Zylox-Tonbridge Medical Technology Co., Ltd. (HKG:2190) Not Lagging Industry On Growth Or Pricing

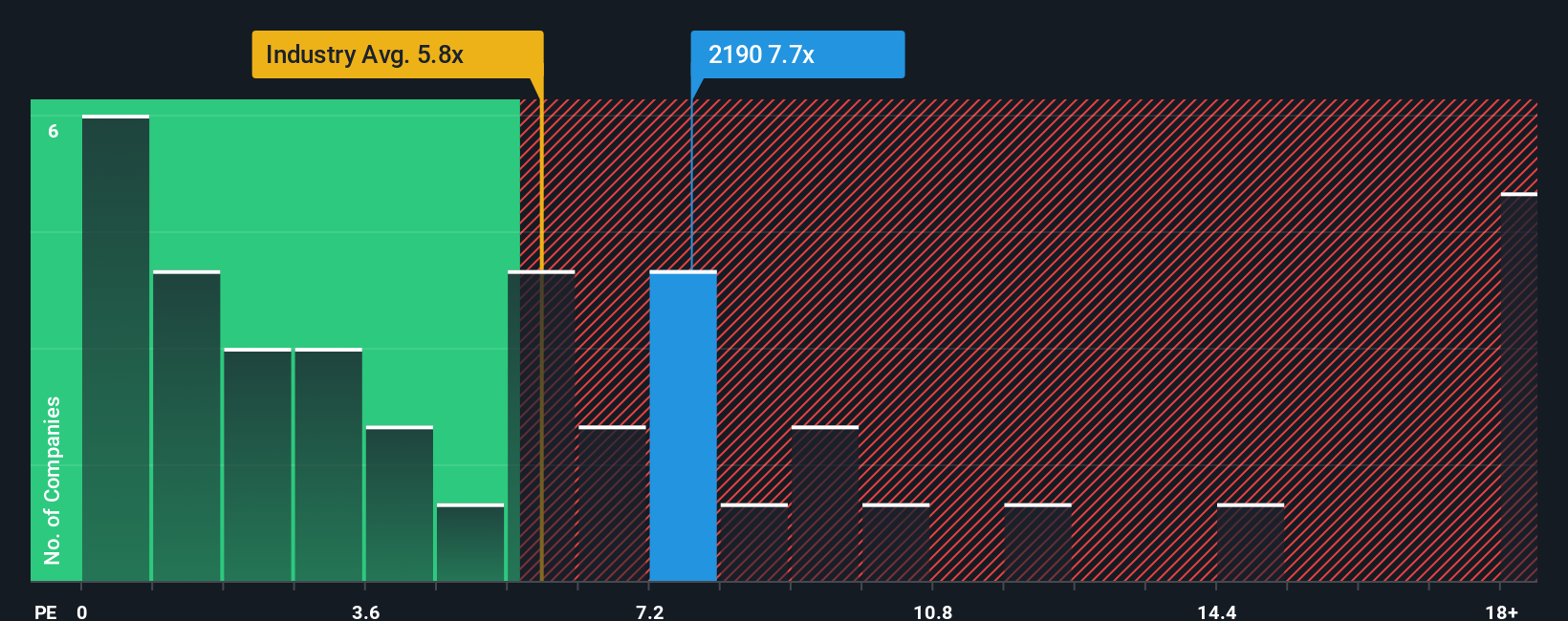

With a price-to-sales (or "P/S") ratio of 7.7x Zylox-Tonbridge Medical Technology Co., Ltd. (HKG:2190) may be sending bearish signals at the moment, given that almost half of all Medical Equipment companies in Hong Kong have P/S ratios under 5.8x and even P/S lower than 1.7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Zylox-Tonbridge Medical Technology

What Does Zylox-Tonbridge Medical Technology's Recent Performance Look Like?

Zylox-Tonbridge Medical Technology certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zylox-Tonbridge Medical Technology.How Is Zylox-Tonbridge Medical Technology's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Zylox-Tonbridge Medical Technology's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 35% last year. Pleasingly, revenue has also lifted 247% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 29% each year over the next three years. That's shaping up to be materially higher than the 23% each year growth forecast for the broader industry.

With this in mind, it's not hard to understand why Zylox-Tonbridge Medical Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Zylox-Tonbridge Medical Technology shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Zylox-Tonbridge Medical Technology with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Zylox-Tonbridge Medical Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal