DFI Retail Group (SGX:D01): Assessing Valuation After Profit Growth and Strategic Restructuring Moves

Most Popular Narrative: 15.3% Undervalued

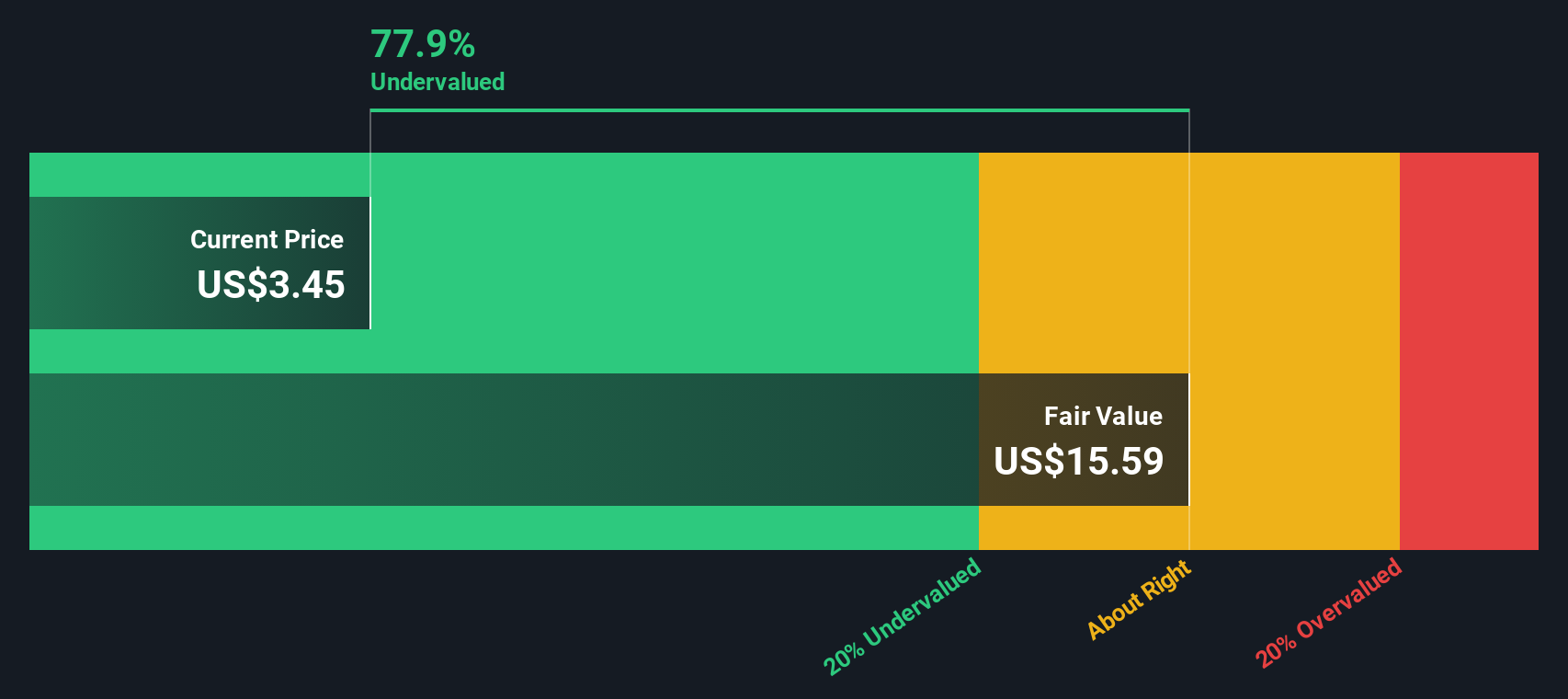

According to the most widely followed narrative, DFI Retail Group Holdings is currently trading well below estimated fair value. Analysts are highlighting potential for future earnings growth and margin expansion to drive further upside.

“DFI has achieved profitability in its e-commerce segment, and management is pursuing an accretive digital ecosystem by integrating profitable e-commerce, retail media, and loyalty data/AI initiatives. This positions DFI to benefit from rising adoption of digital payments and omni-channel retailing in Asia. These trends are likely to support both revenue growth and net margin improvement as scale and personalization increase.”

What is driving this surprisingly bullish valuation? The narrative points to major anticipated financial improvements, including changes in profit margins and sector-defining earnings projections. Want to see the exact numbers that justify an above-market valuation? The full narrative reveals the growth assumptions, future profit metrics, and hidden catalysts behind this eye-catching target.

Result: Fair Value of $3.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weak consumer sentiment in Asia and slow digital adoption could challenge DFI’s turnaround, which makes its future growth less certain.

Find out about the key risks to this DFI Retail Group Holdings narrative.Another View: Discounted Cash Flow Perspective

A different angle comes from our DCF model, which examines the company's long-term cash flow potential instead of focusing on near-term profit metrics. This method also suggests DFI Retail Group could be undervalued by the market at this time. Does this support the case for further upside, or are both models missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DFI Retail Group Holdings Narrative

If you want to dig deeper or approach the analysis from your perspective, you can easily build your own narrative using our hands-on tools in just a few minutes. Do it your way

A great starting point for your DFI Retail Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why limit yourself to just one stock? Make your next move count by checking out these tailored lists of companies built around insights you care about most. Find the next opportunity before it gets crowded.

- Tap into groundbreaking breakthroughs in artificial intelligence by checking out which companies are at the forefront of this booming sector with our AI penny stocks.

- Capture value ahead of the market by browsing handpicked stocks that our models show are priced below their true worth in the undervalued stocks based on cash flows.

- Grow your portfolio’s income stream by focusing on top picks that deliver consistently high yields, thanks to our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal