Assessing Blackstone (BX): Is the Recent Momentum Justified by Its Current Valuation?

Most Popular Narrative: 3.5% Undervalued

According to the most widely followed narrative, Blackstone is currently seen as slightly undervalued based on analyst consensus. This narrative highlights the company's strong position in private markets and its ability to attract increased investor capital, which is expected to drive structural growth.

Strategic alliances and innovations in private credit and wealth management are intended to boost revenue through expanded market reach and larger spreads. Economic and geopolitical uncertainties, including tariffs and trade negotiations, pose risks to Blackstone's revenues, real estate values, earnings, and overall financial performance.

Want to uncover the growth formula behind this bullish view? Analysts are betting on Blackstone beating industry growth rates, with future success depending on a combination of revenue, earnings, and margin expansion. Wonder what ambitious financial assumptions are fueling this fair value? Discover the figures that are setting the bar for Blackstone's next chapter.

Result: Fair Value of $181.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing market volatility and trade uncertainties could quickly shift investor sentiment and put pressure on Blackstone’s growth outlook.

Find out about the key risks to this Blackstone narrative.Another View: The Market’s Current Multiple

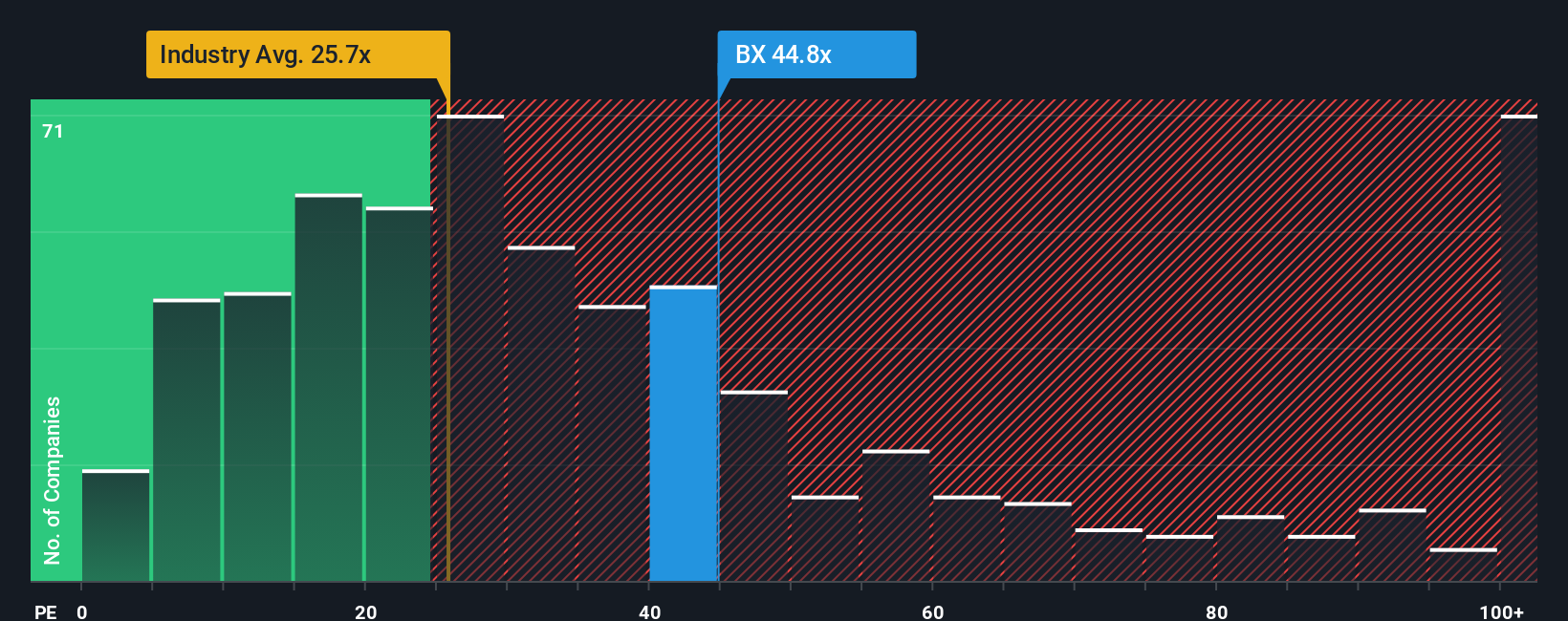

While the consensus price target points to Blackstone being undervalued, a look at its current price-to-earnings ratio compared to the industry average tells a different story. Is the market already accounting for years of ambition?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blackstone Narrative

If you see things differently or want to dig deeper, you can decide for yourself in just a few minutes. Do it your way

A great starting point for your Blackstone research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Choices?

Don’t let unique opportunities pass you by. There is a world of growth potential beyond just Blackstone. Use the Simply Wall St Screener to target new stocks and stay ahead of the crowd.

- Target exceptional companies set for long-term gains by checking out undervalued stocks based on cash flows and put value-driven stocks on your radar before the masses catch on.

- Tap into emerging breakthroughs, from machine learning to automation, by exploring AI penny stocks and stake your claim in tomorrow’s technology leaders.

- Boost your regular income with established companies offering strong yields by reviewing dividend stocks with yields > 3% and make your portfolio work harder for you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal