AerCap Holdings (AER): Evaluating Valuation Following Senior Notes Issuance and Milestone Freighter Deliveries

When something significant happens at AerCap Holdings (NYSE:AER), investors tend to sit up and pay attention. Lately, there has been no shortage of headlines. Just this month, AerCap priced a $1.2 billion senior notes offering to fuel its next round of fleet acquisitions and debt refinancing. At the same time, the company marked a milestone with the delivery of its first two converted Boeing 777-300ERSF freighters to Kalitta Air. These moves not only strengthen AerCap’s financial liquidity but also highlight strategic bets on a changing air cargo landscape. This signals to market watchers that the company is focusing on long-term growth.

AerCap’s shares have climbed by 27% so far this year, part of a persistent multi-year uptrend that has gathered momentum alongside these developments. The successful bond sale and the introduction of a new freighter generation build on an already busy few months, including the launch of a $750 million share buyback program. Against that backdrop, investors appear increasingly confident in AerCap’s operational flexibility and growth pipeline, with the stock showing both short-term resilience and solid long-term returns over the past three and five years.

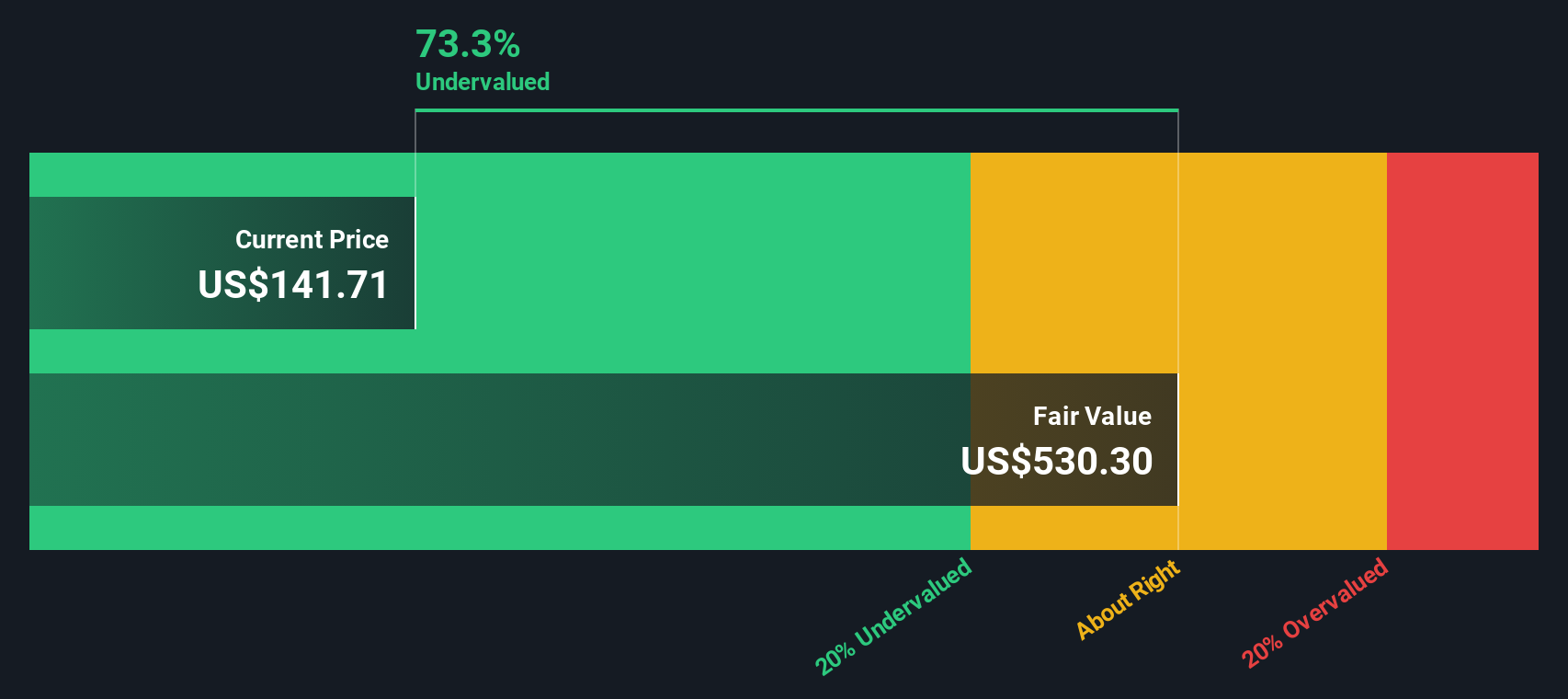

After all this activity and a significant rise in shares, the question is clear: is there still upside ahead, or has the market already priced in AerCap’s ambitious growth story?

Most Popular Narrative: 7% Undervalued

The prevailing narrative sees AerCap Holdings as moderately undervalued, projecting upside potential against current market levels based on future growth and profitability assumptions.

Expansion of ancillary services, particularly AerCap's spare engine leasing and new engine/MRO partnerships such as the Air France-KLM JV, diversify revenue sources and add higher-margin income streams. This positively impacts overall earnings growth.

What’s fueling this bullish outlook? One critical ingredient is hidden in future estimates for revenue, margin compression, and share count declines. There are bold assumptions about profitability and market positioning that might transform AerCap’s valuation completely. Do you want to uncover the main levers behind that optimistic price target? The secret formula might surprise you.

Result: Fair Value of $132.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, supply chain recovery or shifts in airline demand could flood the leasing market with aircraft, which could put pressure on AerCap’s revenues and asset values.

Find out about the key risks to this AerCap Holdings narrative.Another View: SWS DCF Model

While the market seems convinced by analyst forecasts and peer comparisons, our SWS DCF model takes a different approach. This method looks directly at AerCap’s future cash flows and suggests a drastically different story. Can long-term fundamentals change how we see today’s price?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own AerCap Holdings Narrative

If you'd rather draw your own conclusions or approach the data differently, you can craft your personal narrative in just a few minutes. Do it your way.

A great starting point for your AerCap Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock a world of fresh opportunities beyond AerCap Holdings, where the next breakthrough, hidden value, or game-changing sector could transform your portfolio. Take action now and don’t leave potential on the table by missing these hand-picked routes:

- Uncover tomorrow’s industry leaders by tracking penny stocks with strong financials. See which companies are defying expectations with penny stocks with strong financials.

- Tap into the growing field of artificial intelligence breakthroughs by checking out which firms are driving innovation with AI penny stocks.

- Capture outstanding value opportunities by seeking out undervalued stocks based on cash flows. Maximize your return potential through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal