IPH Ltd. (ASX:IPH) Valuation: Assessing the Impact of New Securities on Growth and Capital Strength

IPH (ASX:IPH) has made waves by issuing 8,834 fully paid ordinary securities that are now quoted on the ASX. This move is part of the company’s ongoing effort to shore up its capital structure. For those tracking the stock, this announcement signals the company’s intention to reinforce its financial toolkit and possibly to fund future expansion. Investors are left with a straightforward question: is this the first step in a larger transformation, or simply routine balance sheet management?

The timing of this capital raising comes after a challenging period for IPH. The stock’s share price has slipped over the past year, continuing a downtrend that has seen it lose nearly 28% year on year and close to 48% over three years. Despite posting steady revenue and net income growth annually, recent months have seen momentum falter, leaving some investors wary and others on alert for signs of a rebound. The company’s latest move could potentially shift sentiment, especially if it is seen as a springboard for renewed growth.

Now, with the capital structure strengthened and the market absorbing this newest issuance, is there a genuine buying opportunity here, or has the market already priced in any hopes of a turnaround?

Most Popular Narrative: 31.9% Undervalued

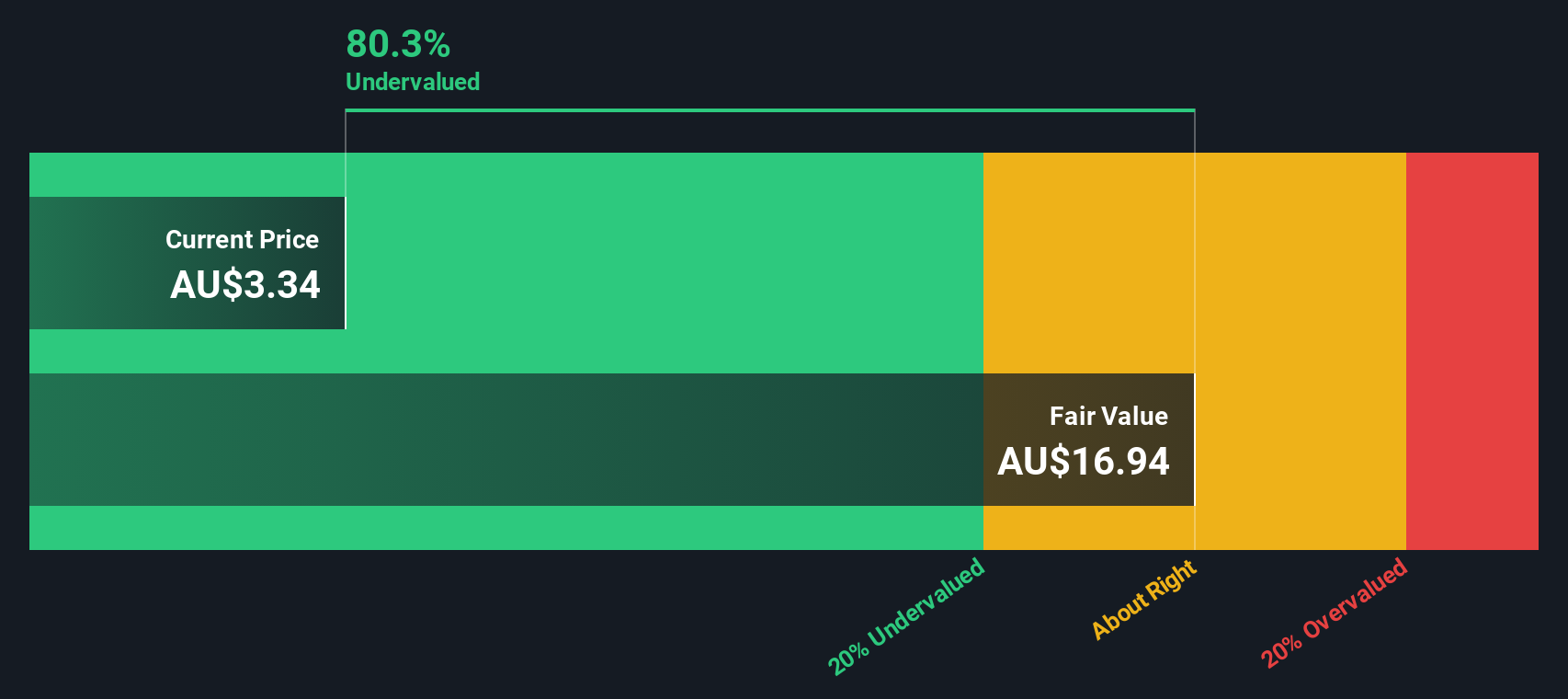

According to the consensus narrative, IPH is currently trading well below fair value with a notable margin to the analysts’ calculated target price. The popular view points to fundamental drivers that could lead to a significant rerating if the narrative proves correct.

Strong double-digit growth in Asian patent filings, combined with recovering workflows and market share gains in the Singapore hub, signal that IPH is well placed to benefit from surging innovation and R&D investment in Asia-Pacific. This lays the foundation for significant revenue growth as filings move through the examination and grant process from FY26 onward.

Curious about how analysts arrive at such a bullish fair value? The secret lies behind a set of aggressive assumptions about future profitability, international expansion, and earnings potential. Hungry for the details that could move this stock? Discover which levers the narrative expects to drive the next phase of growth and what it would take for IPH to bridge that discount.

Result: Fair Value of $5.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain. Continued weakness in U.S. patent filings or delays in delivering acquisition synergies could quickly offset the bullish case for IPH.

Find out about the key risks to this IPH narrative.Another View: What Does Our DCF Model Indicate?

Taking a different approach, the SWS DCF model estimates IPH’s fair value using long-term cash flow projections rather than analyst targets. This method also points to the stock being undervalued. Could both methods be right? Is the market missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own IPH Narrative

If you see the story from a different angle or want to dig deeper for yourself, the tools are available to help you build your own perspective in just a few minutes. Do it your way

A great starting point for your IPH research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for Your Next Smart Stock Move?

Why stop at one great idea? Open the door to new opportunities by leveraging these powerful filters to zero in on stocks that fit your strategy. Avoid settling for the obvious. There are sectors with explosive potential and income picks you’ll want on your radar right now.

- Uncover reliable income streams and consistency with high-yielding shares by tapping into dividend stocks with yields > 3%.

- Chase tomorrow’s disruptors by scanning the hottest companies advancing machine intelligence through AI penny stocks.

- Spot deeply discounted gems using refined valuation filters in undervalued stocks based on cash flows before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal