3 ASX Stocks Estimated To Be Up To 46.9% Below Intrinsic Value

The Australian market has recently shown signs of awakening, with most sectors experiencing gains, led by Financials, while certain areas like staples lagged slightly. In this environment of cautious optimism and sector-specific movements, identifying undervalued stocks can be key to capitalizing on potential opportunities; these stocks are often priced below their intrinsic value and may offer room for growth as the market continues to evolve.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Resimac Group (ASX:RMC) | A$1.10 | A$2.13 | 48.4% |

| Regis Healthcare (ASX:REG) | A$6.53 | A$11.54 | 43.4% |

| Reckon (ASX:RKN) | A$0.625 | A$1.18 | 47.1% |

| PointsBet Holdings (ASX:PBH) | A$1.215 | A$2.07 | 41.2% |

| NRW Holdings (ASX:NWH) | A$4.61 | A$8.63 | 46.6% |

| IDP Education (ASX:IEL) | A$5.68 | A$10.67 | 46.8% |

| Elders (ASX:ELD) | A$7.46 | A$14.04 | 46.9% |

| DGL Group (ASX:DGL) | A$0.47 | A$0.77 | 39% |

| Credit Clear (ASX:CCR) | A$0.245 | A$0.46 | 47.3% |

| CleanSpace Holdings (ASX:CSX) | A$0.745 | A$1.40 | 47% |

We'll examine a selection from our screener results.

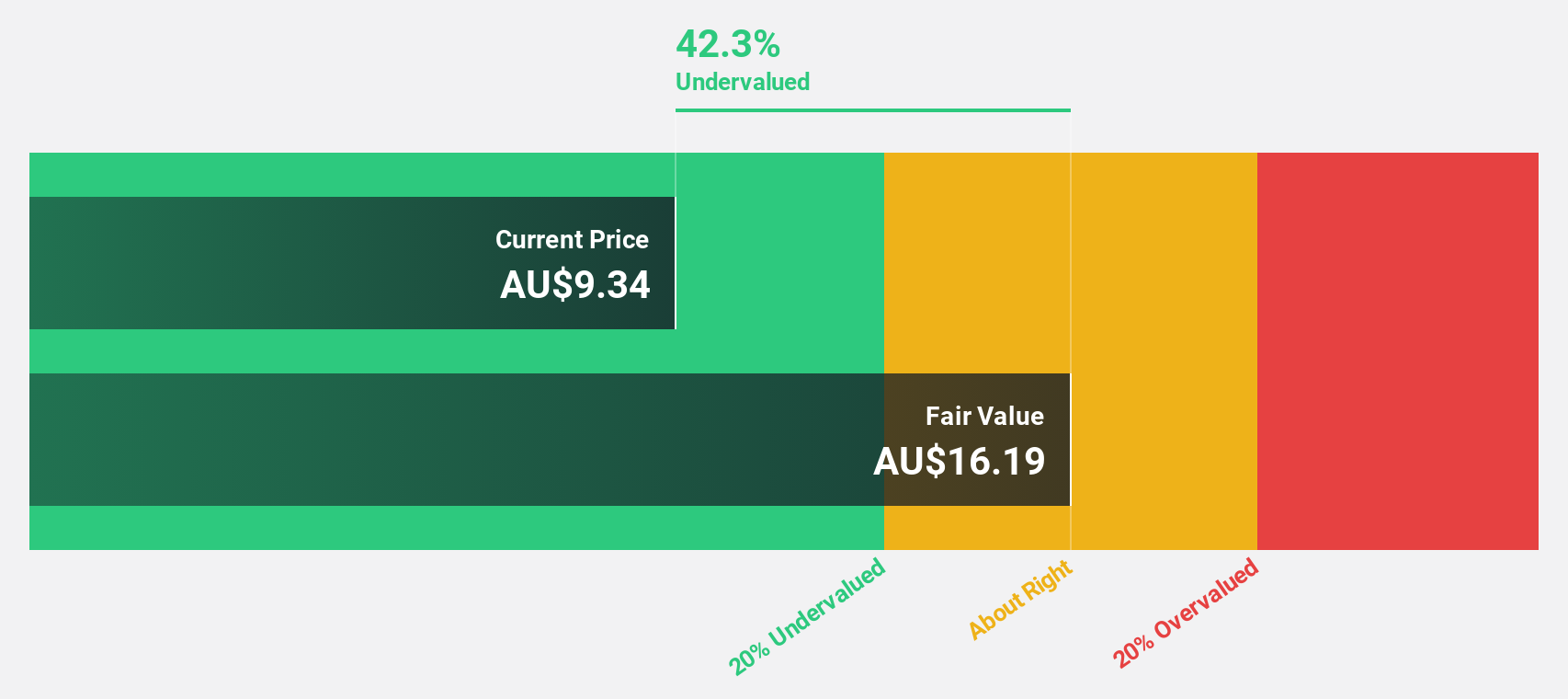

Collins Foods (ASX:CKF)

Overview: Collins Foods Limited operates, manages, and administers restaurants in Australia and Europe with a market cap of A$1.24 billion.

Operations: The company's revenue is derived from its operations in KFC Restaurants Australia (A$1.15 billion), KFC Restaurants Europe (A$312.27 million), and Taco Bell Australia (A$53.02 million).

Estimated Discount To Fair Value: 37.9%

Collins Foods is trading at A$10.53, significantly below its estimated fair value of A$16.95, indicating a potential undervaluation based on cash flows. Despite a forecasted annual earnings growth of 28.6%, the company's net profit margin has decreased from 3.7% to 0.6% over the past year, and its dividend yield of 2.47% is not well-covered by earnings, highlighting some financial challenges amidst strong projected earnings growth relative to the Australian market.

- The growth report we've compiled suggests that Collins Foods' future prospects could be on the up.

- Click here to discover the nuances of Collins Foods with our detailed financial health report.

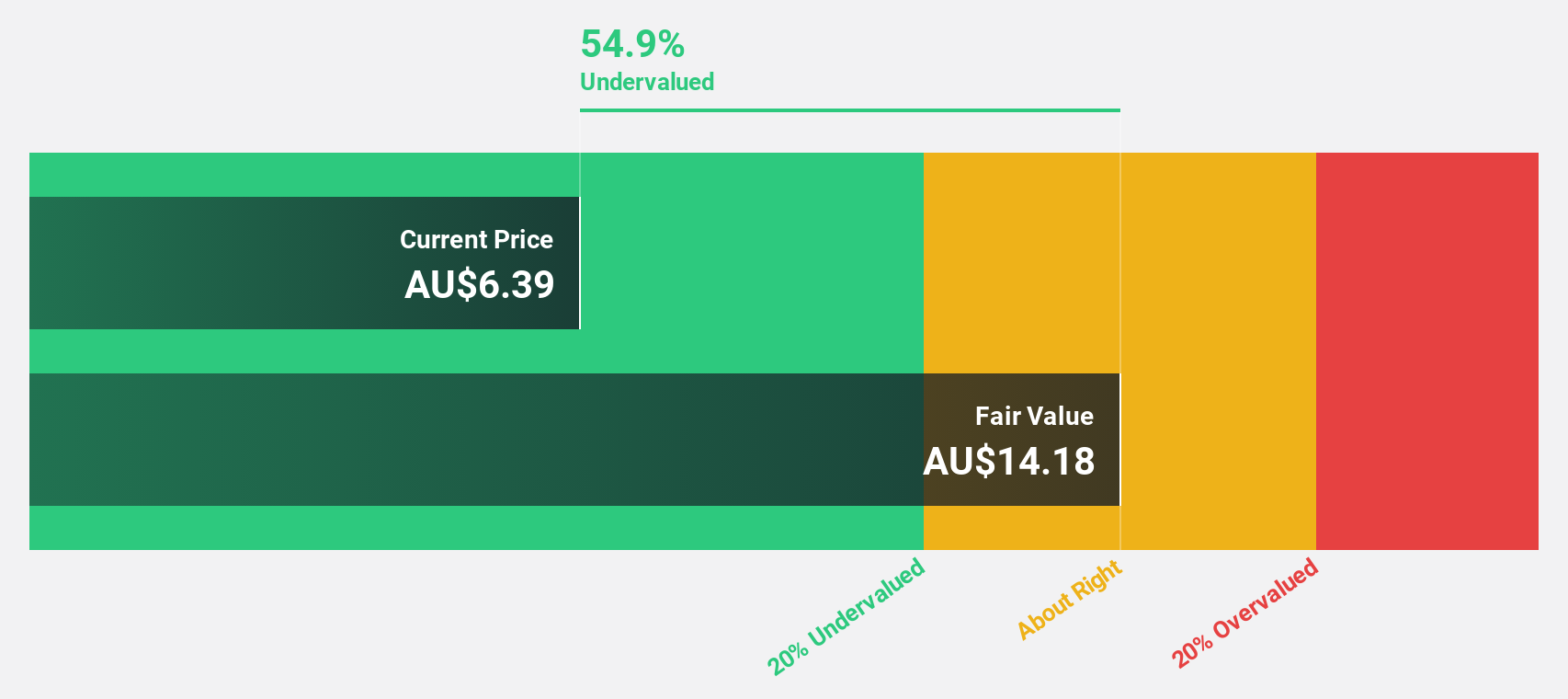

Elders (ASX:ELD)

Overview: Elders Limited offers agricultural products and services to rural and regional customers mainly in Australia, with a market cap of A$1.43 billion.

Operations: The company's revenue is primarily derived from its Branch Network at A$2.70 billion, followed by Wholesale Products at A$362.96 million, and Feed and Processing Services at A$142.30 million.

Estimated Discount To Fair Value: 46.9%

Elders is trading at A$7.46, substantially below its estimated fair value of A$14.04, highlighting a significant undervaluation based on cash flows. Forecasted annual earnings growth of 25.2% outpaces the Australian market's 10.9%, yet recent shareholder dilution and low future return on equity (10.8%) could pose challenges. Leadership changes include Glenn Davis as Chair-elect and Stephanie Nixon joining the Board, bringing expertise in strategy and governance to support Elders' operational focus amidst these financial dynamics.

- Insights from our recent growth report point to a promising forecast for Elders' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Elders.

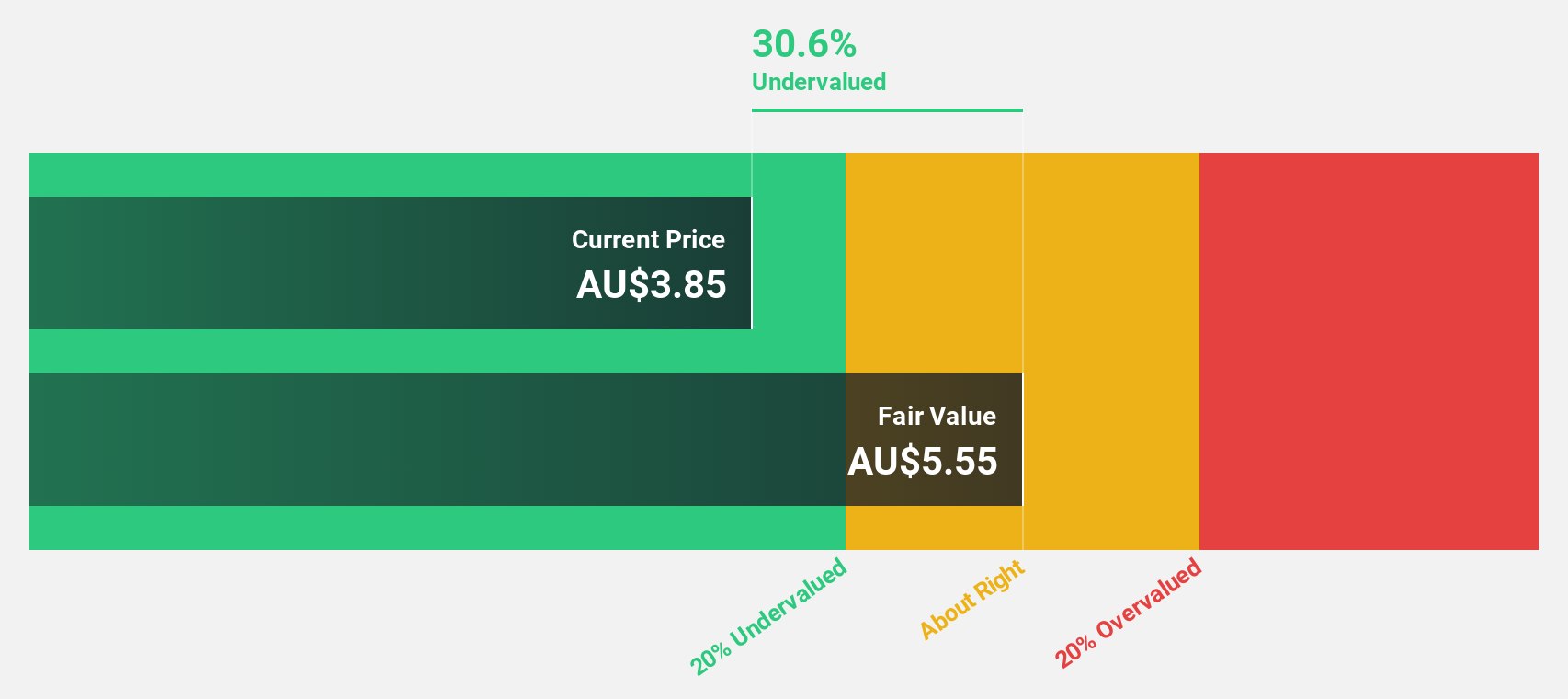

NRW Holdings (ASX:NWH)

Overview: NRW Holdings Limited offers diversified contract services to the resources and infrastructure sectors in Australia, with a market cap of A$2.11 billion.

Operations: The company generates revenue from three main segments: Mining (A$1.54 billion), MET (A$932.02 million), and Civil (A$823.72 million).

Estimated Discount To Fair Value: 46.6%

NRW Holdings is trading at A$4.61, significantly below its estimated fair value of A$8.63, suggesting undervaluation based on cash flows. Despite a drop in net income to A$27.67 million from last year's A$105.1 million, earnings are forecasted to grow annually by 24.5%, surpassing the Australian market's 10.9%. Recent M&A discussions with Fredon Industries and dividend increases indicate strategic growth efforts, although current profit margins remain compressed compared to the previous year.

- Upon reviewing our latest growth report, NRW Holdings' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of NRW Holdings stock in this financial health report.

Taking Advantage

- Gain an insight into the universe of 31 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal