side of the valuation argument makes more sense for you?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinsale Capital Group Narrative

Keep in mind, if you think there’s more to consider or want to dive into the data firsthand, you can shape your own Kinsale Capital Group narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kinsale Capital Group.

Looking for More Investment Ideas?

If you want to step ahead of the market, now is the time to seize smarter opportunities with the Simply Wall Street Screener. Don’t let the next big story slip by.

- Uncover unique growth gems by checking out these 914 undervalued stocks based on cash flows that may be trading far below their fair value and positioned for a comeback.

- Power up your portfolio with income potential. Find which companies are offering solid yields with these 19 dividend stocks with yields > 3% and ride the wave of steady cash flow.

- Tap into tomorrow’s breakthroughs by exploring these 23 AI penny stocks. These are the picks driving progress in artificial intelligence and transforming industries worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal