A Look at Fiserv (FI) Valuation Following New Clover Class Action Lawsuits

Investors in Fiserv (FI) have plenty to digest this week, as several law firms have filed class action lawsuits accusing the company of misleading statements about the performance of its Clover payments platform. Specifically, the complaints allege that Fiserv temporarily boosted revenue growth by forcing merchants to migrate from Payeezy to Clover, which then led to an exodus of clients facing higher prices and operational challenges. With this wave of litigation, attention has turned to how these revelations could impact the company’s future prospects and current valuation.

The stock’s performance in recent months reflects these heightened concerns. While Fiserv grew its revenue and delivered strong net income growth over the past year, shares are down over 26% since last year, and momentum has clearly faded in the past month. The sudden legal focus on Clover’s growth highlights some of the execution risks that have crept into the story. Even as management has reiterated confidence and accelerated share buybacks, investors face mixed messages that have created friction between near-term risk and the longer-term growth narrative.

With Fiserv’s valuation under pressure after a rough year, some may question whether this is a rare opportunity for patient buyers or if markets are accurately reflecting the company’s shifting risk profile.

Most Popular Narrative: 30.8% Undervalued

According to the most popular narrative, Fiserv appears significantly undervalued compared to its potential. This suggests that the current share price does not reflect the company’s long-term growth prospects. This view is anchored on strong future earnings growth, expanding margins, and strategic business moves that could drive sustained value for shareholders.

Fiserv is positioned to benefit from the continued global shift toward digital payments, as shown by international expansion of its Clover platform into new geographies, including Brazil, Mexico, Australia, Singapore, and Europe. The company is also forming significant partnerships such as with TD Bank Canada. These initiatives are expected to drive accelerated revenue growth and higher long-term earnings by increasing payment processing volumes and expanding addressable markets.

Want to know what is fueling analyst excitement for Fiserv? There is a hidden financial engine behind this bold valuation. Curious about the projected growth rates and profit metrics driving analysts’ targets? Dive into the full narrative to see what analysts believe could propel Fiserv well above today’s price.

Result: Fair Value of $187.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent execution delays or margin pressures from heavy investments could dampen Fiserv’s growth outlook and challenge the bullish valuation narrative.

Find out about the key risks to this Fiserv narrative.Another View: What Do Conventional Ratios Say?

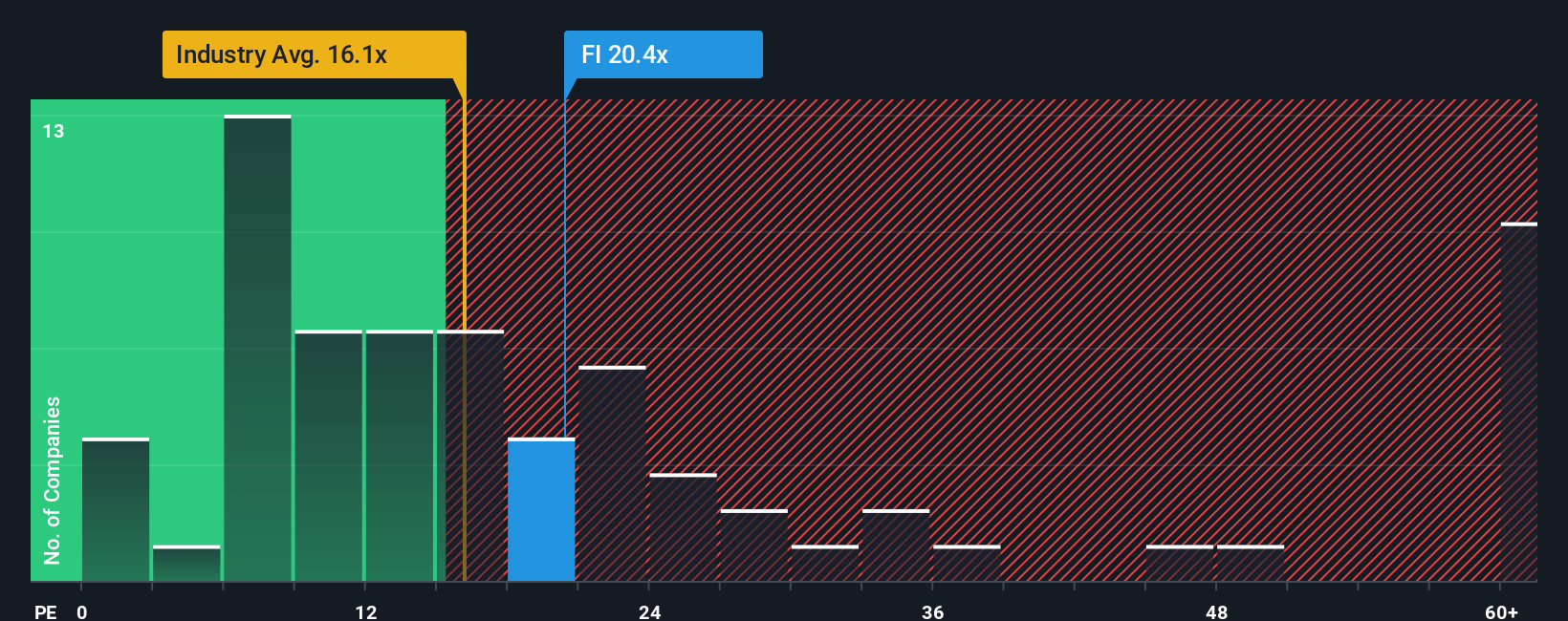

While the first valuation method points to long-term upside, a fresh look using the standard price-to-earnings ratio shows that Fiserv currently looks expensive compared to the wider industry. Could analysts be too optimistic this time?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fiserv Narrative

If the current analysis does not align with your perspective or you want to dig into the numbers yourself, you can quickly craft your own view. Do it your way.

A great starting point for your Fiserv research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why limit your strategy to just one company? Unlock a wealth of new opportunities by using these top screeners on Simply Wall St and give your investing an immediate edge. Missing out on these could mean overlooking tomorrow’s biggest winners.

- Spot undervalued gems poised for a comeback when you check out the latest picks in undervalued stocks based on cash flows.

- Tap into tomorrow’s technology trailblazers by researching breakthrough opportunities in AI penny stocks.

- Catch steady streams of cash flow by tracking companies offering strong yields at dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal