Assessing Strathcona Resources After 40% Rally and Turbulence in Canadian Oil Markets

Thinking about what to do with Strathcona Resources stock? You are not alone. In a market that is always looking for its next growth story, Strathcona’s performance naturally attracts attention. Over the past year, the stock has jumped an impressive 40.5%, and even after a recent pullback, with the price down 2.9% over the last week and 8.2% in the past month, it still boasts a 14.7% gain year-to-date. These swings are more than just numbers; they reflect shifts in how investors see the company’s growth prospects and risk profile. Recent market developments in the Canadian energy sector have stirred up sentiment, adding some volatility but also renewed focus on well-managed, efficiently run producers like Strathcona.

With the stock closing at $35.74, many investors are weighing whether these moves signal the end of the rally or simply a new beginning. Luckily, there is a way to cut through the noise. Tapping into six key valuation checks, Strathcona Resources earns a score of 4, indicating it is undervalued in most areas. That is a strong place to start if you are considering buying or simply holding on. So, what does each valuation approach really say about where Strathcona stands right now? And more importantly, is there a smarter, more nuanced way to understand whether this opportunity is as good as it looks? Let us break it down.

Strathcona Resources delivered 40.5% returns over the last year. See how this stacks up to the rest of the Oil and Gas industry.Approach 1: Strathcona Resources Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by projecting a company’s future cash flows and then discounting them back to today’s value, offering an estimate of what the business is intrinsically worth. For Strathcona Resources, the analysis begins with its current Free Cash Flow (FCF), which stands at CA$653.6 Million. The DCF incorporates both analyst estimates and longer-term projections. By 2029, expected FCF reaches around CA$730 Million, and by 2035 projections point to over CA$2 Billion.

These cash flows, expressed in Canadian dollars (CA$), are discounted using a two-stage Free Cash Flow to Equity model. The resulting intrinsic value per share is estimated at CA$161.09, compared to the recent share price of CA$35.74. This means Strathcona shares are currently trading at a 77.8% discount to their calculated fair value.

In summary, the DCF model suggests Strathcona Resources is significantly undervalued based on projected cash flow growth and today’s market price.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Strathcona Resources.

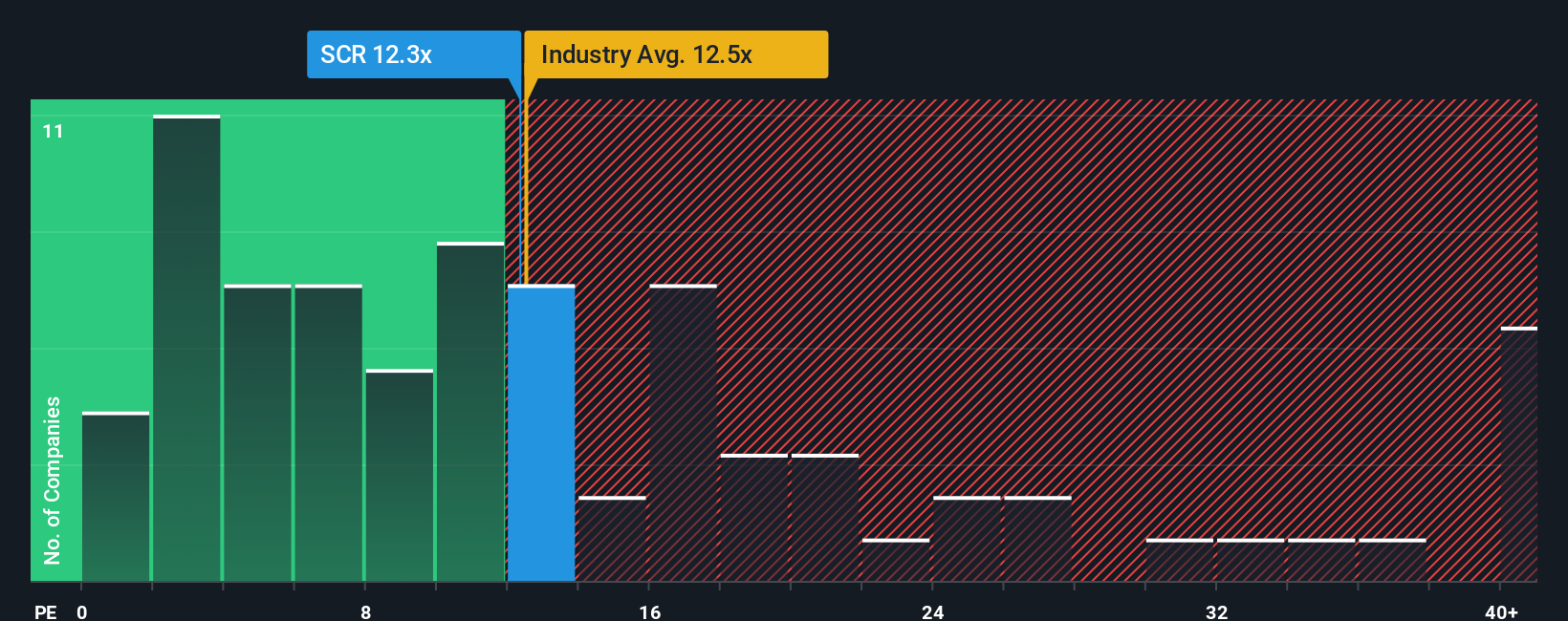

Approach 2: Strathcona Resources Price vs Earnings (PE Ratio)

For profitable companies like Strathcona Resources, the price-to-earnings ratio, or PE ratio, is often the go-to metric for understanding valuation. It tells investors how much they are paying for each dollar of the company’s earnings, which is especially relevant when earnings are consistent and reliable.

Growth expectations and perceived risk both play a big part in what qualifies as a “normal” or “fair” PE ratio. Investors tend to pay higher multiples for companies with strong growth potential or lower risk profiles, while more mature or riskier companies usually command lower ratios.

Currently, Strathcona trades at a PE ratio of 12x. This is slightly below both the Oil and Gas industry average of 12.12x and the peer average of 15.62x, suggesting it might be undervalued relative to others in its sector. However, simply comparing to an industry or peer average can be misleading if the company’s growth, risk, or profitability are notably different.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. This fair multiple, calculated as 7.09x for Strathcona, takes into account not just industry and size, but also the company’s specific earnings growth outlook, profit margins, and business risks. This makes it a more tailored and holistic benchmark than raw averages.

Comparing Strathcona’s current PE ratio of 12x to its Fair Ratio of 7.09x suggests the stock is trading above its intrinsic value based on these fundamentals.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Strathcona Resources Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your own story about a company, your perspective on where Strathcona Resources is heading and why. It connects your view on the business, such as future revenues, earnings and margins, to a financial forecast and then to an estimated fair value. All of this is available in one accessible tool on Simply Wall St’s Community page, used by millions of investors globally.

Instead of relying only on static ratios or consensus forecasts, Narratives give you the ability to make buy or sell decisions based on how your fair value estimate compares to today’s share price. This approach brings your unique insights to the forefront. Each time there is a major company update, like a new quarterly result or breaking news, Narratives update dynamically so your outlook and valuation can keep pace with reality without extra effort.

For example, with Strathcona Resources, you may see some investors take a cautious view and highlight risks around carbon policies, earnings volatility and subdued price targets. Others may believe that operational efficiencies and growth investments justify a higher fair value and strong future returns. With Narratives, you can compare these perspectives, align them with your own, and upgrade your decision making to something more informed and tailored than simply following the crowd.

Do you think there's more to the story for Strathcona Resources? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal