Barrick Gold (TSX:ABX): How Does Leadership Change Impact Its Valuation?

Barrick Mining (TSX:ABX) stunned markets this week by announcing the immediate departure of CEO Mark Bristow after nearly seven years. Mark Hill steps in as interim President and CEO while the board searches for a permanent replacement.

See our latest analysis for Barrick Mining.

Amid headline-grabbing CEO changes, Barrick Mining’s momentum has been building behind the scenes. A steady 1% year-to-date share price return reflects stability, and recent decisions such as the Fourmile project and strategic partnerships point to untapped growth potential despite industry-wide uncertainty.

If the leadership shakeup at Barrick has you rethinking your strategy, it could be the perfect moment to broaden your horizons and discover fast growing stocks with high insider ownership

With leadership uncertainty swirling, steady fundamentals and strategic assets are in focus. However, with shares hovering near price targets and analysts split on next steps, investors are left to consider whether this is a genuine buying opportunity or if the market has already priced in the future upside.

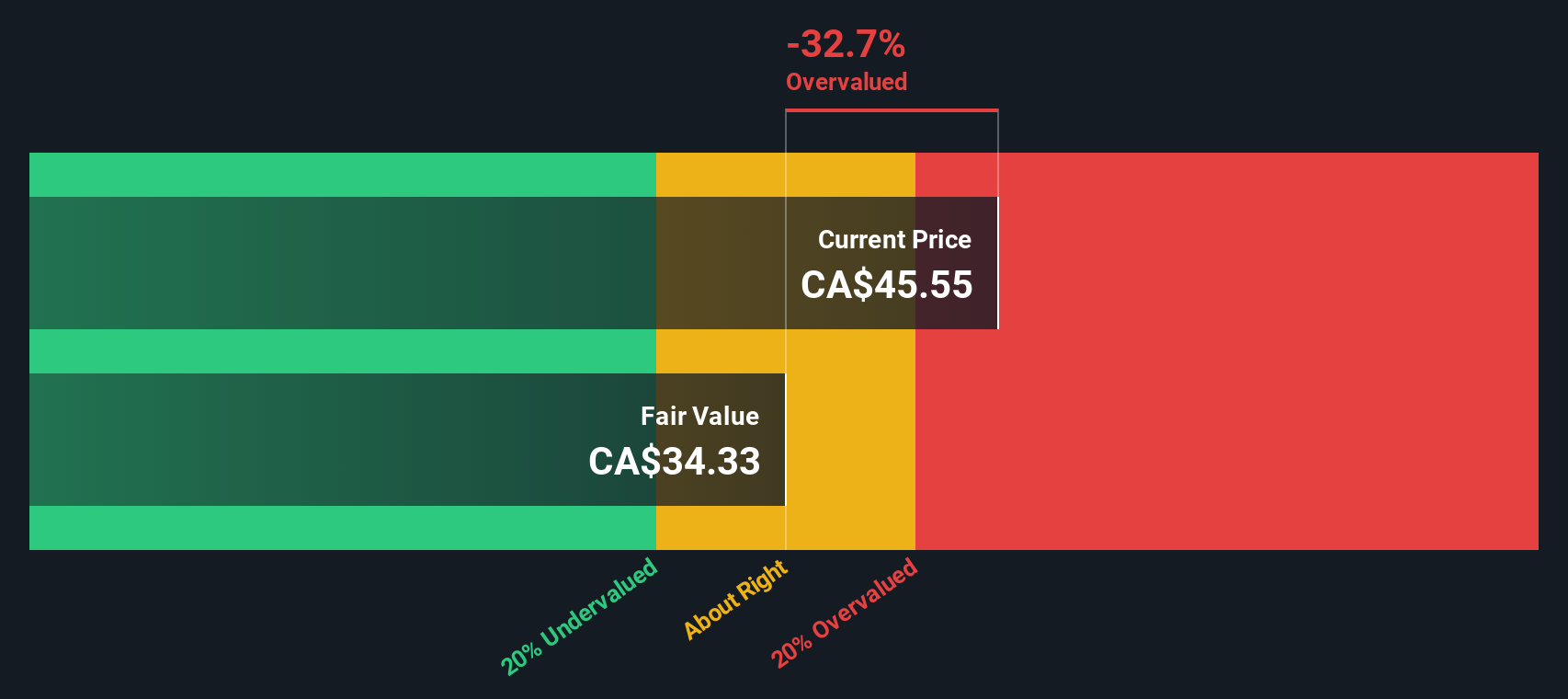

Most Popular Narrative: 4.1% Overvalued

With Barrick Mining closing at CA$47.39, the most widely followed narrative puts fair value lower at CA$45.53. Attention now turns to whether bold production targets and efficiency gains can justify the current share price premium.

Ongoing investment in operational efficiency, including automation, innovation, and digitization, is translating into reduced all-in sustaining costs across core assets. This directly improves net margins and profitability as production volumes scale. Demonstrated ability to extend or expand existing mine lives (for example, Pueblo Viejo stockpile optimization, resource conversion at Fourmile, new mining permits at Zaldivar) increases production visibility and the value of Barrick's high-quality resource base. This supports higher asset valuations and sustained earnings growth.

Want to uncover what’s driving this valuation call? The real story is in aggressive growth assumptions and high conviction in expanding production margins. Which financial levers and future catalysts really prop up the price? The details might surprise you. Dive in for the specifics behind the numbers.

Result: Fair Value of $45.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing exposure to political instability and higher costs from tightening environmental regulations could quickly shift the outlook for Barrick’s ambitious growth story.

Find out about the key risks to this Barrick Mining narrative.

Another View: What Does the SWS DCF Model Say?

The SWS DCF model takes a different approach, estimating Barrick Mining’s fair value at CA$55.14, which is well above its current share price. This method suggests the stock may actually be undervalued and challenges the idea that shares trade at a premium. Which approach do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Barrick Mining Narrative

If you’d rather form your own perspective, you can dive into the data and build a custom take based on your insights in just a few minutes. Do it your way

A great starting point for your Barrick Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Smarter Stock Picks?

Don’t let a single stock define your investing journey. Seize the moment and power up your portfolio with fresh opportunities hand-picked for their potential.

- Unlock consistent income streams by tapping into these 19 dividend stocks with yields > 3% with yields above 3% and reliable payout histories.

- Harness the explosive potential of artificial intelligence with these 23 AI penny stocks, leading the way in transformative tech and tomorrow’s innovation.

- Strengthen your long-term growth with these 916 undervalued stocks based on cash flows, offering attractive entry points based on solid cash flow analysis and opportunities in market pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal