Is Boss Energy's (ASX:BOE) Operational Review a Strategic Reset or Just Business as Usual?

- Boss Energy Limited has initiated a comprehensive operational review of its Honeymoon uranium project in South Australia, focusing on assessing production capacity, mineralisation continuity, and leachability, with expert input and accelerated drilling underway since late July 2025.

- This proactive review signals management’s commitment to rigorously reassessing project assumptions laid out in the 2021 enhanced feasibility study, addressing market concerns about production challenges.

- With resource drilling accelerated to support wellfield planning, we’ll explore how these operational concerns shape Boss Energy’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Boss Energy's Investment Narrative?

If you’re looking at Boss Energy today, the big picture rests on the bet that the Honeymoon uranium project’s long-term role in Australia’s uranium sector will outweigh near-term production risks. The accelerated operational review, now underway, puts the spotlight directly on questions about mineralisation and leachability, exactly the short-term catalysts the market has worried about, as reflected in recent sharp share price declines. Originally, optimism was anchored around expected revenue growth and a return to profit just a few years out, but the current review and UBS’s exit as a substantial shareholder could reframe these assumptions if production targets or resource estimates see further revision. Right now, the key risk is uncertainty around Honeymoon's ability to achieve its planned capacity, which could challenge management’s previous projections and put additional pressure on earnings recovery. Depending on review outcomes, market sentiment and valuation assumptions may need to adjust further.

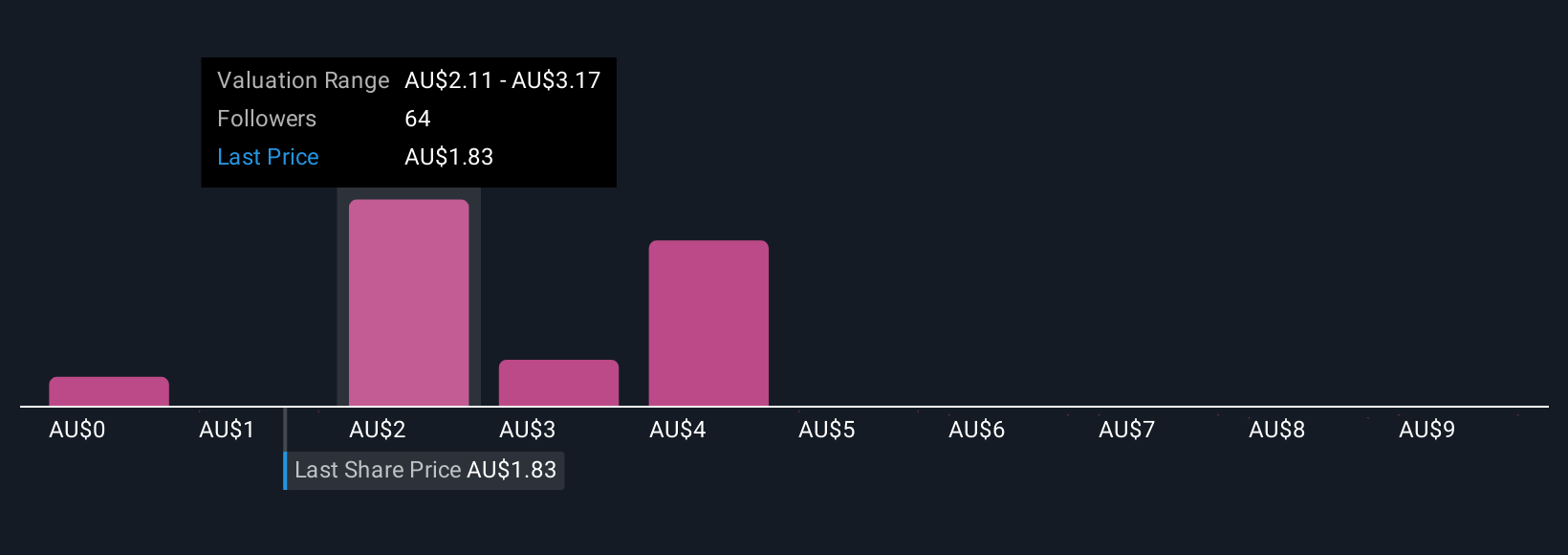

But there’s a real risk that operational review findings could reshape investor expectations for Honeymoon. Despite retreating, Boss Energy's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 27 other fair value estimates on Boss Energy - why the stock might be worth over 6x more than the current price!

Build Your Own Boss Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boss Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Boss Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boss Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal