Counterpoint Research: The average global smartphone price is expected to rise from $370 in 2025 to $412 in 2029

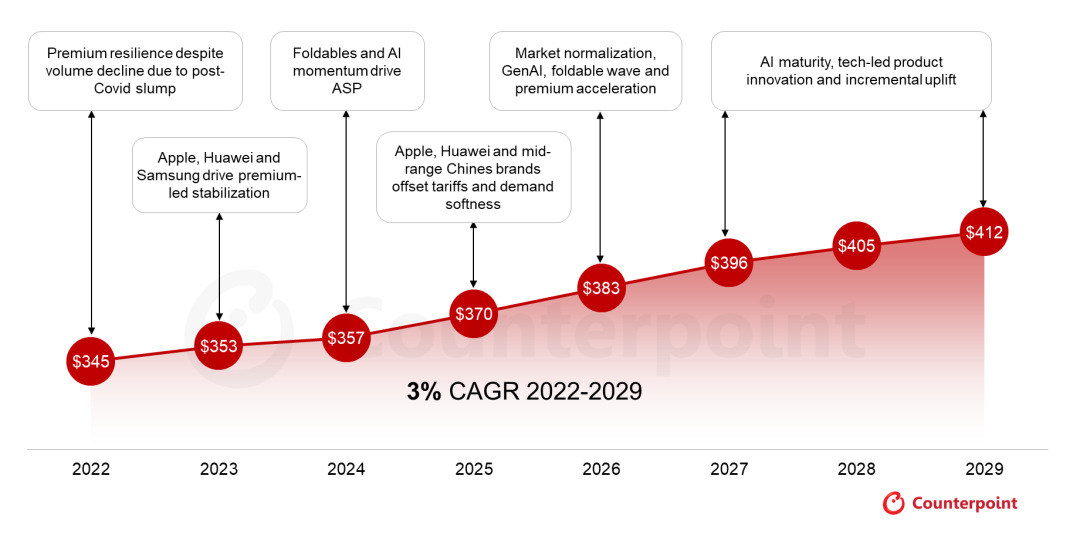

The Zhitong Finance App learned that ASP in the global smartphone market continues to grow year by year, driven by the high-end trend. According to Counterpoint Research's “Market Outlook Tracking Report”, the ASP of the global smartphone market is expected to rise from $357 in 2024 to $370 in 2025, and reach $412 in 2029, with a CAGR of 3%. In addition to the improvements brought about by the high-end trend, the popularity of 5G and consumer preferences for advanced features (even among mid-range models) are driving this steady growth.

Looking ahead to the second quarter of 2025, market performance is more normal than expected. Counterpoint Research's latest forecast shows that global smartphone shipments in 2025 will increase 2.5% year-on-year, higher than the 1.9% forecast for the first quarter, but lower than the 4% forecast at the beginning of the year. The reasons for the slowdown in shipments include rising prices, supply chain adjustments, and macroeconomic pressures. In 2025, ASP is expected to grow by 3.5% to $370, higher than the 2.3% forecast previously, driven mainly by the rise in ASP in North America and the recovery in prices driven by economic recovery in India and the rest of the Asia-Pacific region.

As ASP grows faster than shipments, the combined increase in these two areas will drive smartphone revenue growth of nearly 6% year-on-year in 2025. In the long run, this momentum is expected to drive revenue to maintain 5% CAGR from 2025 to 2029, thus reaching $564 billion in annual revenue in 2029.

Global smartphone market ASP forecast, 2023-2029

Source: Counterpoint “Market Outlook — ASP Forecast Tracking Report”

Note: ASP is based on wholesale prices

From demand fluctuations during the pandemic to supply chain challenges to recent market fluctuations caused by tariffs, the global smartphone market is gradually returning to normal after years of turmoil. Due to continued aggressive promotions from US operators, there is no backlog of inventory, and mobile phone brand manufacturers are maintaining their regular release cycles and procurement strategies. Counterpoint's market outlook predicts that the market will become more “normal” from the second half of 2025 to 2026, further confirming our forecast that average price growth and stable sales volume will maintain revenue growth. So far, smartphones have been largely unaffected by the tariffs imposed by the US on trading partners, and are more resilient than the automotive, semiconductor, and other consumer electronics sectors. However, the uncertainty of US tariffs and the sluggish macroeconomic environment may further complicate the situation in the future.

Affected by early shipments in the first half of the year, North American shipments are expected to decline in the second half of 2025, but tariff transmission will drive a 7% year-on-year increase in ASP for the whole year. Apple's high-end models, continued promotions from carriers, and the impressive performance of folding screen products are expected to raise ASP to $984 in 2026. In the long run, the US will play a stable role in maintaining the high position of global ASP, but since it itself is already a high-end market, it will provide a more gradual contribution to ASP until 2029. We do not expect another sudden rise in prices due to the trade environment, as the additional costs will be absorbed by suppliers, distributors, and consumers alike.

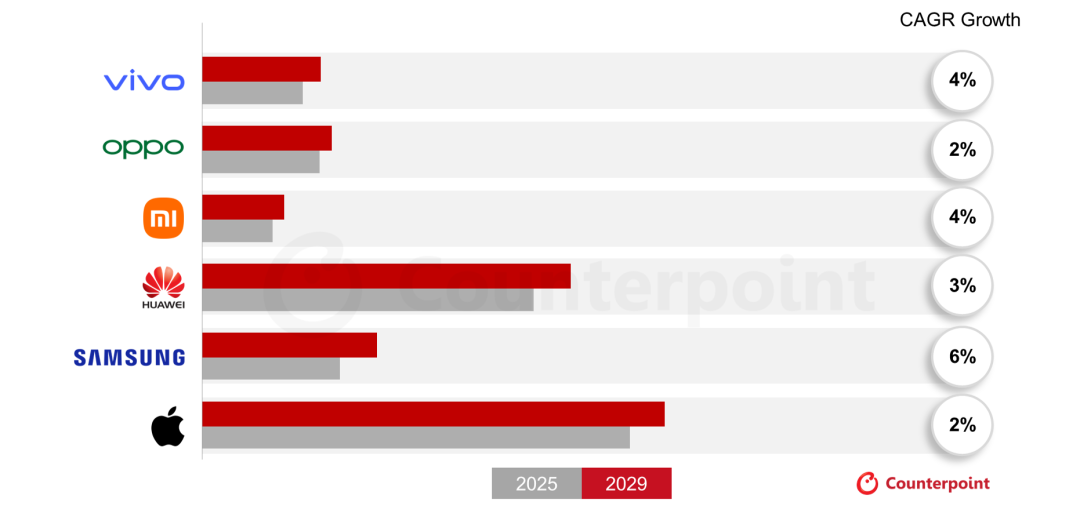

In China, the forecast for the second quarter of 2025 shows a slight decline in the ASP trend from the first quarter. Based on the latest data tracking, Counterpoint lowered the year-on-year ASP growth rate for the full year of 2025 to 3.6% from 4% previously. The structural rise was mainly driven by Huawei, OPPO, and Vivo. On the Apple side, the ASP in China is expected to increase by about 2% year on year in 2025; although there was a slight decline in shipments, the overall performance was better than our expected decline in Q1, driven by an increase in the share of Pro models. Looking ahead to the long term, the high-end trend in the Chinese market will continue to boost the global ASP and strengthen its influence in the global high-end smartphone market.

India will continue to support the mid-tier market, and its ASP will remain below $250 in 2025, but as the high-end trend evolves, its price is expected to gradually rise to reach $287 by 2029. The migration of feature machine users to smart phones, the rise in demand in urban, rural and rural areas, and the growth in digital popularity will bring stable development impetus to mid-range and high-end models.

Apple remains the mainstay of the high-end market, and its average price is expected to rise from $919 in 2025 to nearly $1,000 in 2029, driven by its mix of Pro and basic models (including the latest “e” and “Air” series). The iPhone 16e led to a 9% year-on-year decline in ASP in Q1 of 2025, but with the popularity of Pro models in the second half of the year, ASP is expected to improve. Apple is planning to adopt a dual strategy: in terms of shipment volume, Apple is expanding its consumer base and entering emerging markets and consumer sectors through the E and Air series; in terms of ASP, Apple is consolidating its high-end dominance through Pro models while preparing for the launch of the first folding screen product in 2026. In the long run (2026-2029), the US, China, and Europe will remain Apple's core markets, while price-sensitive markets such as Latin America, Middle East Africa, and India will mainly rely on basic iPhone models and older models to drive shipment growth.

ASP forecast and CAGR for major global smartphone brands, 2025-2029

Source: Counterpoint “Market Outlook — ASP Forecast Tracking Report”

Samsung's ASP trend is expected to remain stable. In the first half of 2025, the performance of the brand's flagship models will reduce its full-year ASP, but the integration of folding screen phones and GenAI will support its long-term growth in the future. On the other hand, Samsung has a large share of the mid-tier segment in emerging markets, which will limit the growth potential of its ASP.

After its return, Huawei is strengthening its ASP growth in the local Chinese market. As supply chain restrictions on self-developed chips ease, Huawei's Mate and Pura series are driving its ASP higher. At the same time, the strong performance of folding screen phones has further supported the growth of ASP. HarmonyOS user loyalty adds an advantage to high-end pricing, and we are optimistic about Huawei's potential to expand in overseas markets.

In the 2024-2025 period, the advent of GenAI smartphones increased the bill of materials (BoM) cost of each device by about $40-60, increasing the price when this type of phone became available. As AI matures, ASP growth will shift from “cost driven” to “value driven”, as consumers will be more willing to pay premiums for devices centered around AI functionality.

Although folding screen smartphones currently account for less than 2% of global shipments, their ASP continues to rise, further influencing consumers' views on high-end products. It is expected that Apple will launch a folding screen phone by the end of 2026, which may bring about a new round of improvement in ASP and reshape the industry's folding screen phone benchmark.

Overall, the global smartphone ASP forecast is quite optimistic. Currently, the impact of tariff fluctuations is weakening, and the supply chain is stabilizing, while the popularity of high-end smartphones, GenAI, and folding screen innovations will also jointly drive ASP upward moderately. This growth will be normalized rather than explosive, so ASP will continue to rise steadily despite macroeconomic downsides.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal