The Bull Case For Topaz Energy (TSX:TPZ) Could Change Following Surge in Insider Buying Activity

- Over the past year, several insiders at Topaz Energy Corp. (TSE:TPZ), including Chairman Michael Rose, have significantly increased their holdings, with the largest single insider purchase valued at CA$2.0 million near the prevailing market price and no reported insider selling.

- This continuing insider buying activity signals strong confidence in the company’s outlook and has influenced investor sentiment in recent months.

- To better understand what this recent insider activity could mean for the future, we’ll examine how increased insider buying activity informs Topaz Energy’s investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Topaz Energy Investment Narrative Recap

To be a shareholder in Topaz Energy, you need to believe in the long-term resilience of the royalty business model despite volatility in oil and natural gas demand, and have conviction the company can manage concentrated operator exposure and offset natural production declines. Recent insider buying, including significant purchases by Chairman Michael Rose, is a strong sign of internal confidence; however, this activity doesn’t materially alter the most important short-term catalyst, ongoing operator drilling activity and new royalty volumes, nor does it reduce the primary business risk of dependence on a few key upstream partners.

Among the company’s recent announcements, the reaffirmation of 2025 royalty production guidance following a strong Q2 earnings report stands out alongside insider transactions. This supports the current growth narrative by keeping near-term expectations in line, while keeping investor focus on continued production delivery and the importance of operator performance.

Yet, despite recent insider optimism, investors should be aware that over-reliance on a small group of key operators still means ...

Read the full narrative on Topaz Energy (it's free!)

Topaz Energy's narrative projects CA$500.8 million revenue and CA$109.0 million earnings by 2028. This requires 15.0% yearly revenue growth and a CA$46.1 million earnings increase from CA$62.9 million.

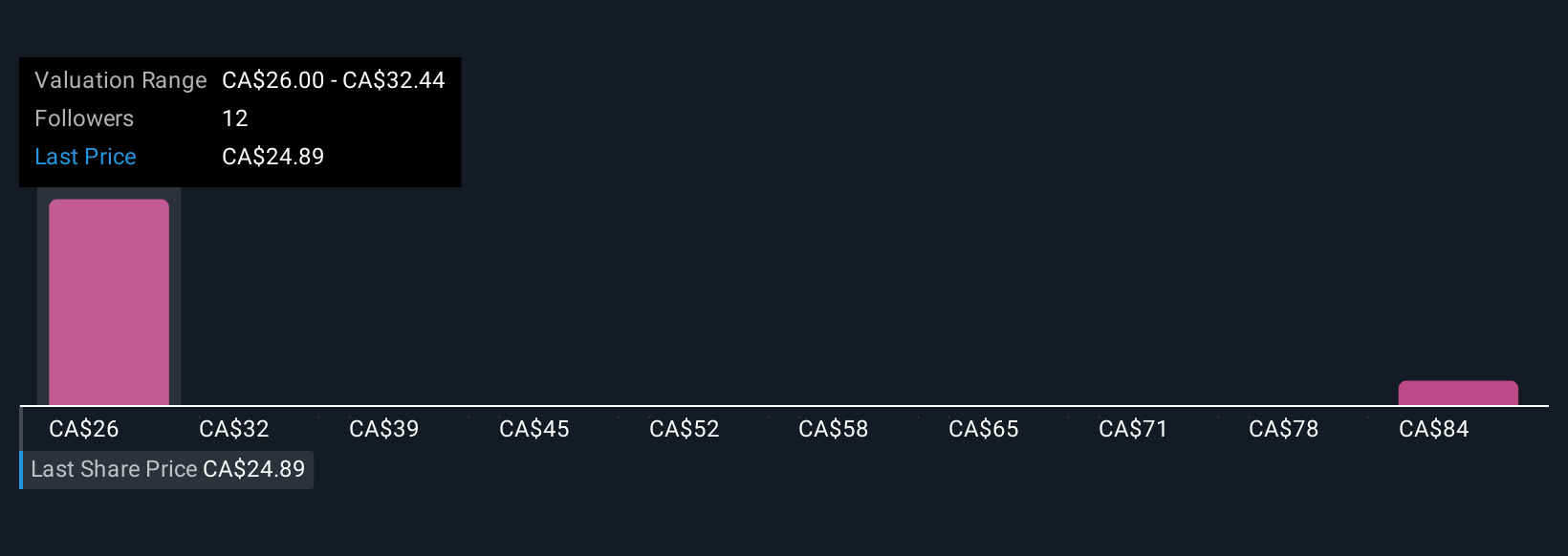

Uncover how Topaz Energy's forecasts yield a CA$31.42 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community fair value estimates for Topaz Energy range from CA$18 to CA$70.44 per share. While some see meaningful upside, others point out that exposure to a few operators could create pronounced swings in earnings and dividends, consider these contrasting viewpoints when forming your view on the company’s future.

Explore 5 other fair value estimates on Topaz Energy - why the stock might be worth 30% less than the current price!

Build Your Own Topaz Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Topaz Energy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Topaz Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Topaz Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal