Boston Properties (BXP): Exploring Valuation After Latest Dividend Declaration

If you have been watching BXP (BXP) lately, the company’s recent quarterly dividend announcement might have made you pause and reconsider your next move. The Board of Directors declared a cash payout of $0.70 per share, keeping in line with their regular schedule. While routine for a real estate investment trust, these dividend decisions can quietly signal management’s outlook and affect how investors feel about the stock going forward.

Stepping back, BXP’s overall performance this year has been a mixed bag. Although the past month saw the stock climb roughly 10%, translating into some revived optimism, the year-to-date gain sits closer to 4%. Over the past year, shares have remained more or less flat. At the same time, three- and five-year returns show tangible growth. This contrast between near-term movement and longer-term results underscores the shifting market sentiment and highlights how each company action, like a dividend payout, can ripple through investor expectations.

Given the recent upward movement and steady income stream, is BXP an undervalued opportunity right now, or has the market already priced in its prospects for future growth?

Most Popular Narrative: 2% Undervalued

According to the most widely followed narrative, BXP is considered slightly undervalued, with a modest discount to its calculated fair value. The consensus among analysts suggests that the current share price does not fully reflect the company’s potential for future growth based on key forecasted metrics.

"Occupancy and rent growth for BXP's high-quality, centrally located assets and premier developments are set to benefit from a marked return to in-person work mandates and a strong flight to quality. This is demonstrated by significant tenant demand, tightening vacancies (notably in NYC and Boston), and double-digit increases in asking rents in premier submarkets, supporting higher future revenues and NOI per square foot."

Want to know why analysts think the numbers behind BXP’s valuation are so compelling? There’s a powerful dynamic at play: high-end office space, booming submarkets, and surprising growth assumptions that could send earnings soaring. Curious about which bullish projections are shaping the consensus view? Dive in to discover what could set BXP apart.

Result: Fair Value of $78.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued declines in occupancy or prolonged leasing hurdles, particularly in new developments, could quickly challenge the current optimism around BXP’s outlook.

Find out about the key risks to this BXP narrative.Another View: Alternative Valuation Tells a Different Story

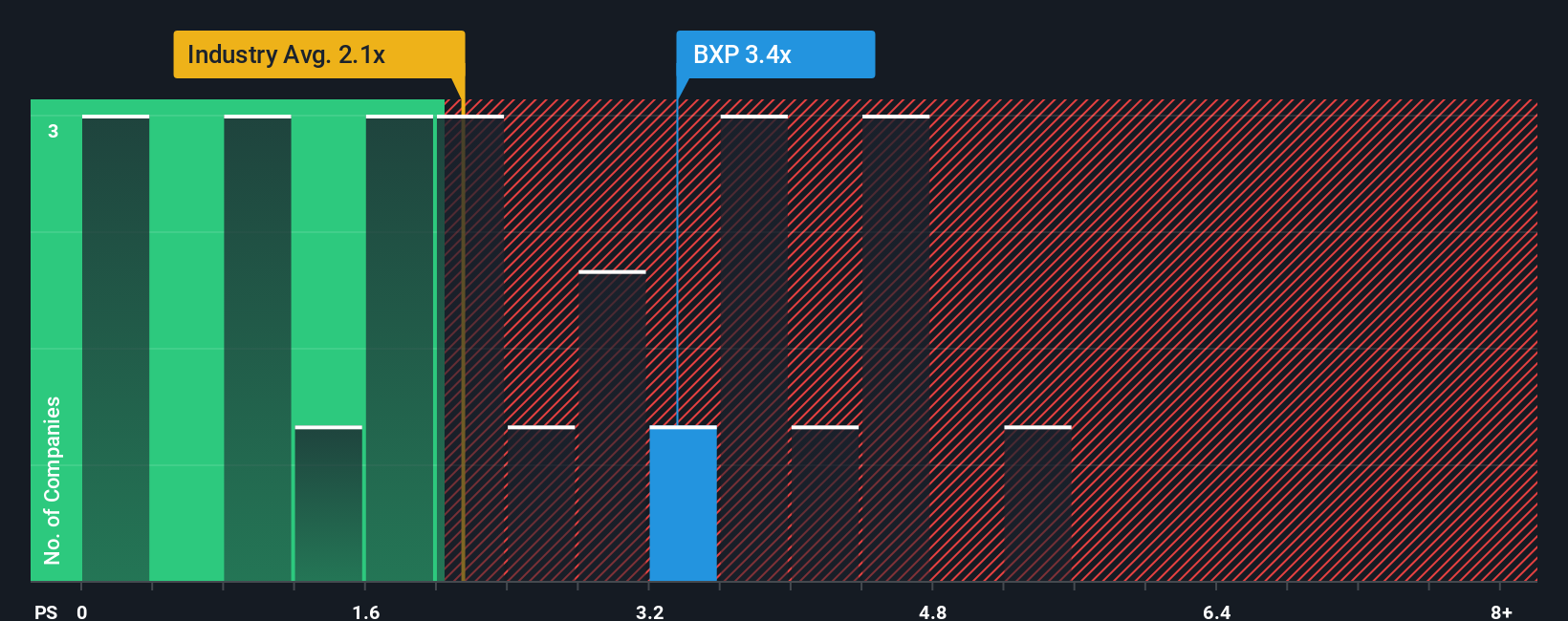

While analysts see BXP as slightly undervalued, a different approach that compares it to the broader industry average on this key ratio suggests the company actually trades at a richer price than its office peers. Which method should you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BXP Narrative

If you think there’s more to the story or want to see how the numbers stack up for yourself, you can craft your own perspective in just a few minutes. Do it your way.

A great starting point for your BXP research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing game and don't miss out on unique opportunities. These powerful screens are surfacing standout companies that deserve a closer look.

- Uncover companies with strong cash flows and attractive prices by scanning through our undervalued stocks based on cash flows. This is your shortcut to potential bargains the market hasn’t fully appreciated.

- Fuel your portfolio’s future by tapping into innovation and growth. See which businesses are pushing the boundaries with AI penny stocks.

- Get ahead of the curve and maximize your yield by joining investors searching for dividend stocks with yields > 3%. This approach is perfect if you want steady income alongside capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal