Intel (INTC): Evaluating Valuation Following Major Nvidia Partnership and Multibillion-Dollar Investment

If you’re looking at Intel (INTC) this week and wondering what just happened, you’re not alone. The tech world got a jolt when Nvidia unveiled a $5 billion investment in Intel, coupled with a jointly announced plan to co-develop custom chips designed for AI-driven data centers and personal computers. For investors, this is more than headlines. It is a move that transforms a long-standing rivalry into a high-stakes partnership, signaling a new direction for both companies. There is real intrigue in how this collaboration might help Intel close the gap with competitors and reposition itself for future growth in AI infrastructure.

The immediate reaction was dramatic: Intel shares surged nearly 23% in a single session, pushing the stock to a fresh 52-week high and bringing its one-year return to around 31%. This leap follows months of slow rebuilding under new leadership and came just as the broader market was reaching new highs. Leading up to this event, Intel posted strong net income growth and tapped government support, but was still grappling with stiff competition and concerns about long-term competitiveness. The last year had been a turnaround story in progress, but this week’s price action stands out as a potential inflection point, with unmistakable momentum picking up behind the stock.

So after such a sharp move, is Intel finally trading at a discount, or is the market now fully pricing in everything Nvidia’s vote of confidence could bring?

Most Popular Narrative: 3.9% Overvalued

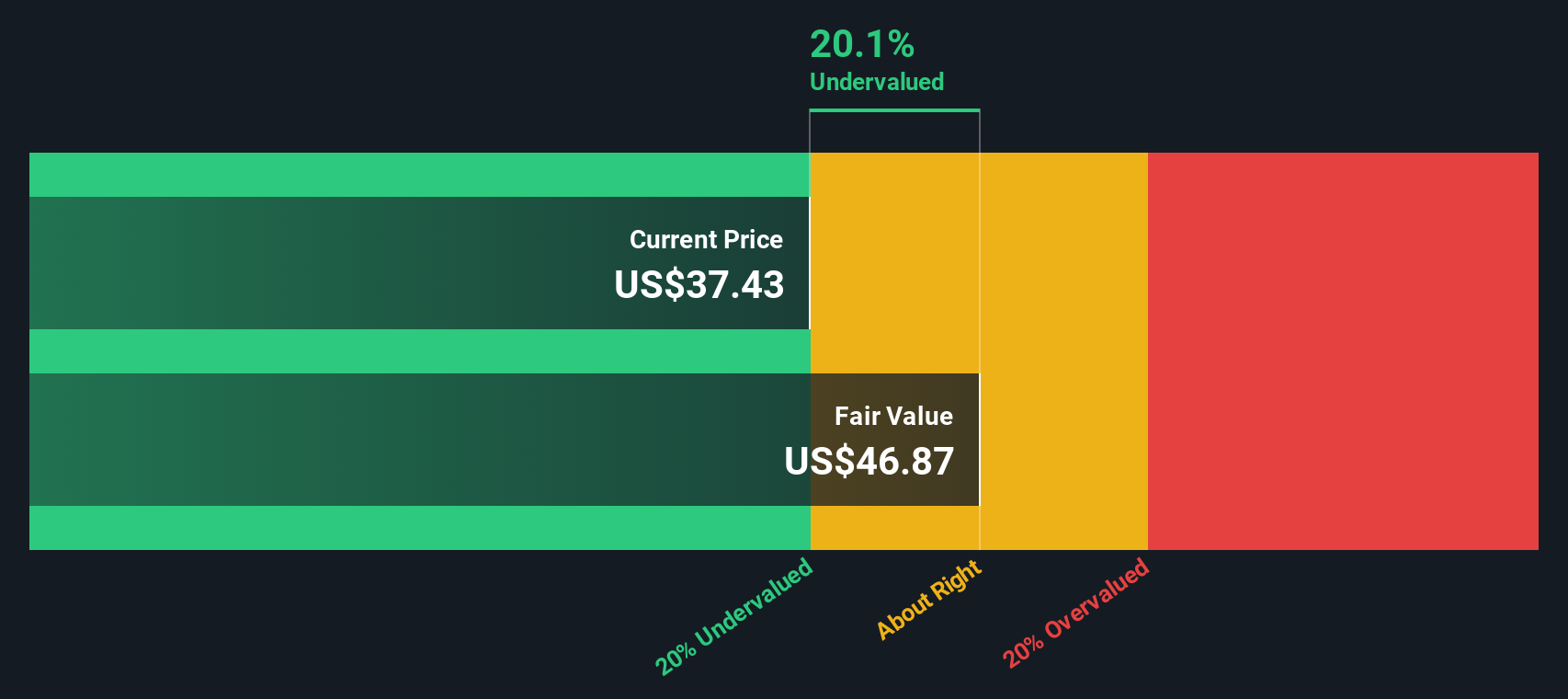

According to julio, the prevailing narrative sees Intel as marginally overvalued. The fair value estimate sits just below the current trading price, suggesting the market may be pricing in more optimism than the fundamentals warrant right now.

Intel is making some smart moves in its turnaround plans, such as shedding some noncore businesses, spinning off shares of its attractive automotive business (Mobileye), and seeking innovative co-investment partnerships with financial firms.

Curious what’s behind this cautious outlook? The narrative leans heavily on a profit expansion story and a bullish future multiple, but there is a twist in the underlying growth forecasts. Want to know which numbers challenge expectations and could reshape the fair value case? The next layer of this strategy reveals game-changing assumptions the market may be missing.

Result: Fair Value of $28.47 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Intel still faces credible risks from manufacturing execution and AMD’s increasing dominance in chip design. Both of these factors could quickly alter the outlook.

Find out about the key risks to this Intel narrative.Another View: SWS DCF Model Tells a Different Story

Taking a closer look with our DCF model, the picture isn’t as clear-cut. This valuation method currently cannot be fully applied, which leaves investors with more questions than answers about fair value. Could the full story be hiding in the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Intel Narrative

If the numbers or stories here leave you unconvinced, dive in and see for yourself. You can craft your own Intel investment thesis in under three minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Intel.

Looking for More Smart Investment Ideas?

Every savvy investor knows that the next opportunity could be just a click away. Check out these powerful themes on Simply Wall Street and stay ahead of the curve. You do not want to let these slip by.

- Target stable growth and income by checking out companies specializing in strong returns with dividend stocks with yields > 3%.

- Uncover the future of healthcare innovation by exploring leaders in medical technology and artificial intelligence with healthcare AI stocks.

- Spot potential in tomorrow’s trailblazers when you scan the market for fast-moving and resilient opportunities using penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal