Bitmine Immersion Technologies (BMNR): Examining Valuation Following $365M Equity Raise for Major Ethereum Accumulation

Bitmine Immersion Technologies (BMNR) just made headlines with a bold $365 million equity offering, completed through a direct sale to institutional investors. The entire sum is headed straight into the company’s vaults to fuel even further Ethereum buying, as BMNR now eyes an ambitious goal: holding 5% of all circulating ETH. With this new capital in hand and vocal support from Chairman Tom Lee, who continues to champion Ethereum’s long-term potential, investors are rightfully asking themselves what these moves could mean for the future of BMNR’s stock.

Looking at the numbers, BMNR’s share price has seen moderate strength, rising 11% over the past three months and finishing up around 4% for the year. That climb contrasts with plenty of volatility across broader crypto-linked stocks, some of which have been pressured by recent market sell-offs. Yet, BMNR’s strategy, decisively expanding its Ethereum holdings, seems to be building momentum, especially as the company cements its status as the world’s largest corporate ETH treasury. News of rapid asset accumulation and direct signals of institutional demand have given shares a narrative that stands apart from many crypto peers.

All this raises a key question: does BMNR’s latest buying spree present a real opportunity for investors, or has the market already priced in the company’s aggressive growth plan?

Price-to-Book of 3321.7x: Is it justified?

Bitmine Immersion Technologies is currently valued at a staggering price-to-book ratio of 3321.7x, which is far higher than its peers in both the US software industry and the broader market. This suggests the stock is trading at a significant premium to the underlying value of its assets.

The price-to-book ratio measures how much investors are willing to pay for each dollar of a company's net assets. In technology and software sectors, high multiples can reflect expectations of future growth or unique strategic advantages. However, a ratio as elevated as BMNR’s usually signals overheated investor enthusiasm or speculative activity, especially when compared to the US software industry average of just 4x and peer average of 13.9x.

This extreme premium implies the market is pricing in significant future earnings growth or asset appreciation. However, such a lofty valuation also amplifies expectations and increases the pressure for BMNR to deliver outstanding results to justify its current share price.

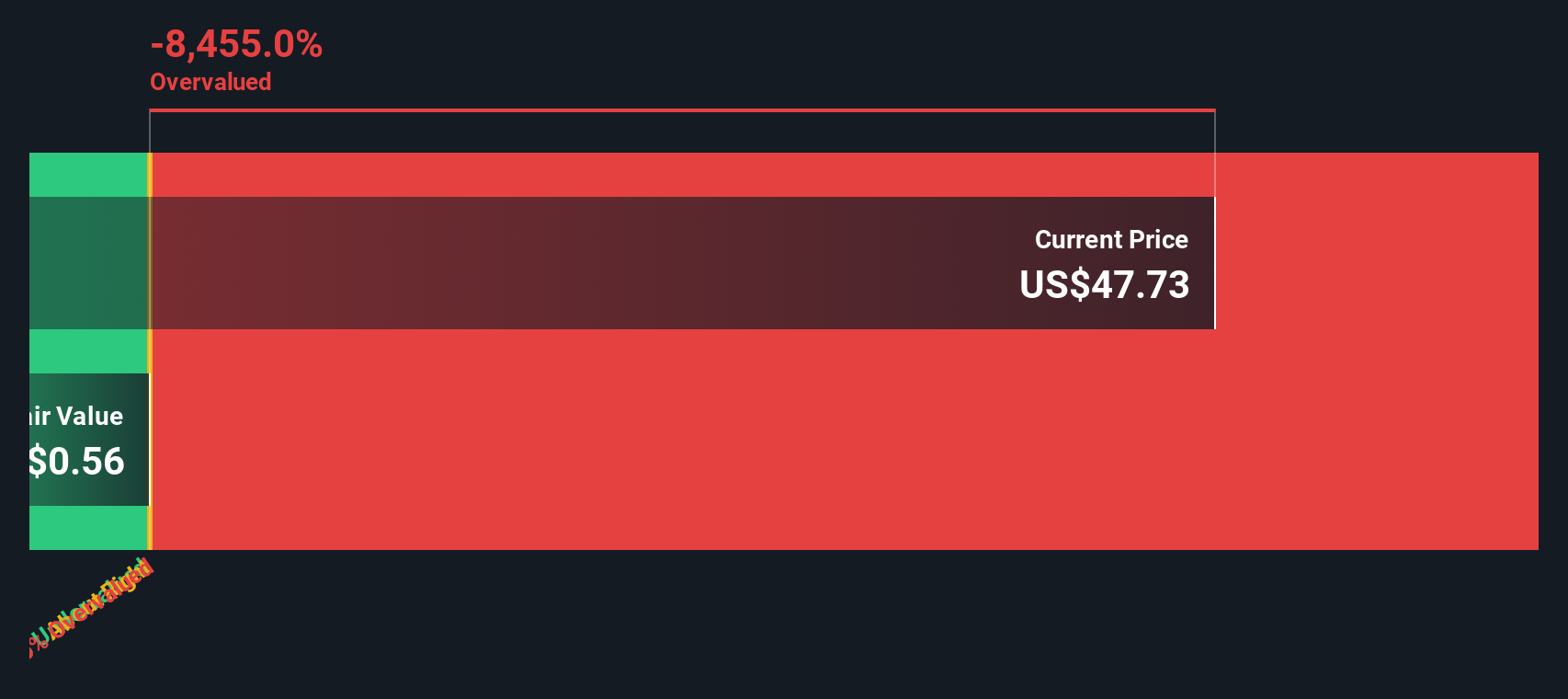

Result: Fair Value of $0.55 (OVERVALUED)

See our latest analysis for Bitmine Immersion Technologies.However, sharp valuation premiums and persistent negative net income could spark investor doubts, particularly if BMNR does not deliver meaningful revenue growth soon.

Find out about the key risks to this Bitmine Immersion Technologies narrative.Another View: SWS DCF Model Tells a Similar Story

Taking a different approach, the SWS DCF model also points toward an overvalued picture for Bitmine Immersion Technologies. Instead of focusing on asset value multiples, this method weighs cash flows and future potential. Could consensus between models signal overheated expectations, or is there more beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bitmine Immersion Technologies Narrative

If you see things differently or would rather dig into the numbers your own way, it only takes a few minutes to craft a personal view. So why not Do it your way?

A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Your next winning stock could be just a click away. Take action today and don’t let smarter opportunities slip past you. Let these handpicked ideas jumpstart your research and move you ahead of the crowd:

- Uncover hidden gems trading below their value by using our undervalued stocks based on cash flows. This tool is perfect for investors seeking stocks poised for a rebound.

- Target stocks at the intersection of medicine and machine intelligence by tapping into our healthcare AI stocks, which opens doors to healthcare innovations powered by AI.

- Track companies making waves in digital currencies by browsing through our cryptocurrency and blockchain stocks for exposure to blockchain pioneers and next-generation payment platforms.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal