SentinelOne (S): Assessing Valuation After AI Acquisitions and Raised Revenue Guidance Spark Renewed Investor Confidence

If you are holding, watching, or even just curious about SentinelOne (S), you have probably noticed a flurry of activity in both headlines and on your brokerage screen. The company’s recent moves are turning heads for a reason: SentinelOne has ramped up its pace of AI-focused acquisitions, integrated deeper with industry partners like Stamus, and reported progress toward ambitious annual recurring revenue targets. These steps, taken together, paint the picture of a company pushing hard to cement its role at the forefront of cybersecurity’s AI revolution. For investors, the big question is whether these advances outpace the risks that still linger around growth and profitability.

After a challenging year in which the stock slipped around 22%, recent momentum has been noticeably stronger. In the past month alone, SentinelOne’s shares have jumped 13%, reflecting a shift in sentiment as the market digests news of raised revenue guidance, strategic product expansions, and credible execution on its AI-native platform. Even in the context of prior volatility and cautious optimism, the last few months suggest investors see new catalysts for growth, though memories of past slowdowns remain fresh.

With shares running higher on upbeat news but still trading below intrinsic value estimates, some investors may be considering whether this is an opportunity to invest in an emerging AI leader at a discount, or if the market is already fully taking future gains into account.

Most Popular Narrative: 18.7% Undervalued

The most widely followed valuation narrative places SentinelOne at a notable discount to intrinsic value, suggesting an attractive entry point for investors who align with its future growth trajectory.

SentinelOne's robust innovation in AI-driven, autonomous security, highlighted by substantial enterprise adoption of Purple AI and the AI-native SIEM platform, strongly positions the company to capture growing budgets as cyber threats become more sophisticated. This is likely to drive sustained revenue growth and improve gross margins as their differentiated offerings enable premium pricing.

Curious how a cybersecurity player with a recent history of losses still lands a bullish valuation? The secret sauce behind this story mixes ambitious tech expansion with a huge swing in expected profitability. Analysts are betting on a future dramatic turnaround, including metrics you would not expect from a company in this position. Want to see how bold expectations shape this call?

Result: Fair Value of $23.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the outlook is not without uncertainty, as economic slowdowns or intensifying competition from larger cybersecurity players could challenge SentinelOne’s projected growth trajectory.

Find out about the key risks to this SentinelOne narrative.Another View: What Does the Market Ratio Say?

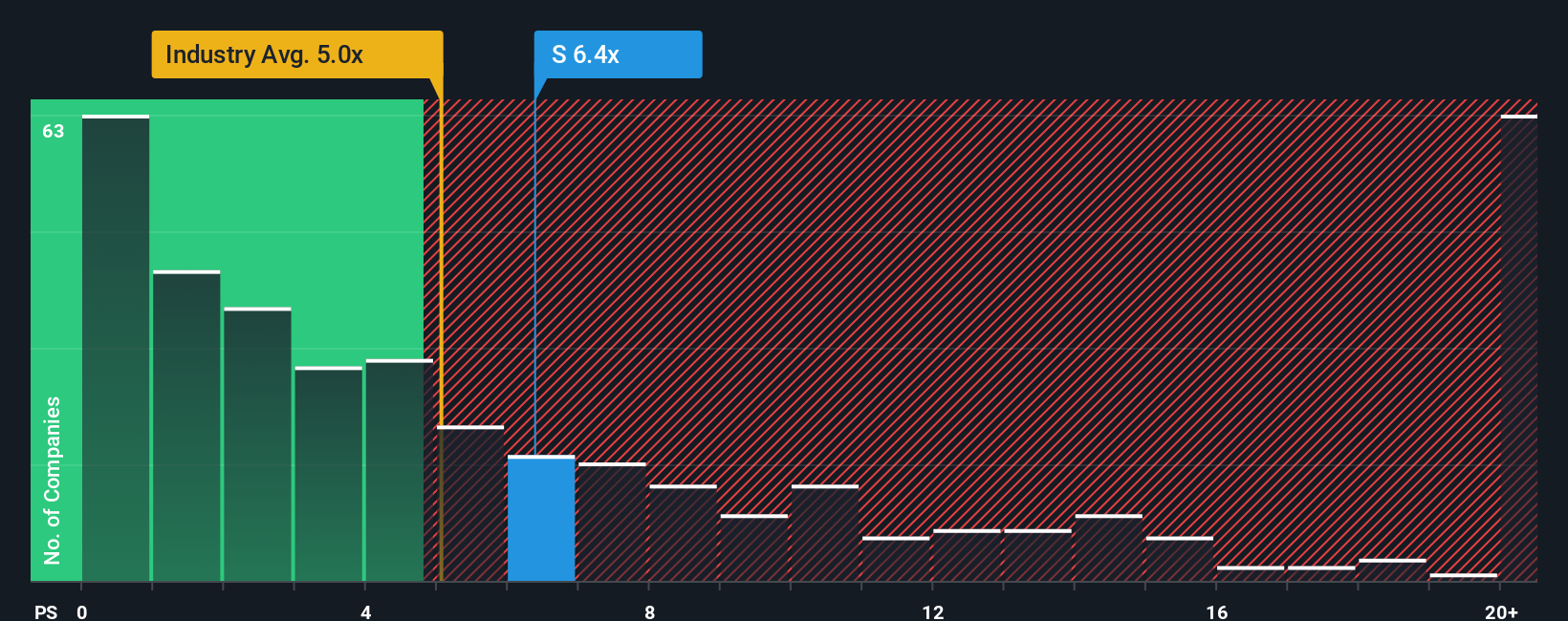

Looking at how SentinelOne trades compared to the broader US Software sector, the company is priced higher than the industry average on a key market ratio. Does this signal optimism or set the stage for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SentinelOne Narrative

If you want to dig deeper or believe there is another angle on SentinelOne’s story, you have the tools to build your own perspective. You can do this in just a few minutes. Do it your way

A great starting point for your SentinelOne research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Investment Opportunities?

Don’t stop your research at SentinelOne. Use the Simply Wall Street Screener to uncover exceptional stocks in fast-moving sectors, growth stories the market’s overlooking, or companies with solid income potential. Miss these ideas and you could miss the next big winner.

- Uncover potential in up-and-coming tech innovators by checking out penny stocks with strong financials and see which small caps are making big moves before the crowd catches on.

- Capture the growing momentum in artificial intelligence by trying AI penny stocks and zero in on companies leading the way in AI breakthroughs.

- Boost your portfolio’s earning power with dividend stocks with yields > 3% to find stocks delivering attractive dividend yields alongside financial resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal