How Investors May Respond To Vistra (VST) Downgrade Amid Delays in Data Center Contract Finalization

- In the past week, Jefferies downgraded Vistra from "Buy" to "Hold" due to concerns about delays in finalizing a key data center agreement for the Comanche Peak nuclear plant and political risks in energy markets, prompting increased investor caution.

- This analyst move shines a spotlight on the heightened sensitivity of power market participants to regulatory uncertainty and the critical timing of long-term energy supply contracts as data center demand accelerates.

- We will consider how this increased scrutiny of Vistra’s data center contract pipeline and exposure to political risks could impact the company’s investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Vistra Investment Narrative Recap

To be a Vistra shareholder right now, you need conviction that accelerating demand for grid power, driven by AI and data centers, will support long-term growth, and that the company can convert this into stable multi-decade contracts. The recent Jefferies downgrade calls immediate attention to stalled progress on the Comanche Peak nuclear data center deal and highlights regulatory uncertainty as the most pressing risk, but the core investment case remains, since the largest catalyst is still the completion of major data center agreements, which has not yet occurred.

Among Vistra’s recent announcements, the approval to extend the Comanche Peak Nuclear Power Plant’s operating license through 2053 directly reinforces this catalyst, preserving the asset’s eligibility for large, long-horizon supply contracts crucial for tapping new demand and mitigating short-term political risk.

Yet, in contrast to the long-term growth narrative, the heightened political and regulatory hurdles surrounding the Comanche Peak deal present a key issue investors should be watching for...

Read the full narrative on Vistra (it's free!)

Vistra's outlook projects $24.5 billion in revenue and $3.4 billion in earnings by 2028. This requires a 9.8% annual revenue growth rate and a $1.2 billion increase in earnings from the current $2.2 billion.

Uncover how Vistra's forecasts yield a $221.57 fair value, a 7% upside to its current price.

Exploring Other Perspectives

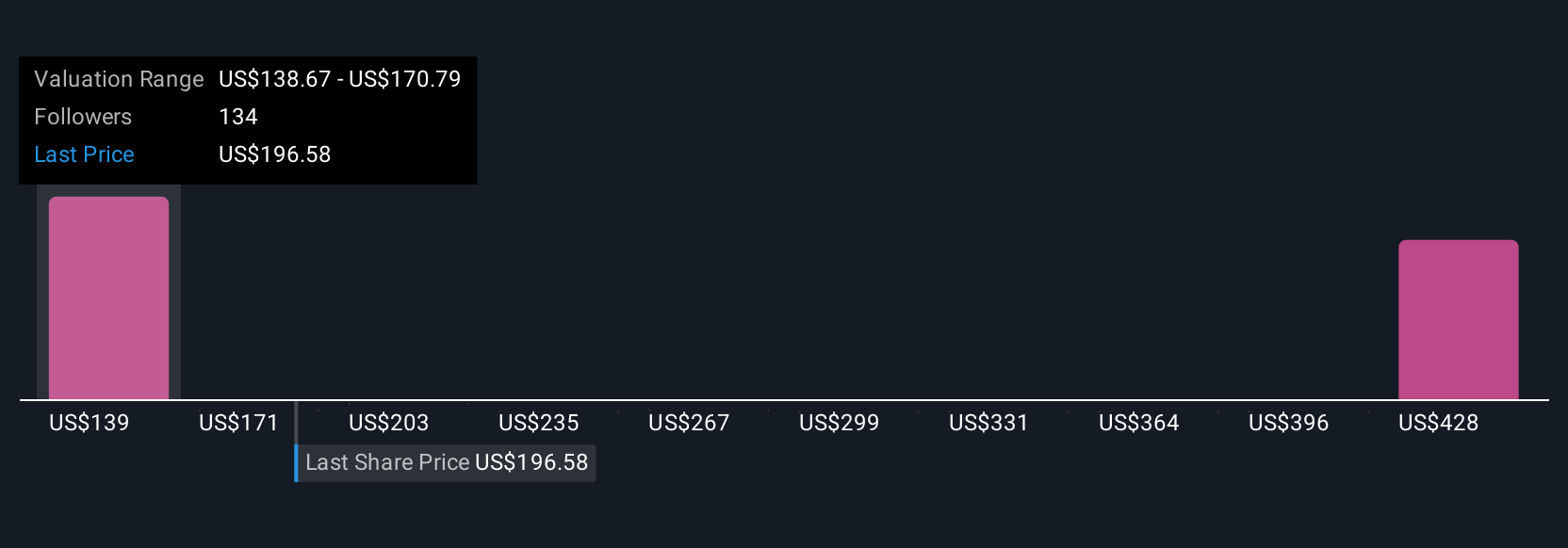

The Simply Wall St Community shared 15 fair value estimates for Vistra, ranging widely from US$142 to US$408.94 per share. As caution over major contract delays and political risk grows, your outlook on the company’s ability to secure long-term agreements could set your view apart from your peers.

Explore 15 other fair value estimates on Vistra - why the stock might be worth 31% less than the current price!

Build Your Own Vistra Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vistra research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vistra research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vistra's overall financial health at a glance.

No Opportunity In Vistra?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal