AI ignites a bullish frenzy of chip stocks in Jiulian Yang! The Philadelphia Semiconductor Index recorded the longest continuous rise since 2017

The Zhitong Finance App learned that as of the closing of US stocks on Tuesday, chip stocks, one of the core driving forces of this round of “long-term US stock bull market” since 2023, closed strongly. The sector even achieved the longest continuous upward trend in nearly eight years. Among them, TSM.US (TSM.US), which has the title of “the king of chip foundry”, and the global memory chip leader Micron (MU.US) reached record highs this week. Chip stocks in the US stock market recorded the longest continuous upward period since 2017, driven by a wave of growth driven by artificial intelligence and AI investment fanaticism.

Looking ahead to future trends, judging from chip market research reports from authorities such as Wall Street financial giant Goldman Sachs and the World Semiconductor Trade Statistics Organization (WTST), under the impetus of this unprecedented global AI investment boom, chip stocks are still likely to be one of the best-performing technology sectors in the US stock market from a long-term investment perspective.

Recently, the “super bull market” of global chip stocks has been passionately interpreted, especially when semiconductor/chip stocks closely linked to AI training/inference systems are rising like a rainbow. Goldman Sachs's latest semiconductor industry research report can be described as “adding another spark” to the extremely hot AI bullish sentiment. After the Communacopia+ Technology conference hosted by the agency, which covered the world's top semiconductor companies, the Goldman Sachs research team stated that the semiconductor industry continues to maintain an “AI-driven structural bull market” main line judgment.

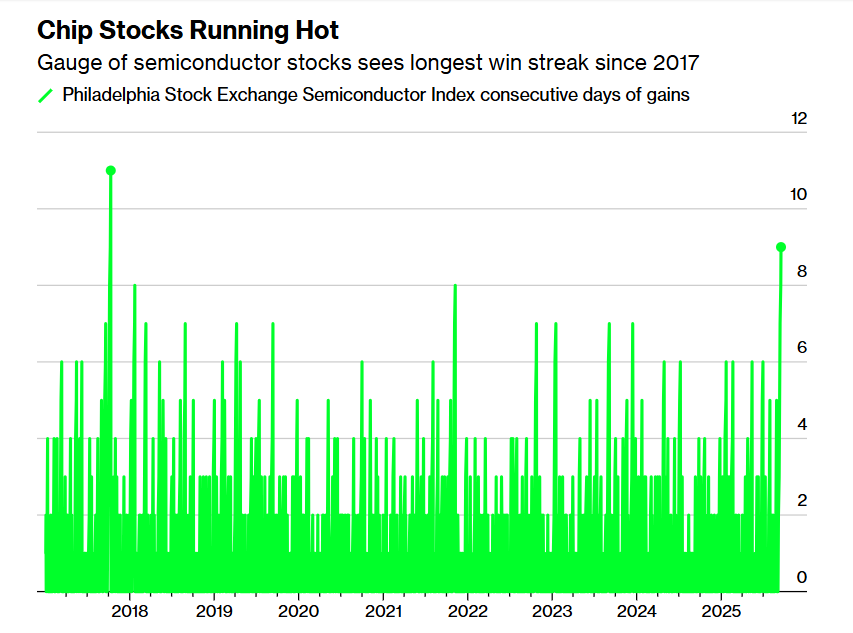

By the close of the US stock market on Tuesday, the US chip stock benchmark index — the Philadelphia Stock Exchange Semiconductor Index, which is also regarded by investors as a “global chip stock weather vane,” rose only 0.3%, but this is the benchmark index's nine consecutive trading days of growth, making it the longest continuous increase since 2017. The index had a cumulative increase of 8.7% over the nine trading days, and during the year it rose as high as 22%, significantly outperforming the Nasdaq 100 Index, which had an increase of nearly 16% over the same period.

Chip stocks continue to rise in popularity — the Philadelphia Semiconductor Index experienced the longest continuous rise since 2017

Among the individual stock segments worth watching in the index, AMKR.US (AMKR.US) shares rose more than 5% as of Tuesday, Ansemi Semiconductors (ON.US) shares rose 3%, Intel (INTC.US) rose 2%, and Applied Materials (AMAT.US) rose 1.5%. Although the stock price of Nvidia (NVDA.US), the strongest leader in artificial intelligence chips, fell 1.6%, it still rose more than 30% during the year. The stock price of Broadcom (TSM.US), another popular chip stock that has hit record highs since this year, fell 1.1%, but rose by an astonishing 55% in 2025.

TSMC's stock price hit a record high on Tuesday. The strong rise in TSMC's US ADR stock price is second only to Broadcom in the US chip stock performance this year. In the chip industry chain, TSMC can be called the “Eternal God” (YYDS). AI GPUs and AI ASICs are in high demand. With decades of core technology accumulation in the chip manufacturing field, TSMC has long been at the cutting edge of chip manufacturing technology improvement and innovation, leading the world's advanced process and packaging technology, and high yield, and has long dominated the vast majority of global chip OEM orders, especially those with the most advanced manufacturing processes at 5nm and below.

The stock price of US-based memory chip giant Micron (MU.US) has been rising rapidly since September. Thanks to the fact that demand for core memory chips closely related to artificial intelligence training/inference systems is still extremely hot, demand for HBM storage systems continues to blowout, and a wave of price increases for a range of data center type memory chip products, including enterprise-grade SSDs and DDR series, Micron's stock price has risen as high as 35% since September and reached a record high this Monday. Wall Street financial giant Citigroup reaffirmed the agency's “buy” rating for Micron Technology and raised the target price from $140 to $175. Another financial giant, Mizuho, raised Micron's target share price sharply from 155 US dollars to 182 US dollars.

“AI faith” has taken the market by storm, and the chip stock bull market is far from over?

“It can be said that almost everything we have seen in AI infrastructure construction and the entire technology sector is driven by semiconductor-related stocks,” said Wayne Kaufman, chief market analyst at Phoenix Financial Services. He added that Oracle's recent strong earnings report and the over $10 billion AI infrastructure deal between Microsoft and Nebius Group NV are positive signs for the global chip sector.

“Companies are placing orders for AI infrastructure over a very long period of time, which shows that they feel they may fall far behind in terms of computing power infrastructure to meet the needs of artificial intelligence,” Kaufman said in an interview. “This means that the semiconductor/chip rally looks very sustainable. Even if some stocks may overbuy in the short term, chip giants like Nvidia and TSMC will still be the biggest winners.”

Since 2025, chip stocks closely linked to artificial intelligence computing power infrastructure have been among the most stable winners in the global market. According to data compiled by the agency, Nvidia, Broadcom, TSMC, and Micron contributed more than 65% of the increase in the chip index this year — the Philadelphia Semiconductor Index.

Needless to say, the global cloud computing giant Oracle, which has just announced a contract reserve of 455 billion US dollars that far exceeds market expectations, and the strong performance and future outlook announced last week by Broadcom, the “superdominant” AI ASIC chip, have greatly strengthened the “long-term bull market narrative” of AI computing power infrastructure sectors such as AI GPUs, ASICs, and HBM. The demand for AI computing power brought about by generative AI applications and inference terminals dominated by AI agents can be called a “sea of stars”, which is expected to drive the AI computing power infrastructure market to continue to show exponential growth. “AI inference systems” are also Hwang In-hoon's biggest source of future revenue for Nvidia.

The world's demand for AI computing power continues to blowout, and AI infrastructure investment projects led by the US government are getting bigger, and global tech giants continue to spend huge sums of money to build large-scale data centers. This largely means that for investors who have long loved Nvidia and the AI computing power industry chain, the “AI belief” that has taken the world by storm “supercatalysis” to the stock prices of computing power leaders is far from over. They are betting that the stock prices of AI computing power industry chain companies led by Nvidia, TSMC, and Broadcom will continue to interpret the “bull market curve.” It further pushes the global stock market to continue its bullish run The market.

The latest outlook for the semiconductor industry: AI-driven growth is still extremely strong

Goldman Sachs said that the overall rhetoric of semiconductor companies focusing on AI computing power infrastructure is very optimistic. The share of AI-related revenue will continue to rise sharply over the next two years, and enterprise-level AI workloads will be handled by more large-scale “merchant solutions (merchant solutions)” in the future. There is still room to absorb inventory and weak demand in non-AI-related fields. Goldman Sachs suggests the impact of this part on short-term fluctuations in the semiconductor sector.

For example, at the Communacopia+ Technology conference, Broadcom CEO Chen Fuyang predicted that the company's revenue closely related to AI is expected to exceed the sum of software and non-AI business revenue within the next two years. At the same time, Broadcom management has also set a target of reaching up to 120 billion US dollars in AI revenue by 2030, which is directly linked to CEO remuneration. According to Goldman Sachs's research report, this latest outlook figure is a full five-fold increase compared to the agency's forecast of Broadcom's $20 billion AI revenue for the 2025 fiscal year, highlighting management's extreme confidence in AI ASIC chip revenue generation.

Gary Dickerson, President and CEO of Applied Materials, said at the same conference that HBM and advanced packaging manufacturing equipment will be strong growth vectors in the medium to long term, and that new chip manufacturing node devices such as GAA (surround gate) /backside power supply (BPD) will be the core driving force for the company's next round of strong growth. In particular, for advanced packaging manufacturing equipment, Dickerson said that the revenue doubling path for this business line is still on track and is about to achieve huge increases. The market share in the HBM equipment sector continues to expand, and it is increasingly related to DRAM etching innovation.

According to Wall Street investment giants Loop Capital and Wedbush, the global AI infrastructure investment wave with AI computing power hardware at the core is far from over; it is only just beginning. Driven by an unprecedented “storm of AI computing power demand,” the scale of this round of AI investment is expected to reach 2 trillion US dollars. Nvidia CEO Hwang In-hoon also predicted that by 2030, AI infrastructure spending will reach 3 trillion to 4 trillion US dollars, and the scale and scope of the project will bring significant long-term growth opportunities to Nvidia.

Driven by the epic stock price increases and continued strong performance of AI computing power industry leaders such as Nvidia, Google, TSMC, and Broadcom, an unprecedented AI investment boom has swept through the US stock market and the global stock market, driving the global stock index benchmark stock index, the MSCI Global Index, to rise sharply since April, and recently it has continued to reach record highs.

According to the latest semiconductor industry outlook data recently released by the World Semiconductor Trade Statistics Organization (WSTS), the recovery in global chip demand is expected to continue from 2025 to 2026, and analog chips, which have continued to weaken since the end of 2022, are expected to enter a strong recovery curve soon.

Following a strong rebound in 2024, WSTS expects the global semiconductor market to grow by 11.2% in 2025, with a total value of US$709 billion. Mainly due to continued strong momentum in the GPU-led logic chip sector and the HBM-led storage sector, both fields are expected to achieve strong double-digit growth, thanks to continued strong demand in fields such as artificial intelligence inference systems, cloud computing infrastructure, and cutting-edge consumer electronics.

WSTS predicts that the global semiconductor market will grow 8.5% to reach US$760.7 billion by 2026, building on the strong recovery in 2025. Among them, it is expected that memory chips will once again lead the growth, logic and analog chips will also contribute significantly, and analog chips are expected to enter a strong recovery cycle.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal