UK Penny Stocks To Watch In September 2025

Amidst a backdrop of faltering trade data from China, the UK’s FTSE 100 and FTSE 250 indices have experienced declines, reflecting broader global economic uncertainties. For investors seeking opportunities within this landscape, penny stocks—though an older term—remain a relevant area for exploration. These stocks often represent smaller or newer companies that can offer affordability and growth potential when backed by strong financial fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.615 | £516.68M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.25 | £181.77M | ✅ 3 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.37 | £40.03M | ✅ 4 ⚠️ 3 View Analysis > |

| Ingenta (AIM:ING) | £0.675 | £10.19M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.57 | $331.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.44 | £123.7M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.22 | £194.23M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.75 | £10.33M | ✅ 3 ⚠️ 4 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.65 | £267.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.46 | £74.95M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 291 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

FRP Advisory Group (AIM:FRP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FRP Advisory Group plc, with a market cap of £346.05 million, offers business advisory services to companies, lenders, investors, individuals, and other stakeholders through its subsidiaries.

Operations: The company generates revenue of £152.2 million from its specialist business advisory services segment.

Market Cap: £346.05M

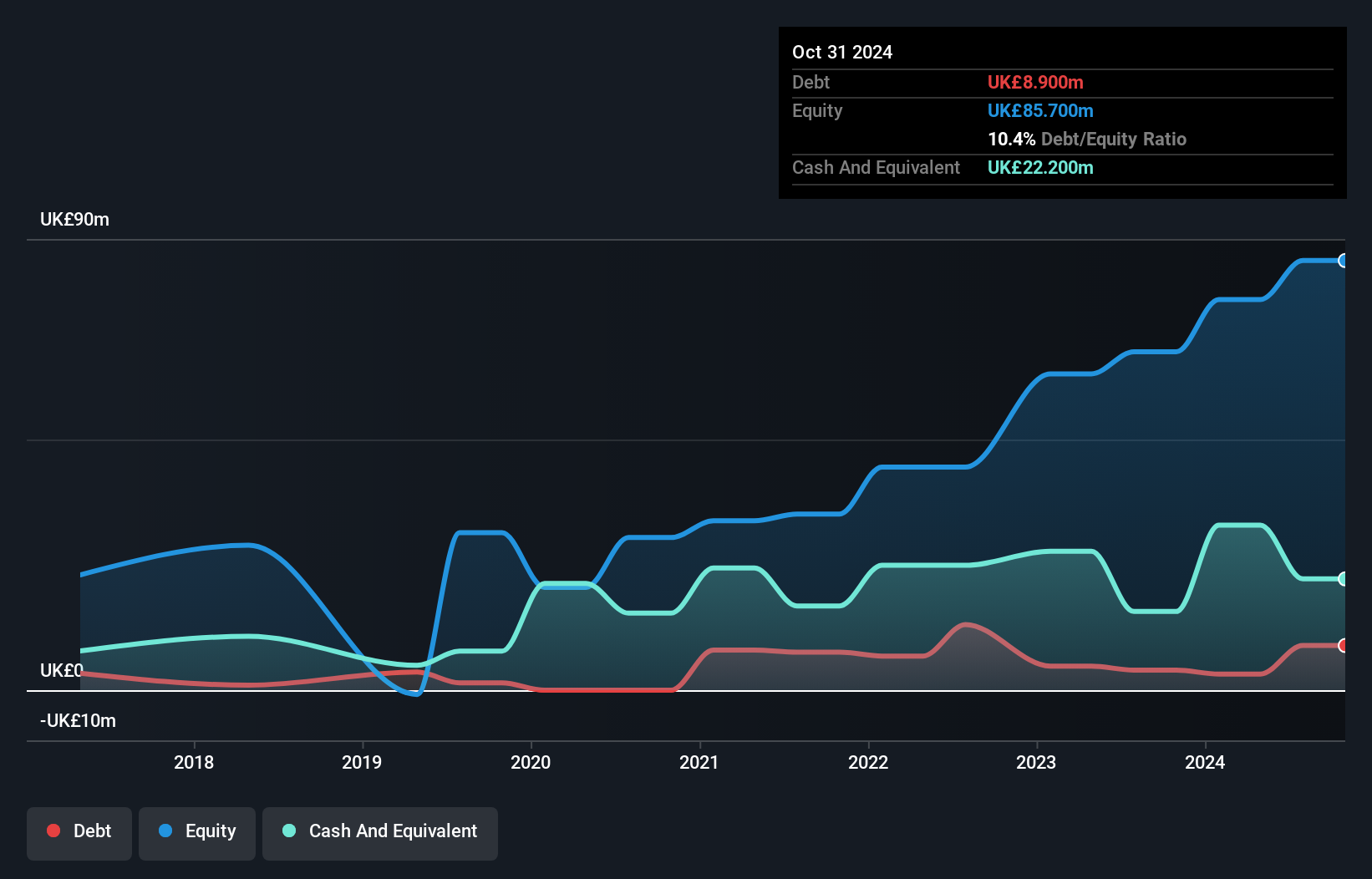

FRP Advisory Group, with a market cap of £346.05 million, is trading below analyst price targets and offers value at 11.2% under fair value estimates. Despite experiencing a decline in net profit margins from 17.2% to 14.8%, the company maintains high-quality earnings and robust financial health, with short-term assets exceeding liabilities and debt well-covered by operating cash flow. Earnings have grown significantly over five years but slowed recently, trailing industry benchmarks. The board's experience and stable weekly volatility add confidence for investors seeking stability in this penny stock space amidst its recent dividend increase announcement for October 2025 distribution.

- Get an in-depth perspective on FRP Advisory Group's performance by reading our balance sheet health report here.

- Gain insights into FRP Advisory Group's outlook and expected performance with our report on the company's earnings estimates.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Baltic Classifieds Group PLC operates online classifieds portals for automotive, real estate, jobs and services, and general merchandise in Estonia, Latvia, and Lithuania with a market cap of £1.57 billion.

Operations: The company generates revenue through its segments: Auto (€31.39 million), Real Estate (€22.25 million), Jobs & Services (€15.96 million), and Generalist (€13.22 million).

Market Cap: £1.57B

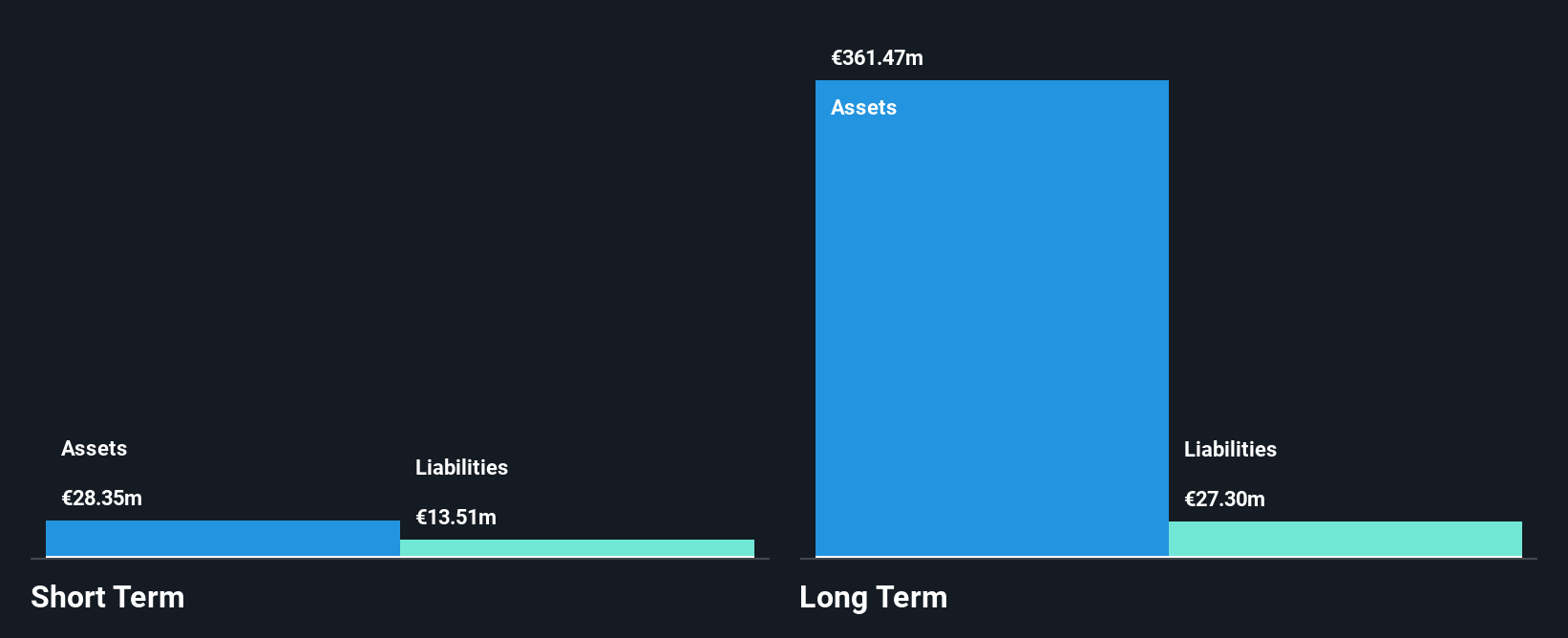

Baltic Classifieds Group, with a market cap of £1.57 billion, is financially robust with earnings growth outpacing the industry at 39.7% over the past year, despite deceleration from its five-year average of 61.1%. The company’s net profit margin improved to 54%, supported by high-quality earnings and stable weekly volatility. Its debt is well-covered by operating cash flow, and short-term assets exceed liabilities, indicating solid financial health. Recent shareholder-friendly actions include a proposed dividend increase and an ongoing share buyback program authorized to repurchase up to 10% of its issued share capital.

- Take a closer look at Baltic Classifieds Group's potential here in our financial health report.

- Examine Baltic Classifieds Group's earnings growth report to understand how analysts expect it to perform.

Liontrust Asset Management (LSE:LIO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liontrust Asset Management Plc is a publicly owned investment manager with a market cap of £199.21 million.

Operations: The company generates revenue primarily through its Investment Management segment, which reported £169.79 million.

Market Cap: £199.21M

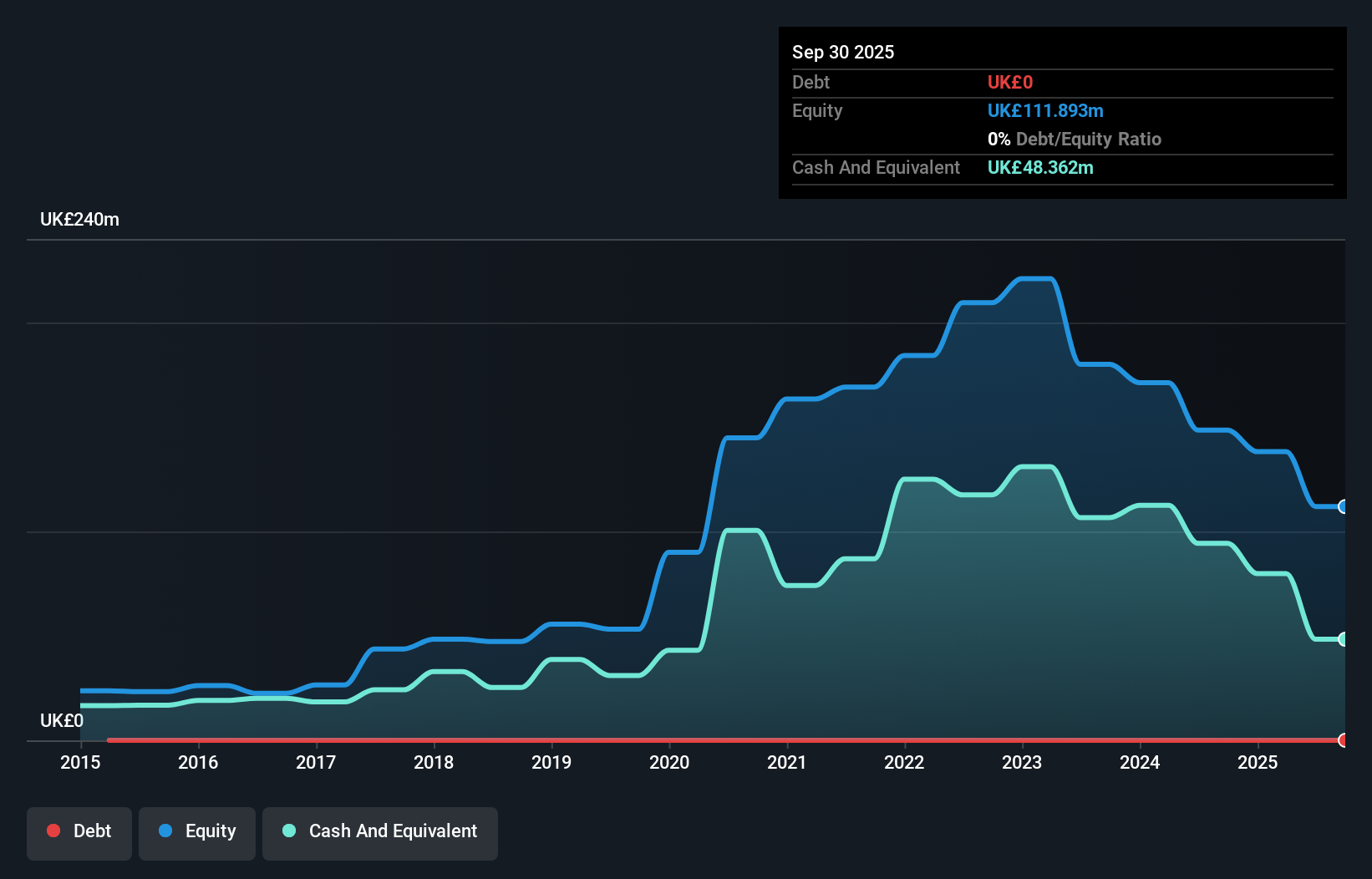

Liontrust Asset Management, with a market cap of £199.21 million, has shown financial resilience by becoming profitable in the past year, reporting net income of £16.7 million compared to a loss previously. The company operates debt-free and maintains strong liquidity with short-term assets exceeding both short and long-term liabilities significantly. Despite trading at 31.5% below its estimated fair value, its return on equity is considered low at 12.1%. Recent strategic leadership changes aim to enhance global distribution capabilities following key executive appointments in the UK and international markets, potentially supporting future growth initiatives.

- Jump into the full analysis health report here for a deeper understanding of Liontrust Asset Management.

- Gain insights into Liontrust Asset Management's future direction by reviewing our growth report.

Make It Happen

- Explore the 291 names from our UK Penny Stocks screener here.

- Ready To Venture Into Other Investment Styles? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal