Is Extended Rinvoq Exclusivity Shifting the Investment Case for AbbVie (ABBV)?

- Earlier this month, AbbVie announced a settlement with all generic manufacturers challenging Rinvoq, extending its U.S. patent protection and exclusivity period until 2037.

- This move strengthens AbbVie's long-term earnings outlook by delaying generic competition, supporting efforts to offset declining revenues from Humira.

- We'll explore how extending Rinvoq's exclusivity window could impact AbbVie's future revenue trajectory and overall investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

AbbVie Investment Narrative Recap

AbbVie’s investment case centers on its ability to defend and extend exclusivity for key immunology drugs like Rinvoq and Skyrizi, offsetting revenue pressures as Humira faces generic competition. The recent Rinvoq settlement meaningfully reduces the near-term risk of sudden revenue erosion, helping stabilize AbbVie's most important short-term catalyst, immunology franchise growth, while the critical long-term risk of regulatory-driven price controls and portfolio concentration still looms. If you believe AbbVie can continue to innovate and manage these headwinds, the extended exclusivity could be a key support, but ongoing vigilance remains essential.

In a related announcement, AbbVie recently secured expanded formulary access for VRAYLAR in Alberta, enhancing its neuroscience franchise. Steps like these may play a part in diversifying revenues away from blockbuster immunology drugs, and support long-term stability as the company manages the declining Humira contribution and pivots to new growth platforms.

However, against these advances, investors should be mindful of how AbbVie’s high reliance on a concentrated product lineup could leave it vulnerable if…

Read the full narrative on AbbVie (it's free!)

AbbVie's outlook projects $73.0 billion in revenue and $20.8 billion in earnings by 2028. This scenario assumes a 7.7% annual revenue growth rate and a $17.1 billion increase in earnings from the current level of $3.7 billion.

Uncover how AbbVie's forecasts yield a $217.45 fair value, in line with its current price.

Exploring Other Perspectives

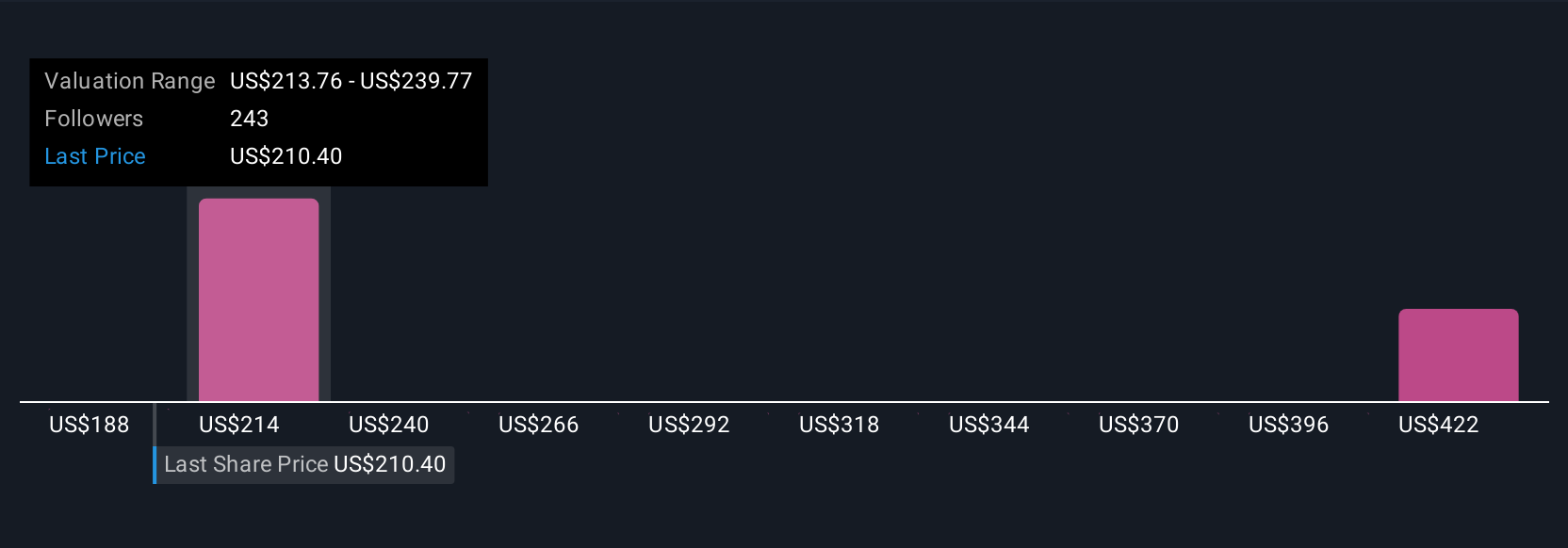

Eight fair value estimates from the Simply Wall St Community span US$187.76 to US$441.60, revealing highly varied outlooks. While many focus on immune franchise growth, the possibility of mounting regulatory pressure and patent expirations continues to shape the outlook for AbbVie’s future performance.

Explore 8 other fair value estimates on AbbVie - why the stock might be worth as much as 98% more than the current price!

Build Your Own AbbVie Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AbbVie research is our analysis highlighting 2 key rewards and 6 important warning signs that could impact your investment decision.

- Our free AbbVie research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AbbVie's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal