eBay (EBAY): Valuation in Focus as Insider Selling Meets New Marketplace Upgrades

If you’re an eBay (EBAY) shareholder or watching from the sidelines, the latest activity at the company is giving investors plenty to consider. Over the past year, a wave of insider selling by senior executives, including a sizable share sale by SVP Mazen Rawashdeh, has raised some eyebrows about what management really expects for eBay’s future. At the same time, eBay is making moves to refresh its marketplace by rolling out features such as improved Cost of Goods Sold tracking for sellers and expanding international shipping. Together, these developments present a mixed picture that could be easy to overlook if you’re focused only on the headline insider moves.

These changes are happening just as eBay’s stock price has shown undeniable momentum. The stock has surged 22% in the past three months and nearly 45% year-to-date, a pace that stands out among online marketplaces. Some of this energy can be credited to product launches and growth in revenues, even as management has faced questions about user engagement and ongoing insider sales. The improvement over the past year suggests growing optimism, or at least a change in how investors are weighing eBay’s risks and rewards.

But here is the key question: with shares climbing so sharply, is the current price reflecting all of eBay’s future growth, or are the markets overlooking something that could point to more upside ahead?

Most Popular Narrative: 2.9% Overvalued

According to the most widely followed narrative, eBay’s current share price sits slightly above its calculated fair value based on forecasts of future earnings, revenue growth, and profit margins.

Expansion of mobile access and innovative app experiences, including new AI-powered listing tools, personalized communications, streamlined C2C managed shipping, and eBay Live social shopping, are driving higher seller and buyer engagement. This is likely to lift active user growth, listing volume, and ultimately top-line revenue.

What are analysts baking into this valuation? The real story behind the numbers includes bolder revenue, earnings, and margin projections than you might expect. Want to uncover the specific financial assumptions and the future profit multiple powering this price target? The answers might surprise anyone watching eBay’s next move.

Result: Fair Value of $88.07 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued weakness in international markets or slower growth in eBay’s collectibles categories could quickly challenge analysts’ optimism and put pressure on future earnings.

Find out about the key risks to this eBay narrative.Another View: Discounted Cash Flow Paints a Different Picture

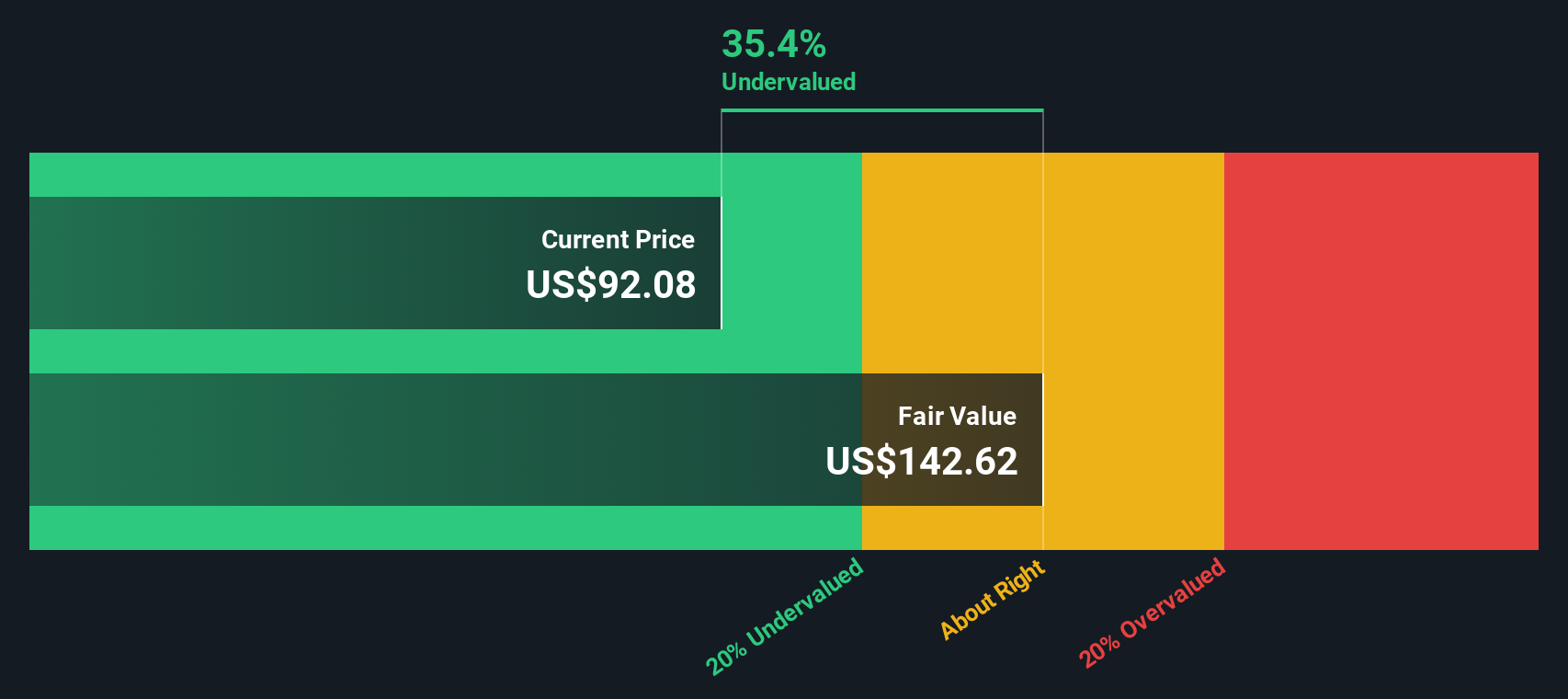

While the first approach suggests eBay is overvalued, our SWS DCF model reaches a much more optimistic conclusion. This implies the shares may in fact be trading well below their intrinsic value. Is the real opportunity being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own eBay Narrative

If you want to dig deeper, challenge the latest views, or put your own analysis to the test, it’s quick and easy to construct your unique narrative. Do it your way Do it your way.

A great starting point for your eBay research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing game and stay ahead of the market with these tailored opportunities from Simply Wall St. Miss them, and you might overlook some of the smartest trends shaping the future of investing.

- Uncover fresh value with companies backed by robust cash flows and potential upside by checking out our undervalued stocks based on cash flows.

- Secure consistent returns and reliable income by browsing stocks that offer yields over 3% via our dividend stocks with yields > 3%.

- Catch forward-thinking innovators applying artificial intelligence to revolutionize healthcare by exploring our healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal