Does Bitmine (BMNR) Have an Edge with Its Aggressive Ethereum Treasury Strategy?

- Bitmine Immersion Technologies recently completed a follow-on equity offering of over US$365 million, issuing 5,217,715 shares at US$70 each and providing warrants, with the capital primarily allocated to expanding its Ethereum holdings.

- This move has positioned Bitmine as the public company with the world's largest Ethereum treasury and drawn increased attention to its treasury accumulation strategy.

- We'll explore how Bitmine's accelerated Ethereum accumulation reshapes its investment narrative and highlights the risks and opportunities of this treasury approach.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Bitmine Immersion Technologies' Investment Narrative?

For Bitmine Immersion Technologies, the investment case increasingly centers on the thesis that public market exposure to Ethereum can create outsized value, mirroring the playbook seen with corporate Bitcoin treasuries. The latest US$365 million equity raise, completed at a premium and backed by warrants, rapidly expanded Bitmine’s Ethereum reserves and cemented its position as the largest listed holder globally. Short term, this capital injection and index inclusion may add liquidity and profile, potentially influencing flows and near-term sentiment. However, it also intensifies the risks inherent in Bitmine’s concentrated ETH strategy, especially as share price swings and recent losses challenge assumptions about resilience should the cryptocurrency market move against them. While this approach could amplify returns if Ethereum rebounds, it leaves Bitmine highly exposed to ETH price volatility and regulatory shifts, both now even more critical for shareholders as the company’s profile grows.

Yet, the recent boost in Ethereum holdings highlights just how steep the downside could be if crypto prices fail to recover.

Bitmine Immersion Technologies' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

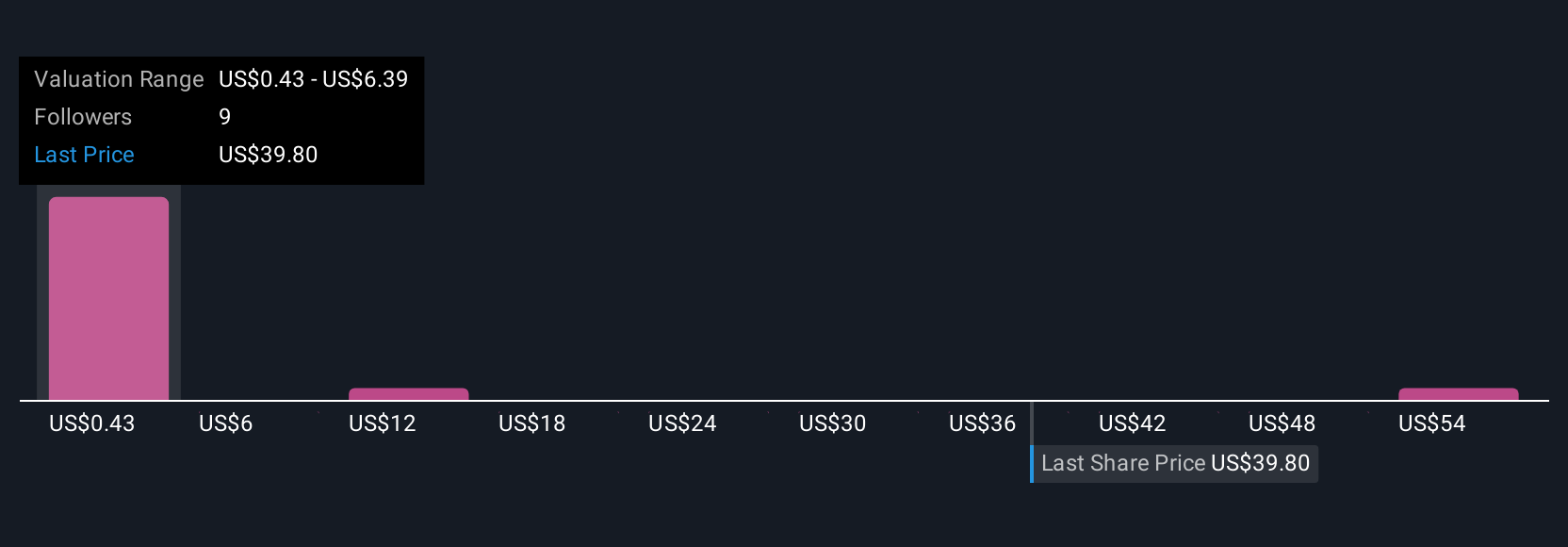

Explore 21 other fair value estimates on Bitmine Immersion Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own Bitmine Immersion Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Bitmine Immersion Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitmine Immersion Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal