Amazon (AMZN) Valuation: Revisiting the Stock’s Worth as Momentum Cools and Growth Continues

Amazon.com (AMZN) Stock Draws Fresh Attention: Time to Reconsider Your Position?

If you’re watching Amazon.com (AMZN), you might have noticed the recent shift in sentiment around the stock. Although there was not a headline-grabbing announcement or sudden development, sometimes a period of quiet movement can spark a new round of debate among investors. With Amazon’s massive scale and history of shaking up retail and technology, even subtle changes in the share price get closely watched for hints about future direction.

Looking at the numbers, Amazon’s share price has dipped just over 1% in the past month, following a slight pullback over the past week. Still, when looking at a longer timeframe, the stock has climbed 6% over the past 3 months and delivered a notable 23% gain for the year. Momentum has cooled from the rapid rally seen in previous years, but the company is still posting solid annual growth in both revenue and net income. For a business of Amazon’s size, this kind of steady performance keeps it firmly in the spotlight as markets analyze each new data point.

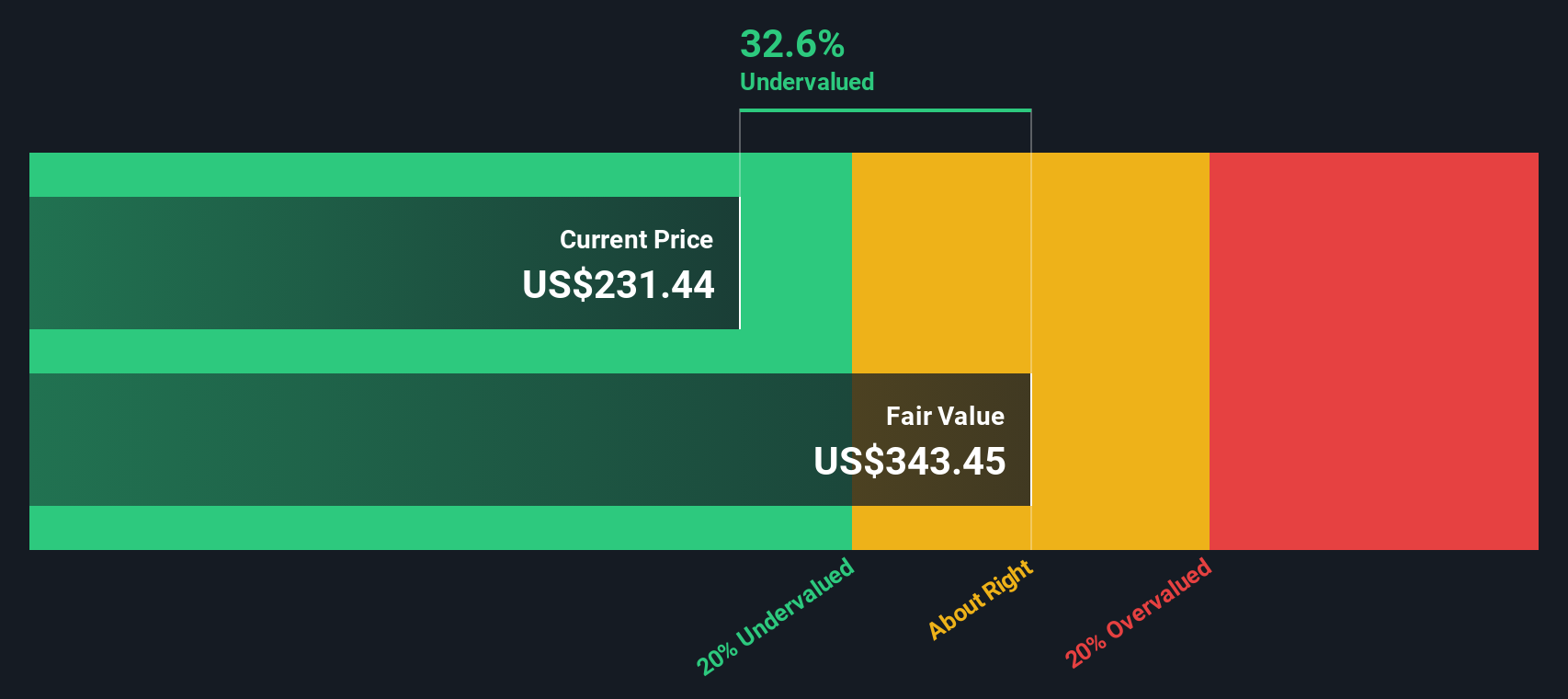

With shares off their peak and the company still turning in double-digit growth, some investors are questioning whether Amazon’s stock is offering a hidden discount or if the market is already factoring in additional years of expansion.

Most Popular Narrative: 2.5% Overvalued

According to MichaelP, the current narrative suggests that Amazon is slightly overvalued compared to its calculated fair value. The analysis takes a deep dive into the underlying cash flow engines and future growth expectations that underpin Amazon’s long-term market position.

The reason I haven’t mentioned free cash flow is because the company keeps reinvesting so heavily in these huge opportunities in front of it, that I believe it is not going to generate any meaningful free cash flows that it can retain or distribute to investors in the near term. It would much rather reinvest heavily because the future opportunity is larger than short term distributions it could make in the form of buybacks or dividends.

Curious how relentless reinvestment strategies shape Amazon’s future worth? The narrative hinges on some bold forecasts for how its major businesses could reshape profitability over time. The real excitement lies in the assumptions and growth trajectories that drive this premium valuation. Are you ready to uncover which segments make or break the story?

Result: Fair Value of $222.55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, it is worth noting that tighter regulation or an extended recession could challenge Amazon’s growth story and shift investor expectations quickly.

Find out about the key risks to this Amazon.com narrative.Another View: DCF Model Paints a Different Picture

Taking a different approach, our SWS DCF model suggests Amazon might actually be undervalued relative to its future cash flows. This raises the question: is the current price telling the full story, or just part of it?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Amazon.com Narrative

If you think there’s more to Amazon’s story or want to dig into the data on your own terms, you can build your own analysis in just a few minutes. Do it your way.

A great starting point for your Amazon.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Don’t limit your investments to just one stock when there are so many promising trends available. Expand your potential by exploring handpicked opportunities designed to help you get ahead, no matter your strategy.

- Identify early movers gaining traction in smaller markets with penny stocks that have strong financials through penny stocks with strong financials.

- Discover healthcare’s next big breakthroughs by looking into medical innovators shaping tomorrow’s patient care via healthcare AI stocks.

- Enhance your portfolio with stocks that offer attractive yields and steady returns by exploring dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal