Why You Might Be Interested In Tokai Tokyo Financial Holdings, Inc. (TSE:8616) For Its Upcoming Dividend

Tokai Tokyo Financial Holdings, Inc. (TSE:8616) is about to trade ex-dividend in the next three days. The ex-dividend date is commonly two business days before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. This means that investors who purchase Tokai Tokyo Financial Holdings' shares on or after the 29th of September will not receive the dividend, which will be paid on the 25th of November.

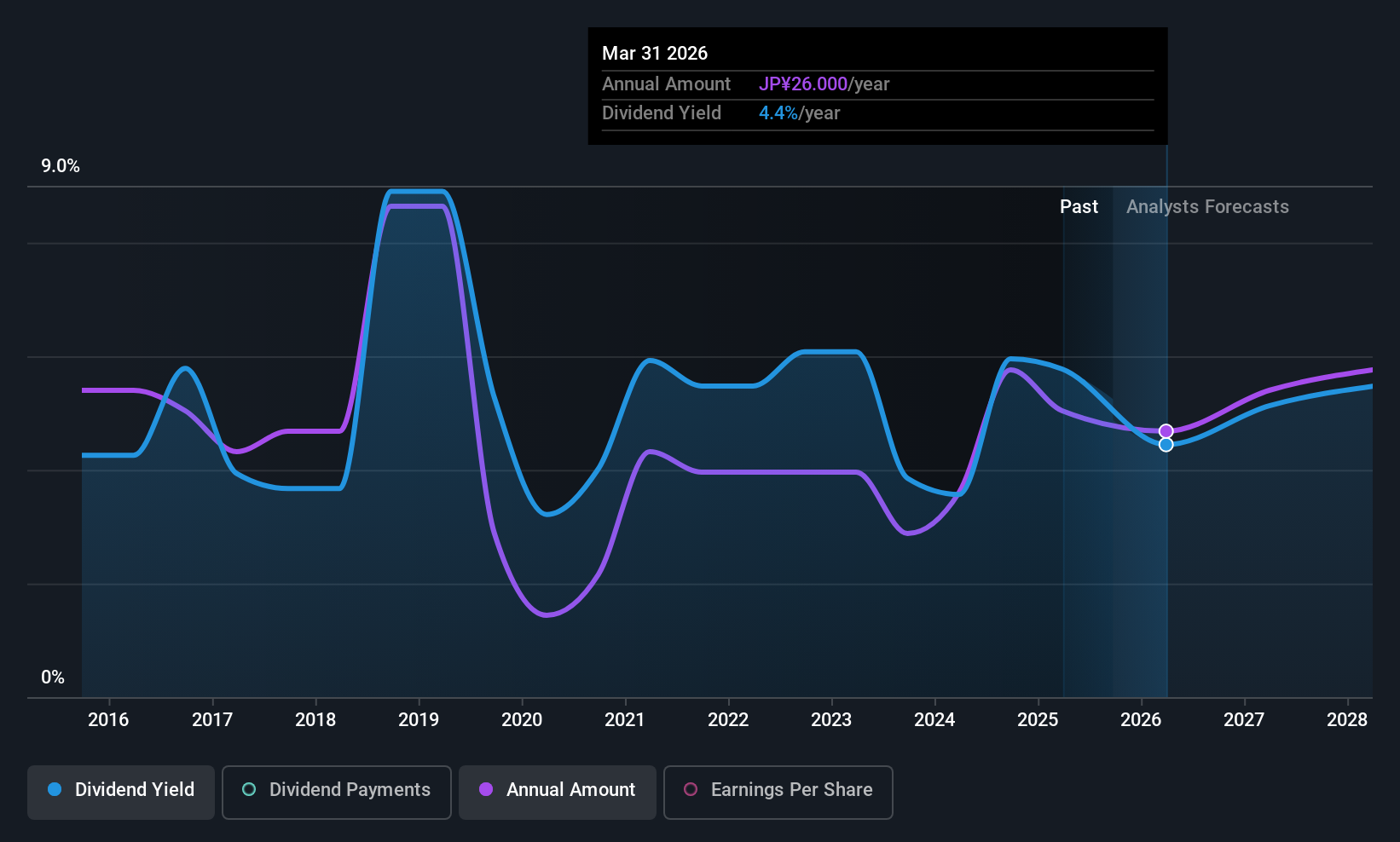

The company's next dividend payment will be JP¥20.00 per share, on the back of last year when the company paid a total of JP¥28.00 to shareholders. Calculating the last year's worth of payments shows that Tokai Tokyo Financial Holdings has a trailing yield of 4.8% on the current share price of JP¥585.00. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Its dividend payout ratio is 86% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth. We'd be concerned if earnings began to decline.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

See our latest analysis for Tokai Tokyo Financial Holdings

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. That's why it's comforting to see Tokai Tokyo Financial Holdings's earnings have been skyrocketing, up 24% per annum for the past five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Tokai Tokyo Financial Holdings's dividend payments per share have declined at 0.7% per year on average over the past 10 years, which is uninspiring.

Final Takeaway

Is Tokai Tokyo Financial Holdings worth buying for its dividend? Earnings per share are growing at an attractive rate, and Tokai Tokyo Financial Holdings is paying out a bit over half its profits. In summary, Tokai Tokyo Financial Holdings appears to have some promise as a dividend stock, and we'd suggest taking a closer look at it.

On that note, you'll want to research what risks Tokai Tokyo Financial Holdings is facing. Our analysis shows 2 warning signs for Tokai Tokyo Financial Holdings that we strongly recommend you have a look at before investing in the company.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal