Is Nikon’s Recent Price Dip a Buying Opportunity Amid Strong 2025 Growth Momentum?

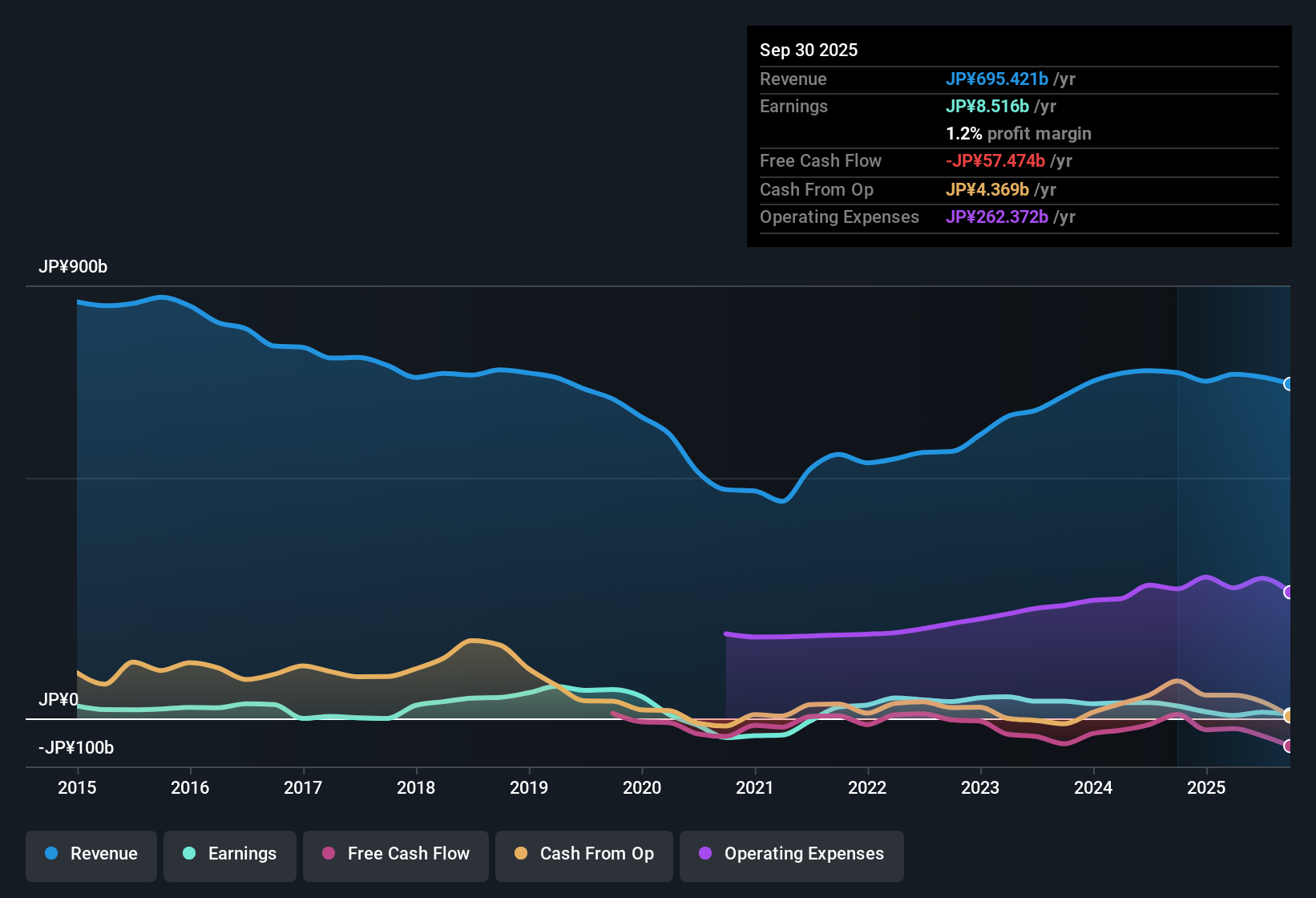

If you are eyeing Nikon as a potential addition to your portfolio, you are definitely not alone. Nikon’s recent performance has been catching plenty of attention, driving conversations among investors who are weighing where the real value lies for this iconic brand. The stock's journey over the past few years showcases an interesting mix of volatility and robust growth. Over five years, Nikon achieved returns of 192.5%, with a strong 17.2% rise over the last year alone. Even short-term moves demonstrate how sentiment can quickly shift, as seen in the sharp 5.9% dip this past week, which contrasts with an 8.7% climb year-to-date and a 5.8% gain over the past month.

Behind this backdrop of impressive long-term growth, recent price moves may reflect a wave of shifting perceptions on Nikon’s future outlook amid broader market developments. For some investors, the pullback could appear as an opportunity, while for others, it might signal heightened caution as new risks emerge in the sector or market as a whole. Whichever camp you fall into, the all-important question remains: is Nikon undervalued at its current price?

According to the standard valuation checks, Nikon does not flash the classic undervalued signals; it scores a 0 out of 6 on commonly used value indicators. However, as any savvy investor knows, a low value score is just one piece of the puzzle. It is worth digging into how these valuation methods work and considering whether a more insightful approach may offer a clearer answer before you decide your next move.

Nikon scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Nikon Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future free cash flows and discounting them back to today's value. This approach essentially asks, "What are all of Nikon's future cash flows worth in today's money?"

For Nikon, the DCF model uses recent cash flow data, with last twelve months free cash flow coming in at a loss of ¥21.6 Billion. Analysts forecast that Nikon's cash flows will rebound over the next several years, reaching ¥12.7 Billion by 2028. Because analyst estimates typically only cover the first five years, Simply Wall St's model extends these projections up to a decade and suggests free cash flow could climb further to about ¥43.9 Billion in 2035.

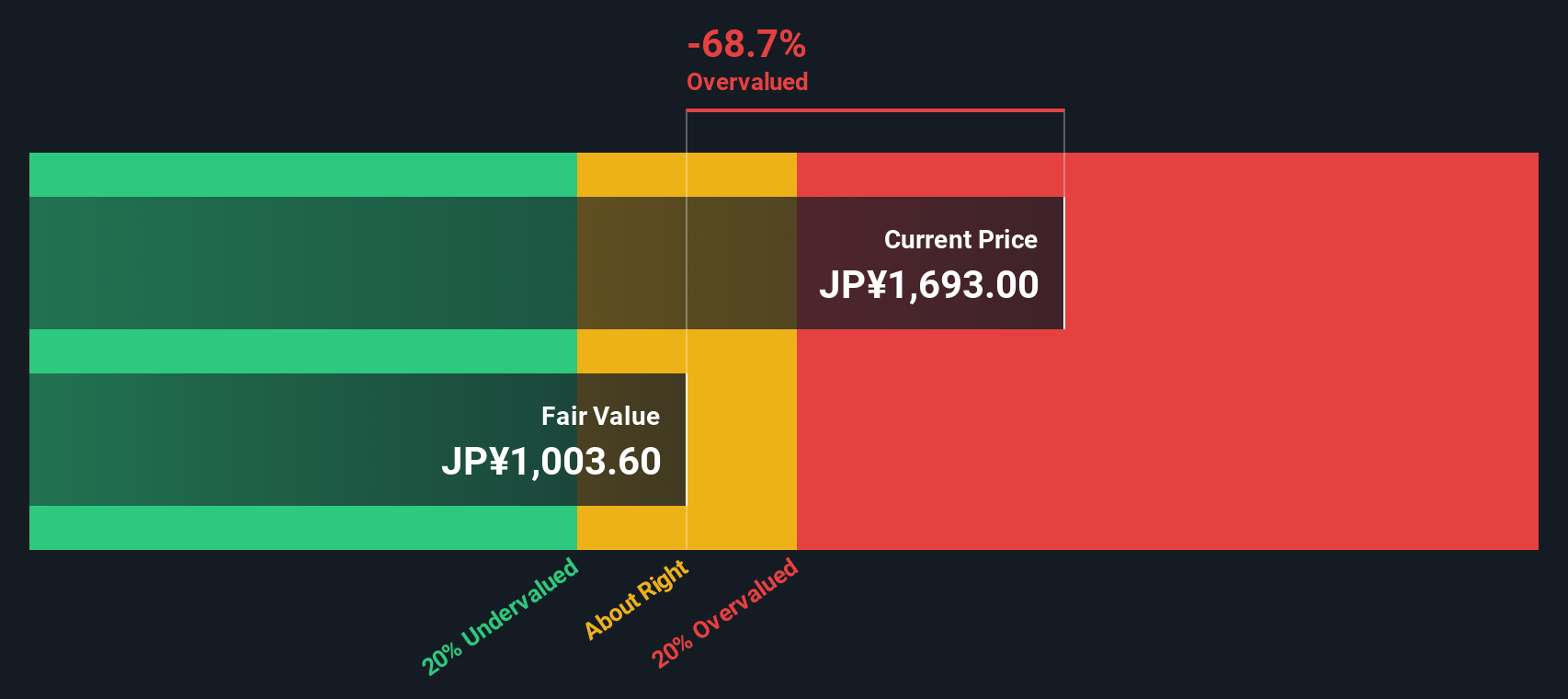

After calculating and discounting these projected cash flows, the model estimates Nikon's fair value to be ¥1,494.79 per share. At current market prices, the stock is about 18.3% above this intrinsic value, implying that shares are currently overvalued according to this DCF assessment.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Nikon.

Approach 2: Nikon Price vs Earnings

For established and profitable companies, the Price-to-Earnings (PE) ratio is a widely used and effective gauge of valuation. It essentially tells investors how much they are paying for each unit of a company’s earnings, making it easier to compare companies, both within the same sector and more broadly.

A “normal” or fair PE ratio for any company is shaped by several factors, including how quickly investors expect its earnings to grow, the level of risk associated with those earnings, and potentially even broader market sentiment. Companies with higher expected growth or lower risk often trade at higher PE multiples, while those facing more uncertainty may see their ratios suppressed.

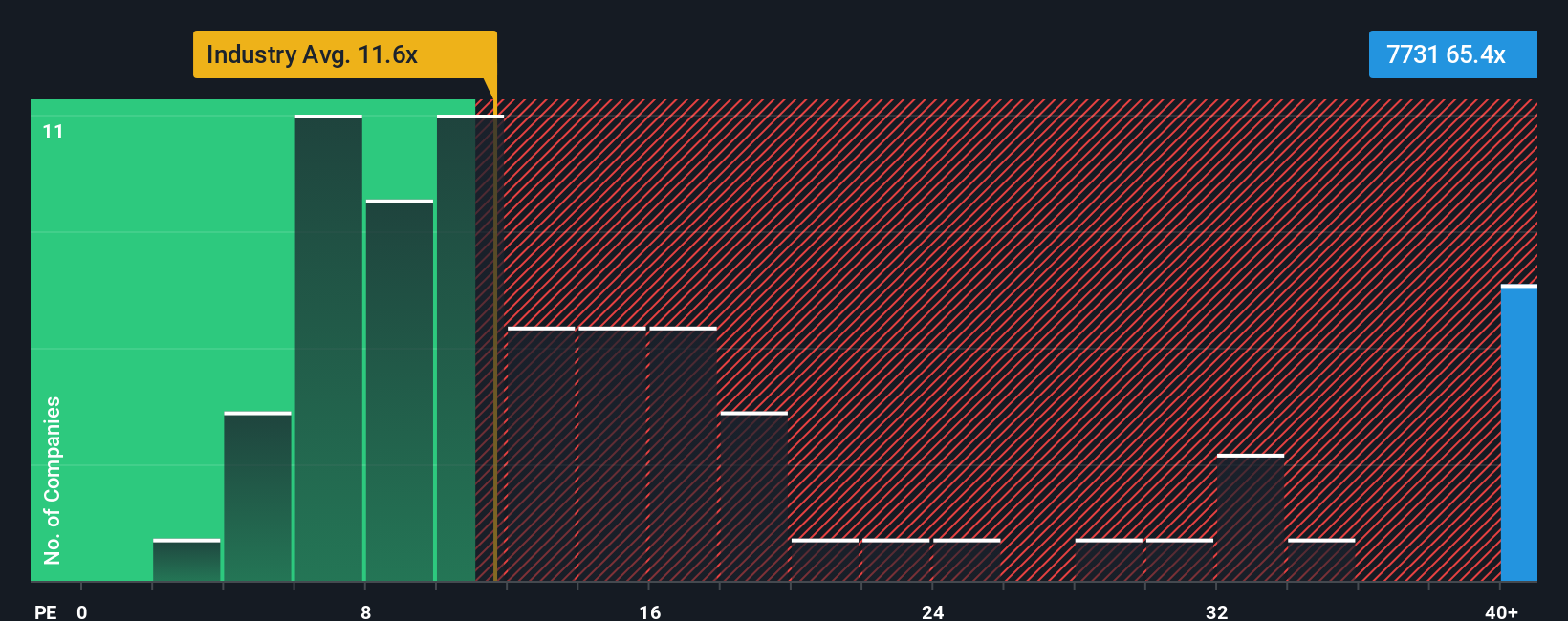

Currently, Nikon is trading at a PE ratio of 45.4x, which is well above both the industry average of 11.7x and the peer group average of 20.4x. While this might initially suggest Nikon is expensive, it is important to remember that direct comparisons have their limits because they do not fully account for a company's unique qualities.

This is where Simply Wall St’s Fair Ratio comes into play. The Fair Ratio for Nikon is calculated at 29.9x, reflecting not just typical sector or peer performance but also considering variables like Nikon’s earnings growth, profit margins, market cap, and specific business risks. By integrating these fundamental factors, the Fair Ratio gives a much more rounded, company-specific estimate of fair value than relying on basic peer or industry averages alone.

With Nikon’s current PE ratio sitting notably above the Fair Ratio, the stock appears overvalued by this measure.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Nikon Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story or perspective about a company’s future, connecting what you believe about its business drivers with your expectations for its revenue, earnings, and margins, and the fair value these assumptions support.

With Narratives, you go beyond just crunching numbers by expressing why you believe Nikon will outperform (or underperform) and translating that story into concrete financial outcomes. Narratives make investing more approachable by helping you visualize how company news, industry shifts, or new forecasts might reshape your outlook. They are easy to explore and create in the Simply Wall St Community page, a tool trusted by millions of investors worldwide.

Using Narratives, you can dynamically assess when to buy or sell by comparing your fair value estimate, based on your story, to the latest share price. Because Narratives update automatically when new information arises, your view stays relevant and actionable.

For example, some investors see Nikon’s growth driven by its RED acquisition and healthcare advances, projecting a high fair value of ¥2,100, while others worry about profit volatility and set a much more cautious value near ¥1,000. Narratives bring these views to life, allowing you to track, debate, and refine your own investment thesis as the Nikon story evolves.

Do you think there's more to the story for Nikon? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal