Did Fannie Mae's (FNMA) 2025 Housing Forecast Just Shift Its Investment Narrative?

- In September 2025, Fannie Mae's Economic and Strategic Research Group released updated economic and housing forecasts, projecting ongoing growth for the housing market, higher mortgage originations, and lower mortgage rates through 2026.

- Unique to this outlook is the anticipation that refinancing activity will increase notably as mortgage rates are expected to trend downward, potentially shaping lending patterns in the years ahead.

- We’ll explore how expectations for increased mortgage originations and refinancing activity could influence Fannie Mae’s investment outlook going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Federal National Mortgage Association's Investment Narrative?

Owning shares in Fannie Mae requires believing in the continued resilience and potential upswing of the US housing and mortgage origination markets, plus the company’s ability to remain a central player if mortgage rates trend lower as forecasts suggest. The latest news adds real weight to this outlook: forecasts are calling for higher mortgage loan originations and increased refinancing activity into 2026, and the possibility of privatization and an IPO is getting fresh traction from the Trump administration. Short-term catalysts now include heightened speculation about the IPO and the direct impact of potentially lower rates, both of which can spark price volatility and shifts in market sentiment. However, risks remain prominent, particularly Fannie Mae’s ongoing lack of profitability, executive and board turnover, and dependence on political decision-making, all now amplified as the stakes rise. Share price swings have been sharp in both directions, so while these events could present real opportunity, they also increase uncertainty compared to recent months. In contrast, ongoing political developments could quickly reshape the company’s risk profile in ways investors should not ignore.

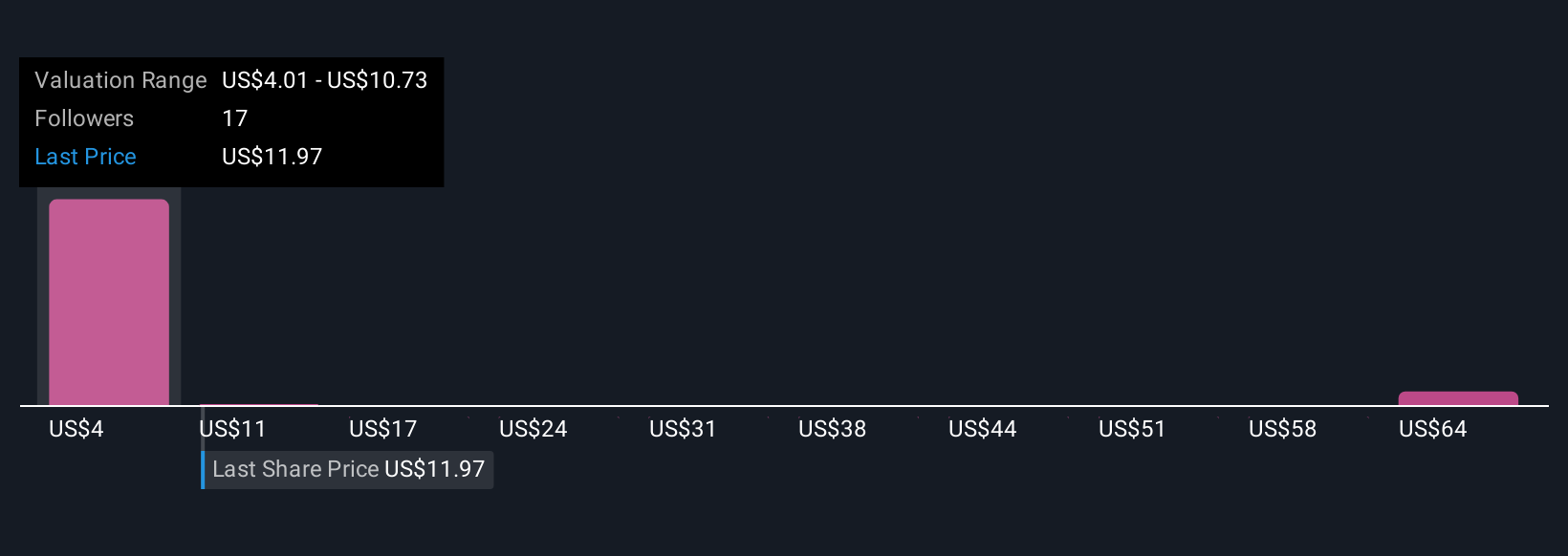

The valuation report we've compiled suggests that Federal National Mortgage Association's current price could be quite moderate.Exploring Other Perspectives

Explore 9 other fair value estimates on Federal National Mortgage Association - why the stock might be worth over 5x more than the current price!

Build Your Own Federal National Mortgage Association Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federal National Mortgage Association research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Federal National Mortgage Association research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federal National Mortgage Association's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal