Scotiabank (TSX:BNS) Valuation in Focus After Major Fixed-Income Capital Raises in Canada and Abroad

Bank of Nova Scotia (TSX:BNS) recently caught investors’ attention by closing a series of major fixed-income offerings, both in Canada and overseas. The bank issued billions in variable and fixed-to-floating rate notes, including a prominent £1.5 billion bond in the UK market. Moves like these often raise questions about a company’s capital strategy, future growth plans, and how it is managing funding in a changing rate environment.

This wave of capital-raising comes at a time when Bank of Nova Scotia’s stock has delivered a strong performance in multiple timeframes. Over the past year, shares have climbed nearly 30% and are up 16% year-to-date, signaling momentum that stands out among peers. These financing activities follow an active calendar for the bank, with its annual investor conference on the horizon and continued steady growth in both revenue and net income over the last twelve months.

After a surge like this, is Bank of Nova Scotia still trading at a bargain, or is the market already recognizing its future potential?

Most Popular Narrative: 2.9% Overvalued

According to the most popular narrative, Bank of Nova Scotia is currently considered slightly overvalued, with the share price sitting just above analysts’ fair value estimates given its expected financial performance.

Accelerated investment in digital platforms, including AI-driven solutions and enhanced online banking capabilities, is expected to drive operational efficiency, reduce costs, and boost net margins through scalable customer acquisition and improved client experiences.

What is the key driver behind the bullish outlook for Bank of Nova Scotia? Some of the boldest forecasts are hinting at a major transformation powered by digital disruption and expansion into new international markets. Curious to discover how this shapes revenue and profit growth projections? There are some eye-opening financial assumptions that fuel this fair value. Find out what sets them apart from conventional bank valuations.

Result: Fair Value of $83.36 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing volatility in Latin American markets and slow loan growth in Canada remain key risks that could challenge these optimistic projections.

Find out about the key risks to this Bank of Nova Scotia narrative.Another View: Discounted Cash Flow Perspective

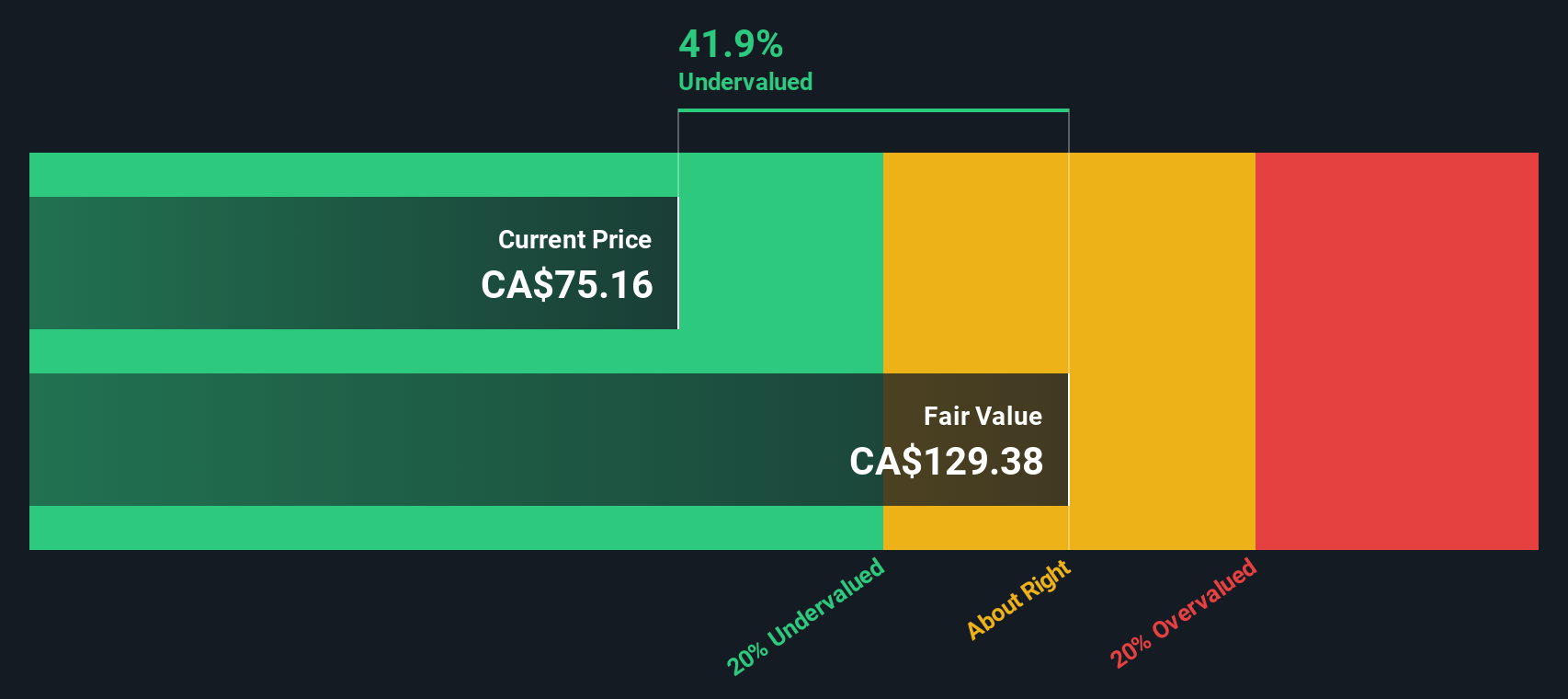

Looking at Bank of Nova Scotia through the lens of our DCF model reveals a very different story. While the market sees shares as slightly overvalued, the SWS DCF model suggests there may be untapped value that the market is overlooking. Could the true worth of the company be hiding beneath headline multiples?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bank of Nova Scotia Narrative

If you have your own perspective or want to analyze the numbers firsthand, you can craft a custom narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bank of Nova Scotia.

Looking for More Investment Ideas?

Don’t miss opportunities that could supercharge your returns. Kickstart your research with these handpicked stock ideas and give your portfolio an edge:

- Unlock high-yield opportunities by tracking companies offering reliable payouts through our list of dividend stocks with yields > 3%.

- Spot emerging tech winners blazing a trail in artificial intelligence by browsing AI penny stocks.

- Uncover undervalued gems trading below their cash flow potential in our selection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal