Digging Into MEG Energy (TSX:MEG) Valuation After Recent Share Price Momentum

If you caught the recent moves in MEG Energy (TSX:MEG), you may be wondering what sparked the shift and what it means if you’re thinking about getting in, holding, or trimming your position. Without a clear event driving the action, it’s understandable to step back and question whether the latest market signals are just noise or hinting at something bigger under the surface. The oil sands operator has been on investors’ watchlists for a while, so it’s only natural to dig into whether there’s value being overlooked.

Taking a step back, MEG Energy’s share price has delivered a mix of highs and lows in the past year. Momentum has been building up again over the past three months. The share price is up roughly 10% in the past quarter and 18% year to date, continuing a longer-term story that saw a 17% return in the past year and over a 1,000% gain over three years. Growth in annual revenue also stands out, even as net income trends have turned slightly negative.

So the big question for investors now is whether there is still an attractive entry point, or if MEG Energy’s future growth is already reflected in the price.

Most Popular Narrative: 3% Undervalued

Analyst consensus suggests MEG Energy is trading slightly below its estimated fair value, mainly due to expectations of future growth, operational progress, and prudent capital management.

Operational efficiency gains and technological improvements are expected to boost margins, lower emissions, and strengthen MEG's ESG standing and market appeal. Expansion projects and disciplined capital allocation support higher production, stable revenue, and increasing shareholder returns through buybacks and dividends.

Curious why analysts see upside even after the recent run-up? The market's view hinges on bold margin assumptions and aggressive growth plans. These set the bar high for MEG's future. Ever wondered what earnings scenario would make this valuation reality? The real story is in the numbers that drive these price targets.

Result: Fair Value of $29.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including MEG's dependence on the Christina Lake project, as well as ongoing exposure to environmental and regulatory pressures that could quickly alter the outlook.

Find out about the key risks to this MEG Energy narrative.Another View: Looking Through a Different Lens

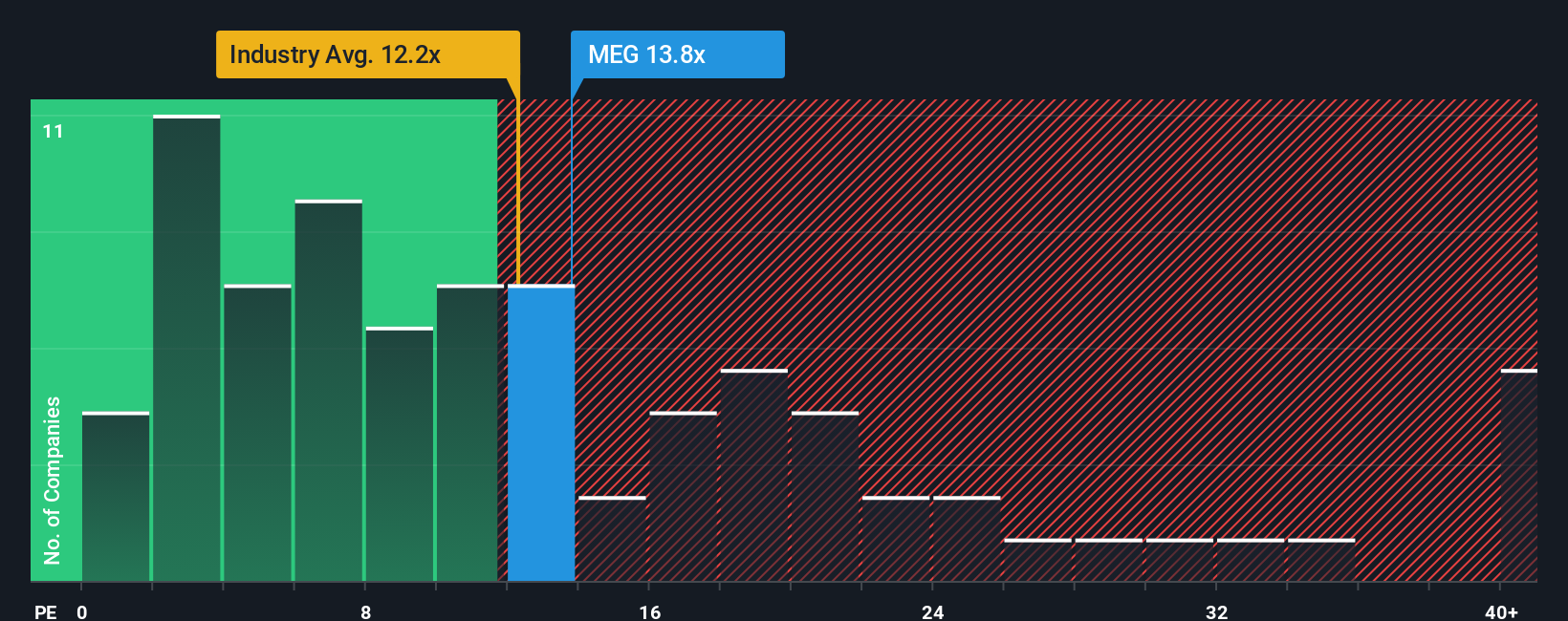

While analyst forecasts suggest MEG Energy has some upside left, comparing its price-to-earnings ratio to the industry average tells a more cautious story. Could the share price be running a little ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MEG Energy Narrative

If these perspectives don’t fit your own view or you prefer to see the numbers firsthand, dive into the details and put together your perspective in just a few minutes. Do it your way.

A great starting point for your MEG Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Ready to get ahead of the crowd? Use the Simply Wall Street Screener to pinpoint fresh opportunities built on real data and clear financials. Don’t let the next potential winner pass you by. Start your research with these handpicked ideas:

- Capitalize on tomorrow’s tech by checking out companies at the forefront of digital intelligence with AI penny stocks.

- Boost your income strategy and spot reliable payers offering yields above 3% through dividend stocks with yields > 3%.

- Catch value gems before the market does by uncovering shares primed for growth using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal