Merck (MRK): Evaluating Valuation After FDA Approval of Innovative Keytruda QLEX Cancer Therapy

If you are weighing your next move with Merck (MRK), there is a new wrinkle worth a close look. The company just scored U.S. FDA approval for Keytruda QLEX, a novel subcutaneous version of its blockbuster cancer medicine. Instead of the lengthy intravenous infusions most patients endure, the new injection can be given in as little as one minute, covering most of the same cancer types Keytruda already fights. This regulatory win is not just about convenience; it could reshape how Merck defends its franchise as generic threats loom in a few years.

This latest approval lands at a turning point for Merck. The company has pushed forward with a string of clinical announcements all year, but investors have been cautious. Merck shares are down nearly 28% over the past year and roughly 19% year to date. Despite long-term growth in revenue and expanding product approvals, the stock’s price momentum has stalled, testing the patience of holders even as the drug pipeline delivers steady news.

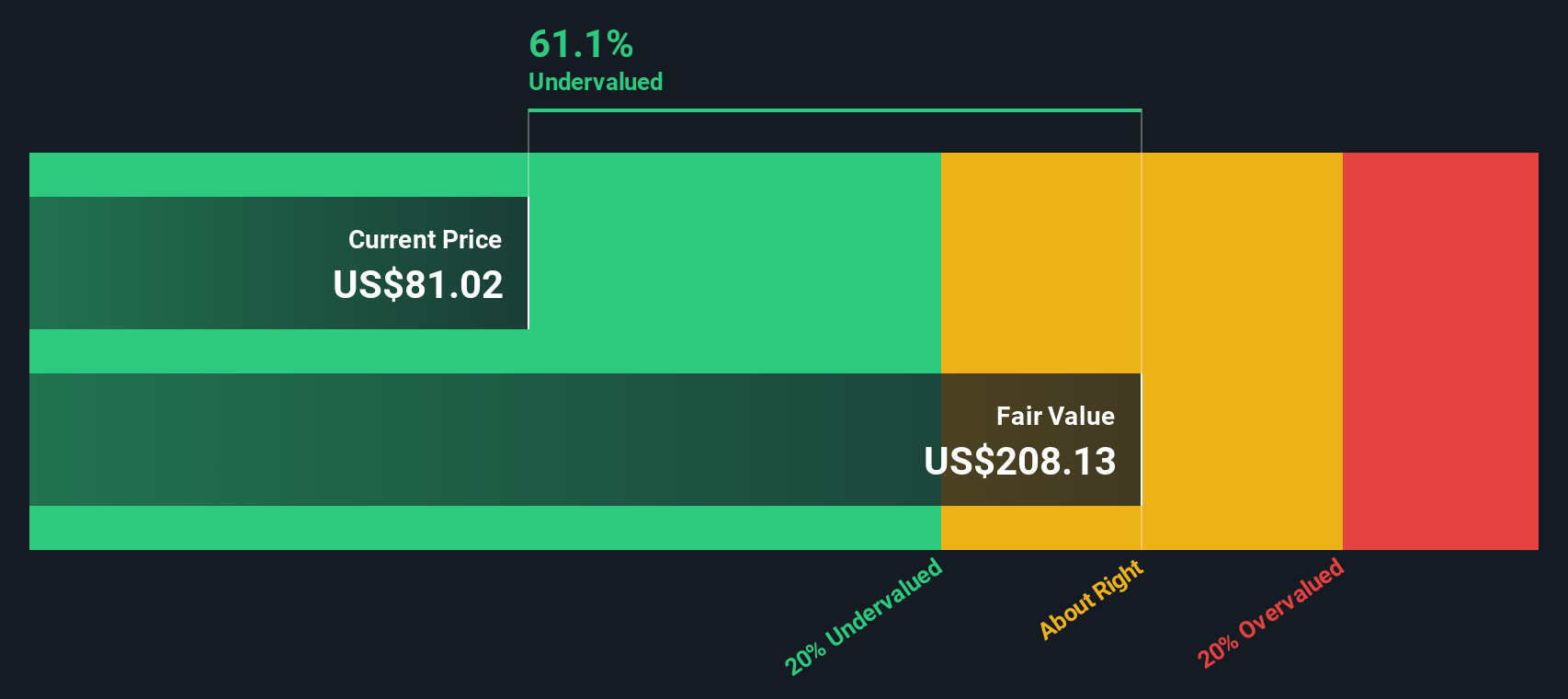

Now that Keytruda QLEX is set to hit the U.S. market, the real question is whether today’s subdued share price gives investors a genuine bargain, or if the market has already factored in all of Merck’s future growth prospects.

Most Popular Narrative: 21.4% Undervalued

The current consensus holds that Merck is trading well below its estimated fair value. Analysts are optimistic projected growth and margin expansion could provide meaningful upside for patient investors.

Merck's strategic investments and acquisitions have tripled its pipeline, aiming to significantly drive earnings growth through blockbuster potential products. Robust R&D and new product launches are expected to maintain leadership in oncology, boosting revenue and enhancing long-term margins.

Feeling bullish or skeptical? This narrative hints at sky-high growth drivers, margin expansion, and a valuation benchmark rarely seen for established pharma giants. Cracking open their revenue blueprint reveals ambitious, closely watched assumptions about future profitability. Can Merck really deliver? The full narrative lays out the pivotal numbers shaping this bold price target.

Result: Fair Value of $102.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Merck still faces pressure from key risks, including potential declines in GARDASIL sales as well as the impact of tariffs on pharmaceutical costs.

Find out about the key risks to this Merck narrative.Another View: What Does Our DCF Model Suggest?

While analysts see upside based on future earnings and margin expansion, our SWS DCF model also points to Merck trading well below its estimated fair value. Both approaches agree, at least for now, that the shares look undervalued. Could they be missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Merck Narrative

If you have a different perspective or want to dig into the numbers yourself, you can quickly craft your own view on Merck’s story. Do it your way

A great starting point for your Merck research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Opportunities?

You should not limit your search to just one story. Make the most of Simply Wall Street’s powerful filters to target stocks with unique strengths and potential. Miss out on these, and you could leave remarkable gains on the table.

- Capture high returns with companies offering attractive yields and proven cash distributions by heading to our dividend stocks with yields > 3% for reliable income in any market with dividend stocks with yields > 3%.

- Uncover tomorrow’s leaders on the frontier of artificial intelligence by scanning our handpicked AI penny stocks for new tech potential using AI penny stocks.

- Snap up overlooked gems trading below their true value by acting now. Our undervalued stocks based on cash flows showcase deep value opportunities with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal