A Fresh Look at EMCOR Group (EME) Valuation Following S&P 500 Equal Weighted Index Inclusion and Healthcare Growth

If you’re watching EMCOR Group (EME) right now, you probably noticed the buzz around its recent addition to the S&P 500 Equal Weighted Index. This milestone is not just a badge of honor for a company in the engineering and construction space; it tends to attract attention from institutional investors and can drive sustained buying from index funds. Alongside a surge in healthcare and pharma-related project demand, EMCOR finds itself at a pivotal moment where growth drivers and increased visibility could be converging in significant ways.

This index move follows a year marked by steady momentum for the stock. Over the past month, EMCOR shares climbed nearly 4%. In the past three months, investors have seen an impressive 26% jump. For those looking at the bigger picture, the stock has increased 46% in the last year and boasts notable multi-year gains. These developments have been supported not just by market mechanics but also by EMCOR’s expanding role in healthcare infrastructure, which now makes up a growing portion of its diversified revenue.

After a year like this, the key question is whether EMCOR’s valuation remains attractive, or if recent enthusiasm means growth has already been fully reflected in the current price.

Most Popular Narrative: 34.8% Overvalued

According to the narrative by Joey8301, EMCOR's current share price is estimated to be about 35% over its calculated fair value. This suggests that, despite the company's momentum, the stock may be trading above where its underlying financials would justify.

"EMCOR has historically grown revenue between 8% and 12% annually, with strong demand in infrastructure, data centers, and industrial construction. While short-term growth may exceed 9%, my long-term estimate assumes a slight moderation to account for economic cycles and project timing."

What is behind this bold call? Picture a future shaped by relentless growth rates and robust profit margins, but with some numbers that might surprise you. Want to know the financial levers and key projections that drive a valuation gap this big? Dive deeper to uncover the story behind the numbers and see which assumptions are fueling this eye-opening estimate.

Result: Fair Value of $468.79 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, labor shortages or a slowdown in infrastructure spending could quickly challenge assumptions about EMCOR’s future growth and valuation story.

Find out about the key risks to this EMCOR Group narrative.Another View: Discounted Cash Flow Tells a Different Story

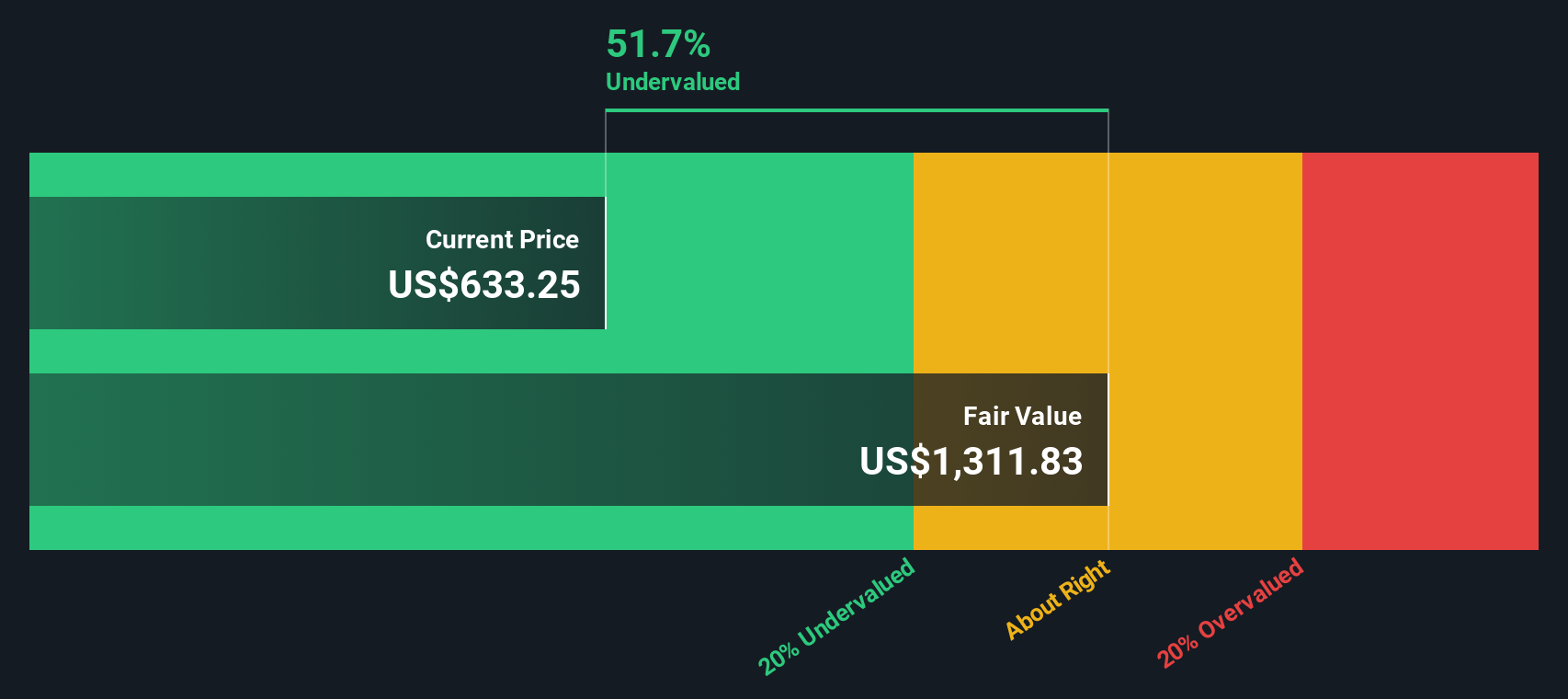

Our DCF model comes to a much different conclusion and suggests EMCOR shares may actually be priced well below their intrinsic value right now. When the numbers point in opposite directions, which method do you trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own EMCOR Group Narrative

If you see the story differently or want to dig into the numbers yourself, it only takes a few minutes to craft your own perspective. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding EMCOR Group.

Looking for More Smart Investment Ideas?

Don’t limit your strategy to just one company when the market is teeming with overlooked pockets of potential. Expand your portfolio’s reach by targeting forward-looking opportunities and winning trends shaping tomorrow’s leaders.

- Spot under-the-radar stocks with strong balance sheets and rising earnings. Tap into the potential of penny stocks with strong financials.

- Capture income with reliable yields over 3%, using our shortcut to select companies featured in dividend stocks with yields > 3%.

- Get ahead of the wave by seeking out companies unlocking breakthroughs in medicine, technology, and diagnostics through healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal