A Closer Look at Gemini Space Station (GEMI)'s Valuation After Recent Share Movement

What’s Behind the Recent Moves in Gemini Space Station Stock?

Gemini Space Station (NasdaqGS:GEMI) has caught a few eyes this week after a dip of just over 5% in a single day. While there is no major news or clear-cut catalyst driving the move, shifts like this tend to make investors curious about what is behind the movement and whether it signals anything bigger for the company going forward. With nothing material in the headlines, it is an open question if this shift speaks to changing risk perceptions or simply the push and pull of the market.

Over the course of the past year, Gemini Space Station’s stock performance has been largely flat or trending downward, with the shares seeing a decline of 25% year-to-date. Even looking back a week, there has been a small drop of just over 1%, reinforcing a picture of gradually fading momentum. With no standout events or clear revenue growth fueling investor enthusiasm, it is hard to pinpoint any surge in confidence just yet.

So, with the price slipping this year, is Gemini Space Station shaping up to be a value opportunity waiting to be unlocked, or is the market already pricing in what lies ahead?

Price-to-Sales of 23.2x: Is it justified?

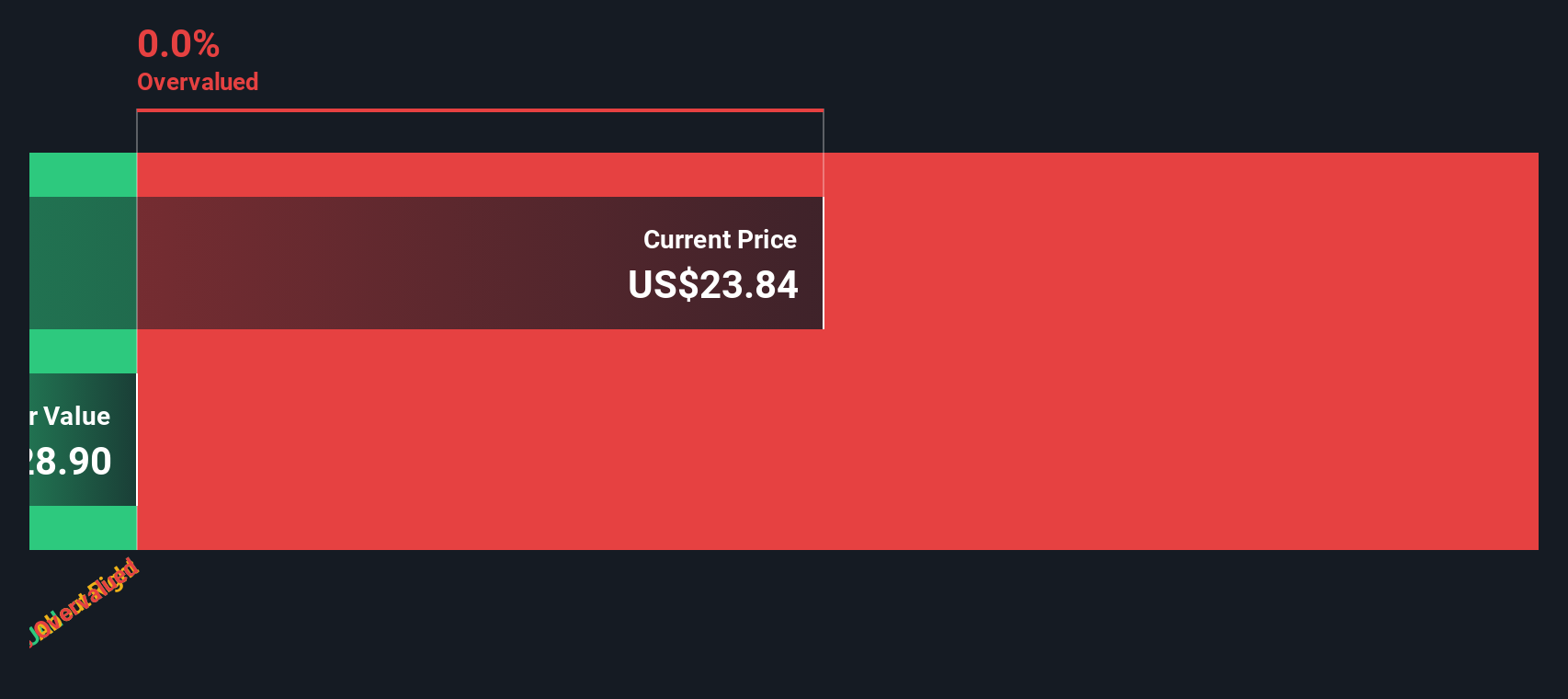

Based on its price-to-sales ratio, Gemini Space Station appears substantially overvalued compared to both industry peers and the broader US Capital Markets sector.

The price-to-sales ratio compares a company’s market capitalization to its total revenues, helping investors assess how much they are paying for each dollar of sales. This figure is often used when companies are unprofitable, as is the case with Gemini Space Station, since traditional price-to-earnings metrics are not meaningful in those scenarios.

With a price-to-sales multiple of 23.2x, which is significantly higher than both the industry average of 4.1x and the peer average of 3.2x, the market is pricing Gemini Space Station well above comparable companies despite its lack of profitability and relatively modest revenue base. Unless future revenue growth dramatically accelerates or the company demonstrates a clear path to profitability, this elevated valuation could be difficult to justify.

Result: Fair Value of $23.84 (OVERVALUED)

See our latest analysis for Gemini Space Station.However, if Gemini surprises with improved profitability or if industry trends shift, the current valuation could quickly appear less stretched than it seems today.

Find out about the key risks to this Gemini Space Station narrative.Another View: What Does a Cash Flow Model Suggest?

Looking at Gemini Space Station through the lens of our DCF model, there simply is not enough reliable data to reach a conclusion about its true value right now. When one approach comes up blank, this presents a challenge for investors.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Gemini Space Station Narrative

If you see things differently or want to examine the numbers on your terms, it is easy to shape your own perspective in just a few minutes. Do it your way

A great starting point for your Gemini Space Station research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for Your Next Winning Idea?

Why let strong opportunities slip by? See what else could be working for you right now by jumping into these tailored stock shortlists curated by Simply Wall Street:

- Accelerate your search for promising innovation with booming AI breakthroughs found through our AI penny stocks.

- Uncover stocks that may be trading below their true worth by running through our collection of undervalued stocks based on cash flows opportunities.

- Secure your portfolio with reliable income streams by tapping into companies offering dividend stocks with yields > 3% above 3% yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal