RTX Valuation in Focus as Shares Continue Upward Trend Without Major News

Most Popular Narrative: 3.9% Undervalued

According to the most widely followed analyst narrative, RTX is considered undervalued compared to its projected fair value. Analysts believe the stock is trading at a moderate discount to what its fundamentals suggest it's worth.

"Robust and growing backlog, highlighted by a 1.86 quarter book-to-bill ratio, $236 billion backlog (up 15% year-over-year), and major new international contracts (e.g., EU, MENA, Asia-Pacific) indicate RTX is well positioned to benefit from sustained increases in global defense spending and heightened geopolitical tensions. This sets up strong visibility for future revenue growth."

Curious about the math behind this valuation? The narrative banks on a combination of climbing profits, robust revenue forecasts, and a future earnings multiple that is typically reserved for industry standouts. Which financial assumptions are boldest, and what could they mean for future returns? Find out how this story threads together numbers and optimism into one compelling case.

Result: Fair Value of $164.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as unpredictable tariff hikes and persistent jet engine cost overruns remain potential catalysts that could quickly challenge the current optimistic outlook.

Find out about the key risks to this RTX narrative.Another View: Our DCF Model Offers a Different Perspective

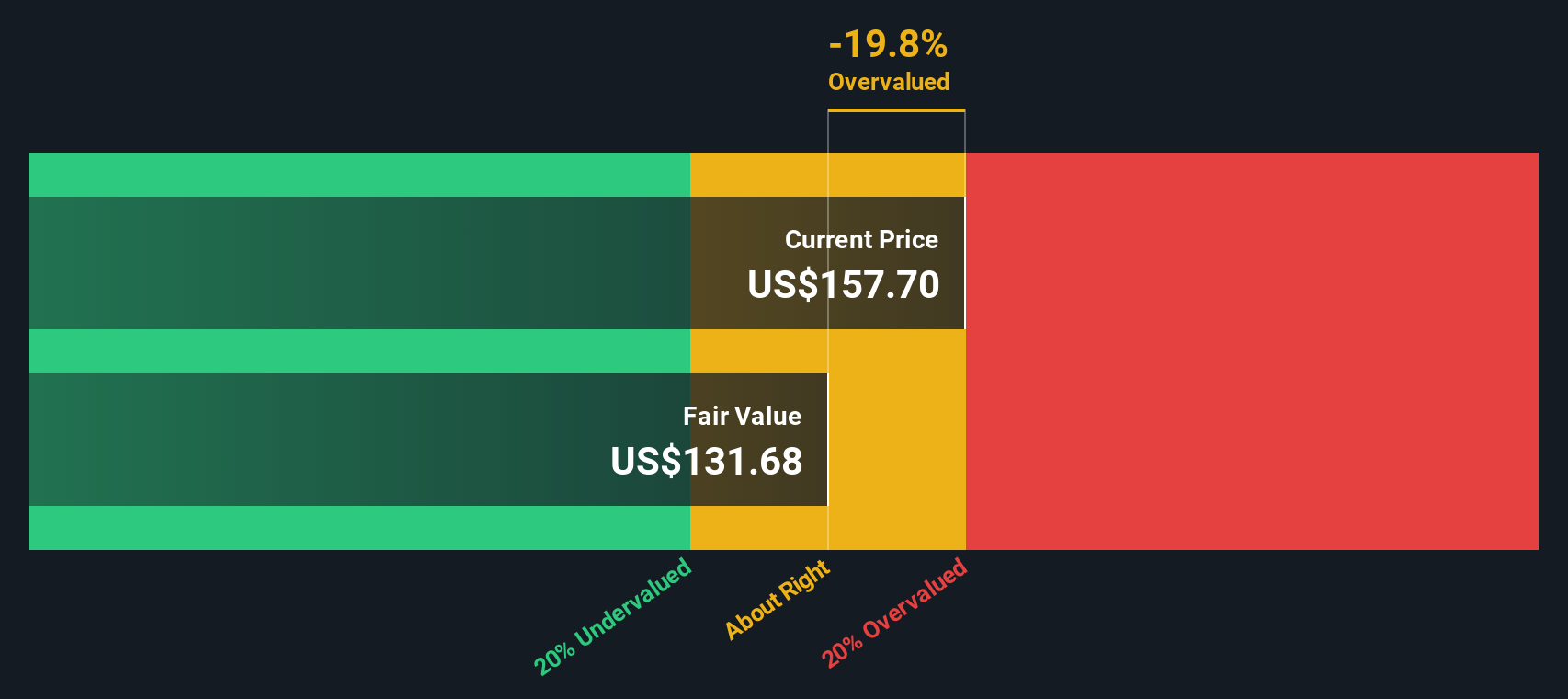

Taking a step back from analyst narratives, our SWS DCF model offers a less optimistic view and actually finds RTX to be overvalued at this time. Could market enthusiasm be overlooking something critical?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own RTX Narrative

If you'd rather follow your own instincts or dive into the details yourself, you can shape your own take in just a few minutes. Do it your way

A great starting point for your RTX research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investing Moves?

Don’t limit your potential to just one stock. Powerful opportunities are waiting. Scan unique ideas with the Simply Wall Street Screener and get ahead of the crowd.

- Capture high yields by tracking companies that deliver steady, reliable income through generous payouts with dividend stocks with yields > 3%.

- Ride the wave of the AI revolution by searching for innovators leading real breakthroughs in intelligent automation and machine learning with AI penny stocks.

- Spot undervalued gems early and seize the chance to invest before the market catches up using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal